Saudi Arabian oil company Aramco is looking to expand its footprint in China to strengthen ties between the two BRICS nations. The company will up its investments into its Chinese partner company, Ningbo Chongjin Petrochemical.

In a Wednesday filing to the Shenzhen Stock Exchange, the Chinese energy company said that Aramco is in talks with Rongsheng Petrochemical to acquire a maximum 50% stake in Ningbo Chongjin Petrochemical. Rongsheng is a Hangzhou-based privately-owned refiner. Additionally, it’s also discussing the possibility of taking a 50% stake in Saudi Aramco Jubail Refinery Company, the refining unit of the Saudi company. In turn, this signals a working relationship between the two companies. The working partnership would only benefit the energy trade relationship between China and Saudi Arabia.

Also Read: Iran to Help Create BRICS Currency to Ditch US Dollar

Rongsheng also adds that the companies could also jointly upgrade and expand the Chinese subsidiary’s equipment. Together, the energy companies could build the massive Rongsheng New Materials (Zhoushan) project. This project project will make high performance petrochemicals, such as engineering plastics, special polyesters and high-end resins. These can be used in electronic devices and semiconductors, according to the Rongsheng company.

BRICS Reaps Ultimate Benefits from China and Saudi Arabia Deal

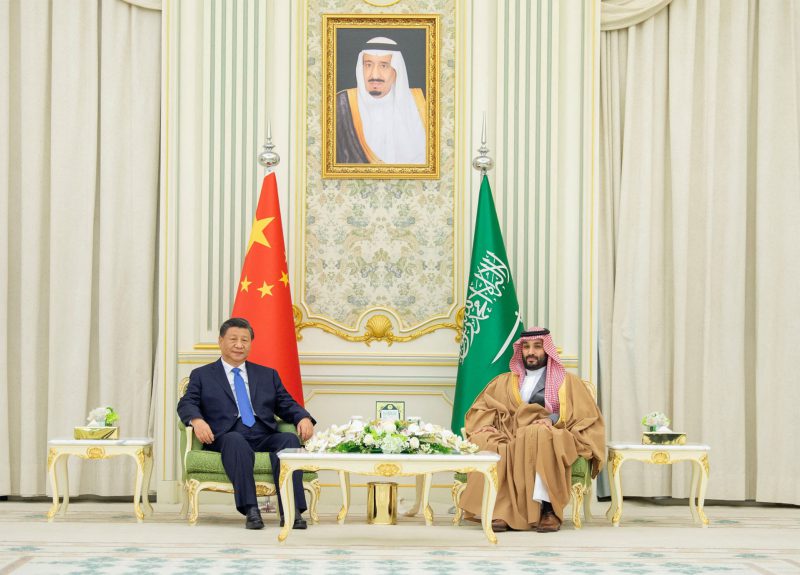

This is one of many moves that China and Saudi Arabia have made in the past year to strengthen ties. With the latter officially joining BRICS at the start of the new year, Saudi Arabia looks to use its wealth in resources to strengthen its international voice and ties with all BRICS nations. In return, China has also sought to grow its presence in the Middle East country.

Also Read: BRICS: Central Banks Record Gold Buying a US Dollar Defense

The partnership reaps mutual benefit, and will likely be carried out without the US dollar if any transactions take place. Hence, China, Saudi Arabia, and the rest of BRICS is strengthened on the energy and oil front, while the US dollar is further weakened.