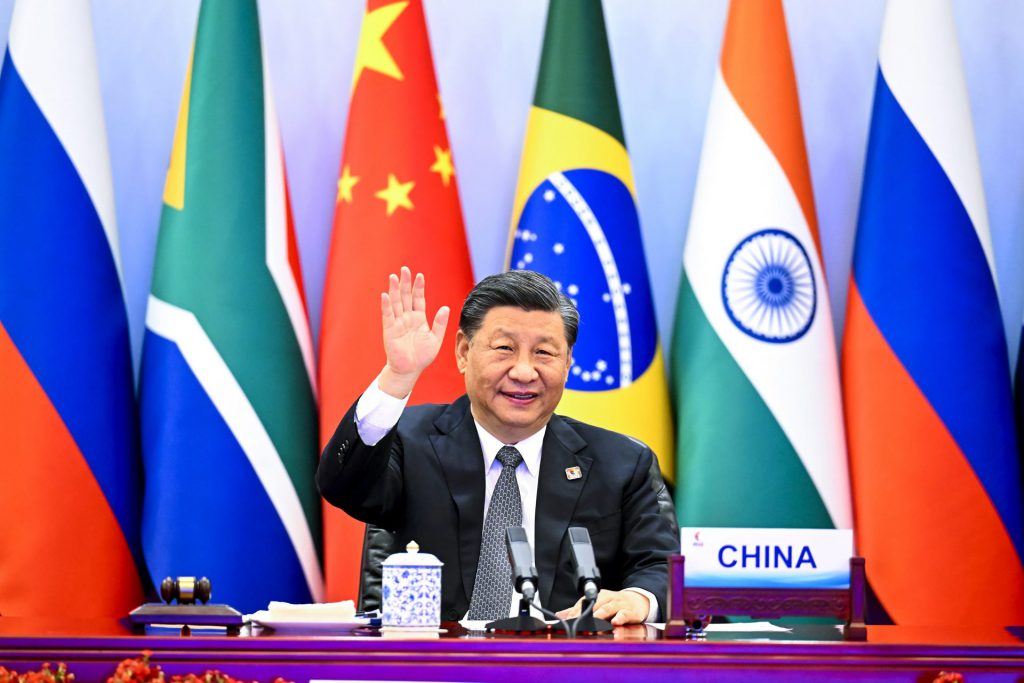

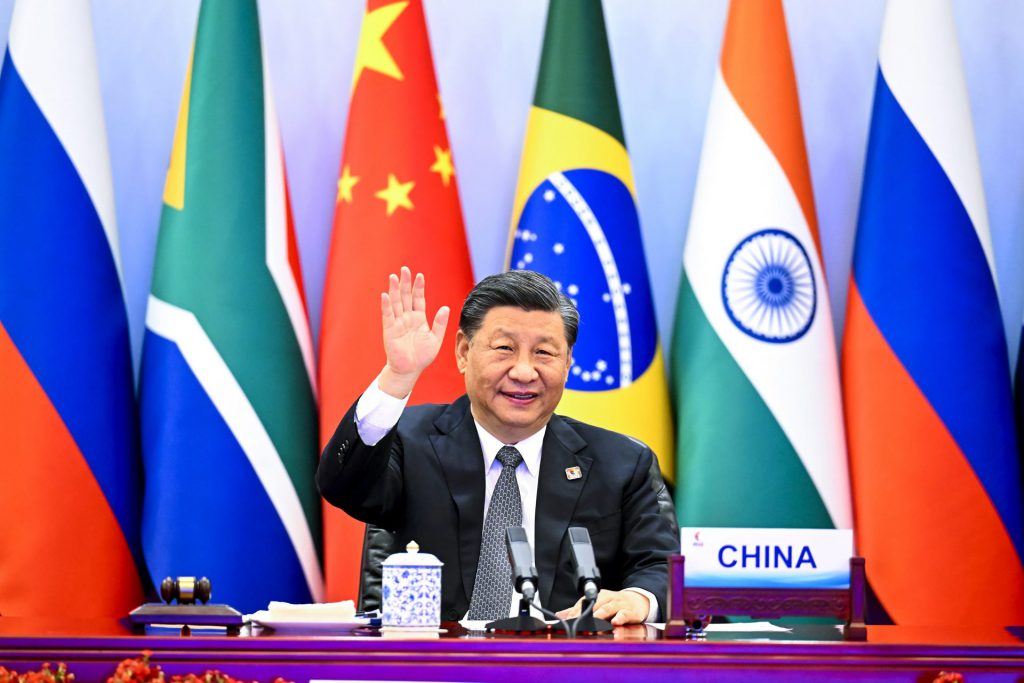

BRICS member China is on a gold buying spree as it added 225 tonnes of gold to its reserves in 2023 alone, the latest data shows. China stockpiled 225 tonnes of gold worth a staggering $13.2 billion last year. The Communist country has been steadily accumulating gold since 2022 purchasing millions worth of the precious metal every month. In December last month, BRICS member China accumulated 9 tonnes of gold worth $532 million.

Also Read: Pakistan Must Never Be Allowed To Join BRICS Under Any Situation: India

Apart from China, the other BRICS countries India, Russia, and Brazil, are steadily purchasing gold. BRICS is officially the largest buyer of gold in 2023, outperforming every other country, reported the World Gold Council. Among the BRICS countries, China tops the list, while Russia and India, take second and third place, respectively. Read here to know how much gold the Central Banks have accumulated in a year.

China Plans BRICS Currency To Be Backed By Gold?

The reason why China is accumulating a staggering number of gold in its reserves remains unknown. While some speculate the move could be to diversify its reserves and be prepared for an upcoming recession, others claim it could be used to back the soon-to-be-released BRICS currency with gold.

Also Read: Oil Prices To Reach $110 per Barrel as Middle East Conflict Escalates

China started the de-dollarization initiative last year convincing developing countries to ditch the US dollar. Read here to know how many sectors in the US will be affected if BRICS ditches the dollar for trade.

If BRICS back their yet-to-be-released currency with gold, it would provide the new tender strength in the currency markets. However, gold can provide support only at the beginning and could derail the currency if the US dollar rises.

Also Read: BRICS: Russia & Iran End SWIFT, Start Bank Transfers in Local Currency

The US dollar might be down in January but has several chances to bounce back in the coming weeks. Therefore, BRICS backing their new currency with gold is nothing but a recipe for disaster in the foreign exchange markets.