The BRICS Currency: A Step Towards Financial Independence

In recent years, the idea of a BRICS currency has gained significant traction among Brazil, Russia, India, China, and South Africa’s member nations.

This proposed currency aims to reduce dependence on the US dollar and establish a more balanced global financial system.

BRICS Currency: A Step Towards Financial Independence

The concept of BRICS (Brazil, Russia, India, China, and South Africa) has gained significant attention recently.

First, let’s look at who originally coined the term “BRICS”.

Originally coined by Goldman Sachs economist Jim O’Neill in 2001, the term BRIC was used to describe the emerging economies of Brazil, Russia, India, and China. South Africa joined the group in 2010, expanding it to the BRICS.

Furthermore, The initial idea behind the BRICS was that these countries would collectively dominate the global economy by 2050.

However, the focus has shifted towards the potential development of a new currency for the bloc, challenging the dominance of the U.S. dollar.

In this article, we will explore the reasons behind the push for a BRICS currency, the challenges it may face, and its potential impact on the global financial landscape.

Understanding the Need for a BRICS Currency

Next, let’s look at what the countries are looking to do. The BRICS countries have long been advocating for a shift away from the dominance of the US dollar in international trade and finance.

Additionally, Western sanctions imposed on Russia and its subsequent eviction from global dollar-trading systems have further fueled the desire for financial independence among BRICS nations.

The introduction of a common currency would not only facilitate intra-BRICS trade but also eliminate the high conversion costs associated with international transactions.

What is the BRICS currency?

Next, the BRICS currency is a hypothetical common currency the BRICS alliance could adopt.

The idea behind the BRICS currency is to create a unified and stable currency to foster economic growth and development.

A new currency would reduce dependency on the US dollar and other major currencies.

The BRICS countries use their own national currencies for trading and international transactions.

As these countries’ economies grow, the idea of a common currency becomes an increasingly relevant topic of discussion.

The BRICS Bloc: A Growing Economic Powerhouse

The combined economic might of the BRICS nations makes them a formidable force on the global stage.

The US dollar makes up 90% of global foreign exchange, thanks to the US’s top economy.

However, the BRICS bloc, with a GDP of over $32.72 trillion, collectively represents 31.59% of the world’s GDP. This economic weight lends credibility to the idea of a BRICS currency that can rival the dominance of the US dollar.

Advancing Financial Outreach: The Role of the New Development Bank

BRICS nations established the New Development Bank (NDB) in 2014. It challenges the global financial order.

The NDB is an alternative to international organizations such as the World Bank and the International Monetary Fund (IMF).

The NDB’s CRA provides loans and assistance to developing countries with low dollar reserves.

The NDB’s issuance of bonds denominated in local currencies further demonstrates the BRICS’ growing financial outreach and utilization of its liquid assets.

Overcoming Challenges: Political Intentions and Divergent Interests

While the concept of a BRICS currency holds promise, challenges must be addressed for its successful implementation.

One significant hurdle lies in reconciling the political intentions behind de-dollarization with the practical considerations of member nations.

Each BRICS country has its own reasons for supporting the initiative, and conflicting interests may arise, potentially undermining the transition to national currencies and hindering the introduction of a common currency.

Achieving Balance: Managing Dependence on China

China’s economic dominance within the BRICS bloc presents another challenge to pursuing a common currency.

As the largest contributor to the BRICS GDP, China’s influence and trade relations with other member countries may lead to an increased bilateral trade deficit.

This dependency on Chinese goods and the potential for Chinese influence to shape trade rules within the bloc must be carefully managed to avoid a form of hegemony that could undermine the goal of financial independence.

Understanding the BRICS Alliance

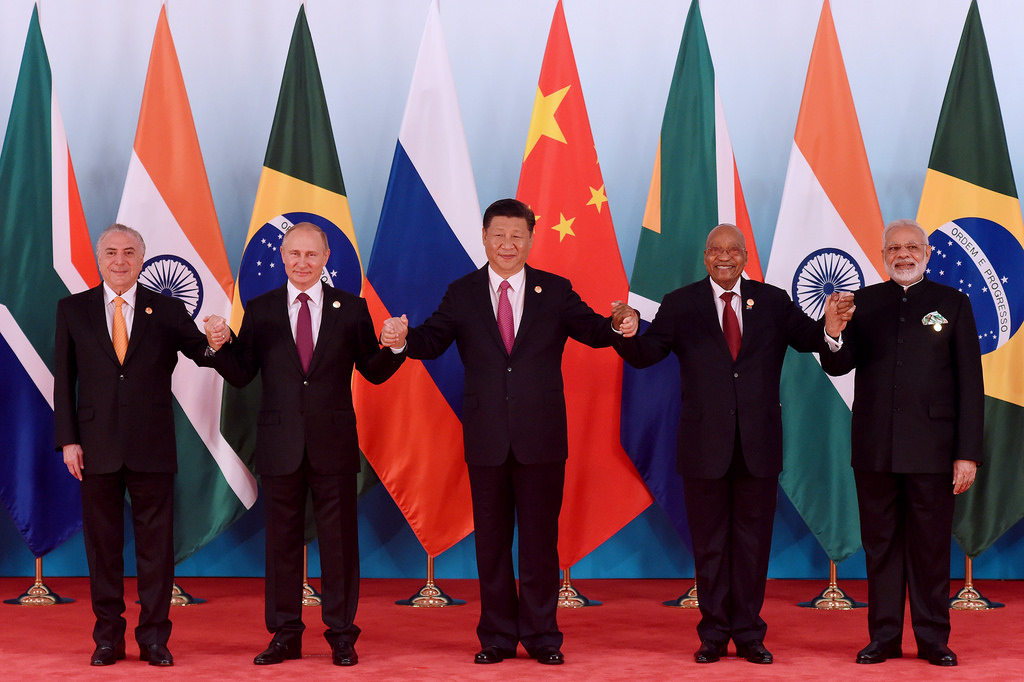

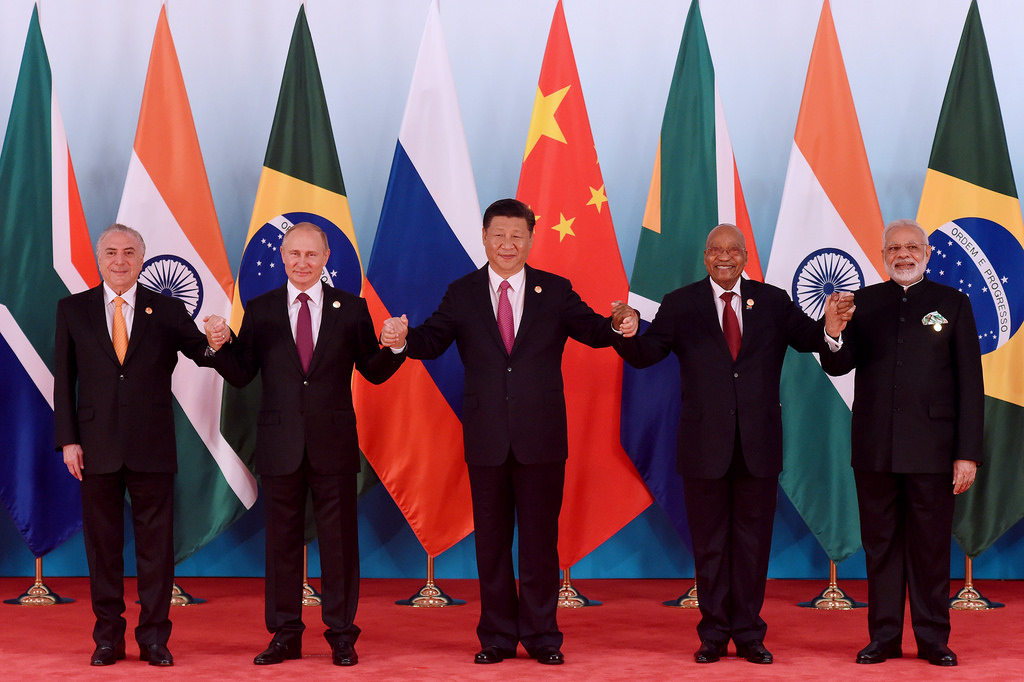

The BRICS alliance is a group of five emerging economies. They include Brazil, Russia, India, China, and South Africa. They aim to promote economic growth, trade, and investment among their members.

In 2016, the BRICS alliance established itself, and its heads of state or government attended an annual summit.

The alliance has significantly promoted economic cooperation through initiatives like the New Development Bank and partnerships in various agriculture, energy, and technology sectors.

Benefits and Challenges of a Unified BRICS Currency

A unified BRICS currency could reduce currency risk and exchange rate fluctuations, promoting trade and investment among member nations.

A common currency could also create a more stable monetary environment and help control inflation.

On the other hand, challenges include differences in economic structures, political systems, and monetary policies, making harmonization difficult.

A common currency could limit monetary policy independence, affecting the ability to respond to economic shocks and crises.

The Need for Financial Independence

Economic Diversification and Reduced Dependency

The idea of a BRICS currency stems from the desire to reduce dependency on the U.S. dollar and establish greater financial independence.

Furthermore, The BRICS nations have experienced economic growth over the years with low labor costs, favorable demographics, and abundant natural resources.

However, their economies have been vulnerable to external shocks, such as Western sanctions imposed on Russia. The need for economic diversification and reduced dependency on the U.S. dollar has become increasingly apparent.

Challenging Dollar Hegemony

The dominance of the U.S. dollar in international trade has been a longstanding concern for many countries.

Additionally, with their collective economic clout, the BRICS nations see an opportunity to challenge this hegemony and establish a new currency that can rival the dollar.

So, by reducing their reliance on the dollar, the BRICS countries aim to protect themselves from the unilateral sanctions imposed by Western nations and create a more balanced global financial system.

Exploring the Feasibility of a BRICS Currency

Internal Trading in Domestic Currencies

As a first step towards financial independence, the BRICS nations have begun exploring internal trading in their respective domestic currencies.

This move boosts intra-BRICS trade and eliminates the high costs associated with dollar conversion in international transactions.

By trading in their own currencies, the BRICS countries can reduce their exposure to fluctuations in the value of the U.S. dollar. Plus, they can enhance economic cooperation within the bloc.

The Role of Central Banks

Central banks play a crucial role in developing a new currency for the BRICS bloc. These banks must coordinate their efforts to ensure the stability and credibility of the currency.

Collaboration among central banks can facilitate the establishment of cross-border payment systems and promote the use of the new currency in international trade.

Additionally, central banks can work together to manage liquidity and address any potential challenges that may arise during the transition to a new currency.

The Impact of Sanctions

The impact of sanctions imposed on BRICS countries has been a driving force behind the push for a new currency.

Western sanctions have limited the ability of these nations to access the global financial system, making it difficult for them to conduct international transactions in U.S. dollars.

By developing a new currency, the BRICS nations aim to bypass these restrictions and create an alternative financial network that is not subject to the influence of Western powers.

BRICS Currency: Challenges and Considerations

Divergent Economic and Political Interests

One of the main challenges in establishing a BRICS currency is the member countries’ divergent economic and political interests.

Russia and China want to challenge the dollar. India, Brazil, and South Africa support the initiative.

Balancing these interests and ensuring cooperation among the member countries will be crucial in developing and implementing a new currency.

Currency Exchange Rate Volatility

Exchange rate volatility poses another challenge in the creation of a BRICS currency.

The value of each member country’s currency fluctuates based on various factors, such as economic conditions, geopolitical events, and market sentiment.

Determining a stable exchange rate regime for the new currency will be essential to avoid excessive volatility and maintain confidence in its value.

In this regard, close coordination among the central banks and the establishment of effective mechanisms to manage exchange rate fluctuations will be vital.

Integration of Financial Systems

Harmonizing regulations, infrastructure, and payment systems is complex while integrating the BRICS’ financial systems.

Member countries have different financial systems, making it challenging to harmonize them.

Additionally, to ensure smooth functioning, standardize procedures and promote interoperability for cross-border transactions.

The Potential Impact on the Global Financial Landscape

Reducing Dollar Dominance

BRICS nations may reduce the dominance of the U.S. dollar with a new currency.

These economies are growing and strengthening their ties. The new currency may become more in demand. The dollar may no longer be the primary reserve currency.

This could have far-reaching implications for the global financial landscape, as the BRICS bloc collectively represents a significant portion of the world’s GDP.

Strengthening Economic Cooperation

The development of a BRICS currency can strengthen economic cooperation among the member countries.

By trading in their own currencies, the BRICS nations can facilitate smoother and more efficient cross-border transactions, reducing the costs associated with currency conversion and hedging.

This increased cooperation can lead to greater trade volumes, increased investment flows, and enhanced economic integration within the bloc.

BRICS Currency: Promoting Financial Stability

The establishment of a new currency for the BRICS bloc can contribute to greater financial stability. By reducing their reliance on the U.S. dollar, the member countries can shield themselves from external shocks and mitigate the impact of global economic crises.

Furthermore, the new currency can act as a buffer against fluctuations in the value of the dollar and provide a more stable medium of exchange for intra-BRICS trade.

What will back the BRICS currency?

Speculation suggests that it could be backed by gold or other rare-earth elements.

The BRICS countries have not yet confirmed the details. The backing of the BRICS currency remains uncertain as it remains in development.

The backing of the currency will play a crucial role in its stability and acceptance in the global economy.

Addressing Exchange Rate Volatility: Establishing a Fluctuation Band

Exchange rate volatility poses a significant risk to a member nation’s currency within a BRICS currency union. It becomes crucial to establish a fluctuation band within which each member currency should operate to maintain stability.

However, the absence of defined convergence criteria for joining the BRICS currency union complicates the task of determining an appropriate fluctuation band. This issue must be addressed to ensure the smooth functioning of a BRICS currency.

The BRICS Currency: A Step Towards Multipolarity

The BRICS currency won’t replace the US dollar right away. It’s a crucial move towards a more diverse financial system.

Furthermore, the US dollar has pros and cons. Losing its exclusive reserve currency status has consequences. As BRICS nations assert their desire for financial independence, the risk-reward tradeoff of de-dollarization becomes increasingly attractive.

Conclusion

In conclusion, the development of a BRICS currency represents a significant step towards financial independence for the member countries.

The BRICS nations want to challenge the US dollar’s dominance by establishing a new currency. This move aims for a more balanced global financial system.

Challenges exist, like differing interests and volatility in exchange rates. A BRICS currency has potential benefits such as less reliance, better cooperation, and improved stability. Pursuing it is a strong idea.

As the BRICS nations continue to strengthen their ties and explore new avenues of collaboration, the future of a BRICS currency holds promise for a more multipolar and inclusive global financial order.