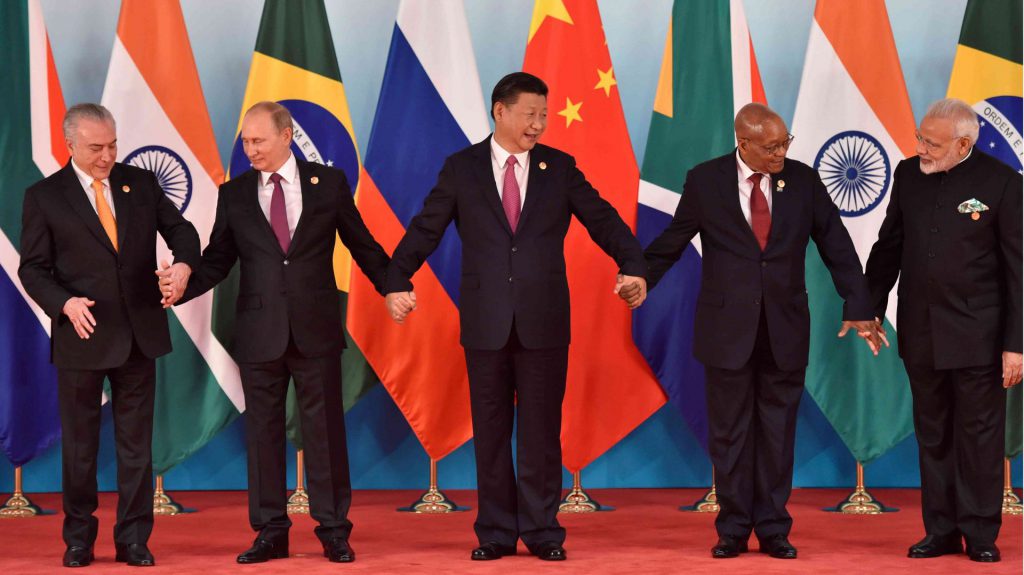

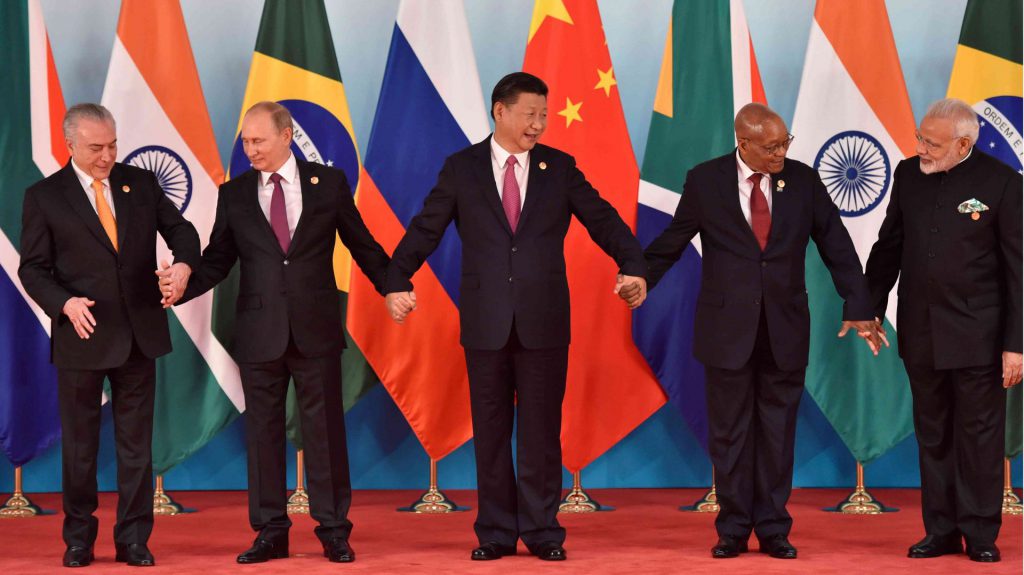

Amid the talk of increased de-dollarization efforts and a possible BRICS currency, there remain viable reasons as to why the idea could ultimately fail. Specifically, as the economic bloc seeks to shift economic global power, they must first confront several obstacles.

Specifically, economic factors regarding an eventual BRICS currency could stand in the way of its mass adoption. Moreover, imbalances within the bloc maintain Chinese dependence, and there are a host of economic realities in Russia, China, India, and South Africa that could hinder its development.

The potential alternative currency has a lot of potential. However, there is a lot that the bloc must confront before it reaches its ultimate goal.

BRICS Account Surplus

A primary reason why a BRICS currency idea could fail is the account surpluses of the BRICS nations. Specifically, the nations in the bloc account for surpluses that depend on Western nations’ deficits. Where general economic perception perceives surpluses and deficits as good and bad, the two ideas have a synchronous relationship.

Specifically, the US and UK have large account deficits to match the alternatives of most of the BRICS nations. Additionally, the International Monetary Fund (IMF) released data showing that global account balances are actually widening since the pandemic.

Although this initially seems like a good thing for BRICS, the unbalanced nature of their economy has an adverse effect. Specifically, these nations are not consuming the resources that they produce. Subsequently, they will need to rely on exports that exist in the rest of the world.

BRICS countries have low domestic demand, which requires the West to consume the vast goods they produce. This would lead to savings and growth, but it is an act that is not possible within the bloc alone. Subsequently, it indicates two different things.

Economic Impact

Firstly, BRICS nations have very low household incomes relative to the rest of the world. Thus, consumer spending between the bloc and the US shows a massive disparity. Specifically, household financial consumption expenditures note that the US spends 50% more than all of the BRICS nations combined.

Thus, these nations require the deficits of the West to consume what their own economies cannot. Without that, deflation would run rampant, and the economy would descend as the surplus remained untouched.

Additionally, the BRICS bloc has high domestic savings rates in relation to the rest of the world. Specifically, the West supports very low savings rates: the US is at 17% and the UK is at 15%. Alternatively, world economies like Germany and Japan maintain savings rates of 29% and 29%, respectively.

The BRICS nations’ high savings rates again present a situation in which exported goods are a necessity. Moreover, these savings rates often increase export growth. As these nations seek to profit from countries that are not saving the way that they are.

Conversely, it has been proven historically difficult to restructure economic activity. Specifically, rebalancing from high savings to domestic demand is nearly impossible. A fact that can be seen in the economic development of Japan.

What Japan Shows Us

Following World War II, Japan became a manufacturing machine. The nation focused on the demand for goods globally while not placing attention on domestic consumption. In 1984, Japan’s exports as a percentage of GDP were 15%, which led to the signing of the Plaza Accord in 1985.

This moment devalued the US dollar against the Japanese yen, leading to its value appreciating more than 40% against the dollar for the next five years. However, this increase eventually took a toll on the economy. Specifically, it impacted exports and decreased to 9% of the GDP in 1989. While also pushing household debt to 68% of GDP in only five years.

Subsequently, in 1986, the country’s Prime Minister attempted to alter its economic standing, switching it from being export-driven to demand-driven. This was released in the Maekawa Report, named after the head of the Bank of Japan, Haruo Maekawa.

The report had suggested economic reform in the country, in an effort to increase living standards and reduce account surpluses. Additionally, it hoped to switch the focus from saving to spending, facilitating an economic rebalancing. However, it faced strong opposition and never actualized within the country.

How To Make a BRICS Currency Work

As de-dollarization efforts continue, and the BRICS currency is developed, two things stand in its way: Firstly, there are the previously discussed account surpluses. Secondly, there is the need for the alternative currency to be pegged to a single currency and that respective policy.

A BRICS currency requires an anchor in one specific economy or monetary system. Moreover, typically, a bloc would peg its currency to the most successful country that has the lowest inflation rate. Subsequently, in the case of BRICS, it would require China’s monetary system.

Conversely, how would this situation look if China sought to tighten its liquidity while Brazil was in a recessionary state? Thus, both nations would seek alternate monetary policies; China wanting higher rates, and Brazil wanting them lower. Then, a common currency would work against opposing interests, only creating conflict.

The vast difference in economies would make the peg system likely to be a net negative for the overall country’s development. Subsequently, it could eventually lead to greater disdain between the countries of such differing powers. China currently holds the greatest influence as it maintains the strongest and most firm economic standing.

This is why the BRICS currency would need to have a limitation on usage to be accepted. Recently, discussions on the BRICS currency being used for international settlements have taken shape. Thus, allowing nations to use their own native currencies for their own interests lessens the potential resentment that could arise from the contrary.

Only time will tell how the currency development will shake out and whether or not it will work. However, it remains that the BRICS currency could ultimately fail for the previously stated reasons.