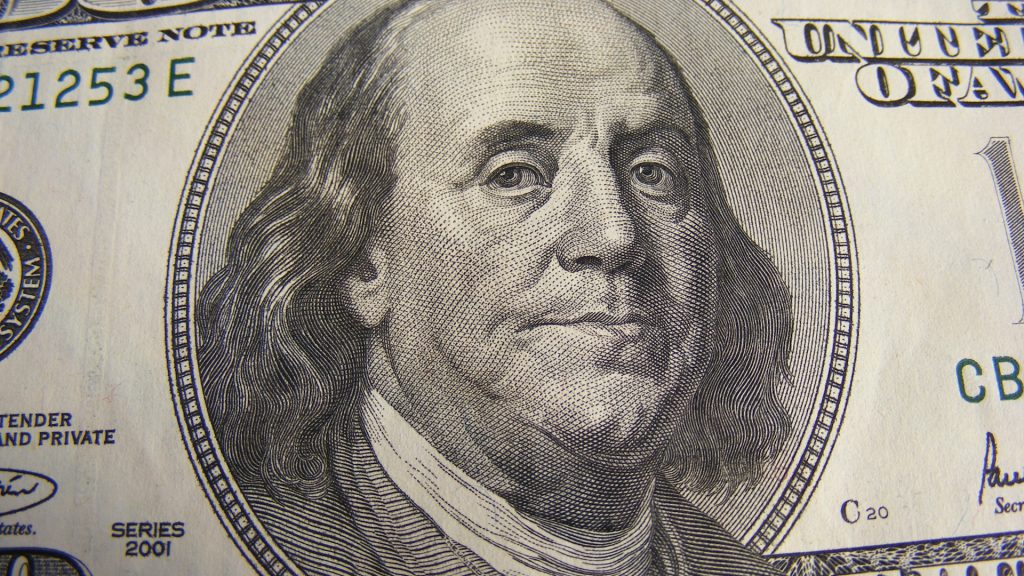

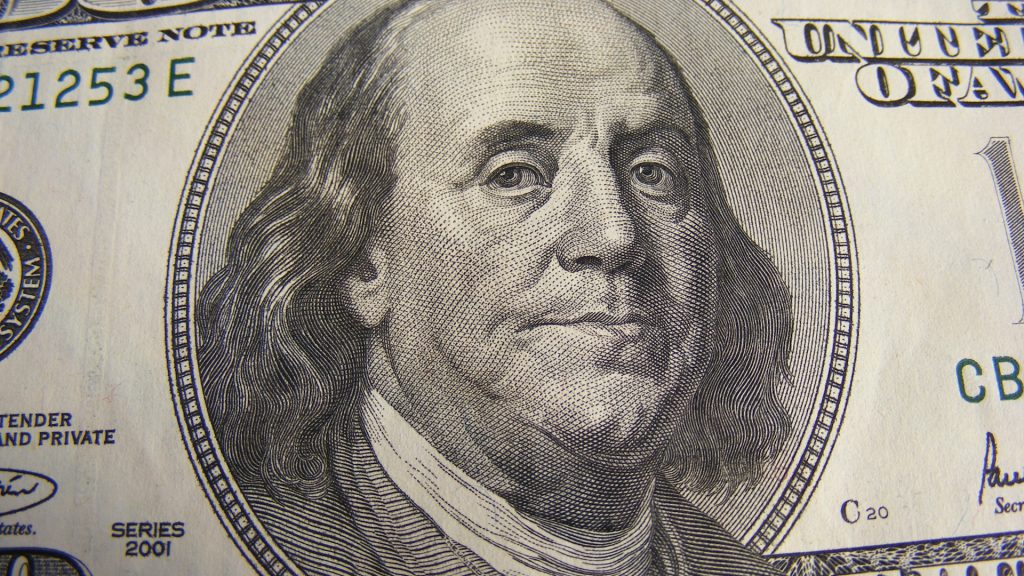

The BRICS alliance is mulling the prospects of creating a ‘single unit account’ as an alternative currency to the US dollar. The development suggests that the BRICS will not depend on a single currency to settle cross-border transactions. The alliance is looking to create infrastructure for ‘unified settlements’ that will not be dependent on other local currencies. The single unit account could be used for commodity deliveries and will be a centralized issuance without the US dollar.

Also Read: BRICS: JP Morgan Predicts the Future of the U.S. Dollar

Therefore, BRICS might not use the US dollar, Euro, Pound, and their local currencies like Chinese Yuan and Indian Rupee. “We see the potential to discuss the creation of unified settlement systems,” said Russia’s Finance Minister Anton Siluanov to CGTN TV.

He stressed that the BRICS bloc will begin discussions on the prospects of a single unit account for unified settlements. “This can be a unit of account for the BRICS member countries. Not a single currency like in the EU, but an alternative to the US dollar. In which the cost of commodity deliveries can be denoted as well as benchmarks for some goods. So as not to depend on the single currency or an issuing center that issues banknotes in a no-one-knows-how manner,” he said.

Also Read: BRICS: U.S. Dollar ‘Global Reserves’ Drop Below 60%

BRICS Taking on the US Dollar

While these are only discussions, the outcome of the challenge to the US dollar is yet to be determined. BRICS is pushing out new ideas to settle global trade without the US dollar, but none of the plans have taken shape. It is expected that the alliance will mutually conclude a currency settlement before the next summit in Russia.

BRICS has made it clear that it will no longer depend on the US dollar for international trade. The alliance will chalk out a new path by strengthening their native economies first for a better tomorrow. Read here to know how many sectors in the US will be impacted if BRICS stops trading in the US dollar.

Also Read: BRICS: U.S. Dollar Losing Dominance in the Global Oil Sector