According to former JP Morgan investment banker Jon Wolfnebarger, the success of the BRICS bloc could affect US living standards. Moreover, as the collective has taken aim at the US dollar, the global standing of America could be in serious jeopardy.

In a new story constructed by Wolfenbarger, he compared recent US dominance to fallen empires. Subsequently, the new story concluded that the United States is not exempt from the historical fate that befell some of the most dominant powers the world has seen.

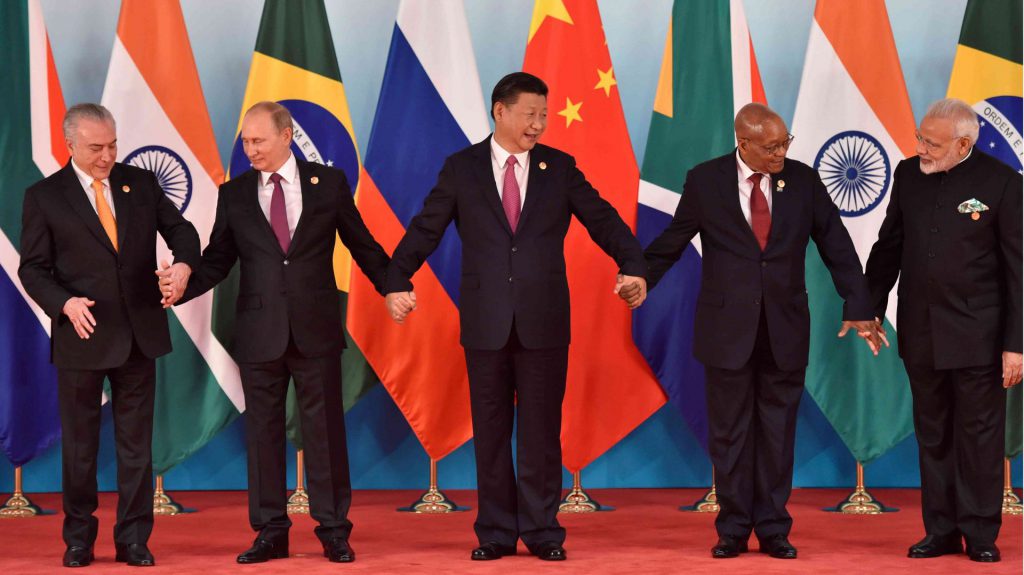

BRICS Bloc Success Will Threaten US Dominance

So far this year, the rising relevance of the BRICS collective has captured headlines. Subsequently, through de-dollarization efforts, the collective has only gained prominence in a global power shift. Moreover, a continued shift could have increased effects on the United States.

Specifically, former JP Morgan executive Wolfenbarger states that the success of the BRICS bloc could affect US living standards. Specifically, stating that a deterioration of the resource currency status of the dollar would hinder the country’s people.

Wolfenbarger stated, “If the BRICS are successful and the US does not change its policies to focus on a stronger dollar, less spending, and peace instead of war, it is possible the dollar will slowly lose its ‘reserve currency status.”

Additionally, he noted that loss would “hurt US living standards and lead to less power for the US government,” comparing it to the US post-World War II. “All empires have failed, and the US will not likely be an exception if the BRICS can create a successful hard currency to compete with the dollar.”

Alternatively, the investor still claimed the BRICS bloc has a long road ahead to dethrone the US dollar. Mostly because “non-US entities have $12 trillion of US dollar-denominated debt” to be paid back in the dollar. Subsequently, stating that “abandoning the dollar would be incredibly difficult and costly.”