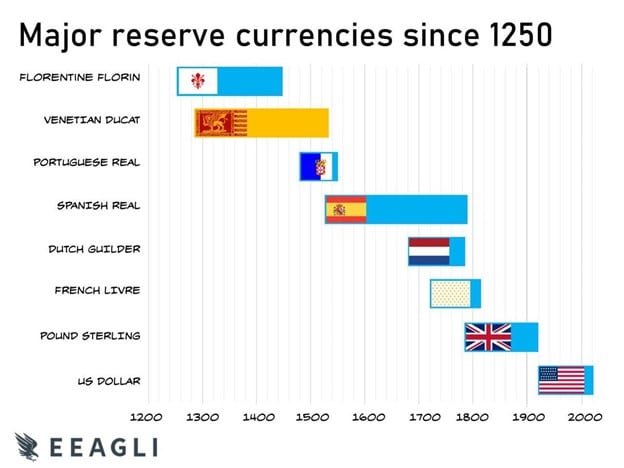

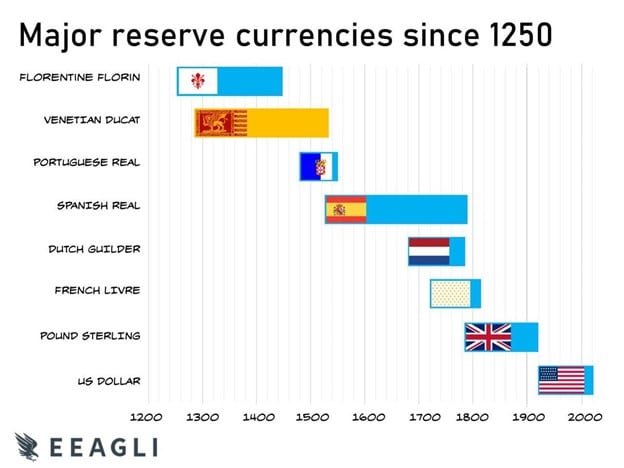

The U.S. dollar became the global reserve currency in 1944 after the Pound Sterling lost its value during WWI and WWII. The decline in Pound Sterling made way for the dollar to dominate the global markets under the presidency of Franklin D. Roosevelt through the Bretton Woods Agreement.

However, developing nations are looking to collectively overthrow the dollar’s dominance at the moment, and reduce the Western financial stronghold. The dollar, on the other hand, is slowly falling in value compared to other currencies in the markets. Yet, this might only be a temporary hiccup and not a permanent one. Below is the timeline of how many currencies dominated the world before the rise of the dollar.

Also Read: BRICS New Currency to be Backed by Gold?

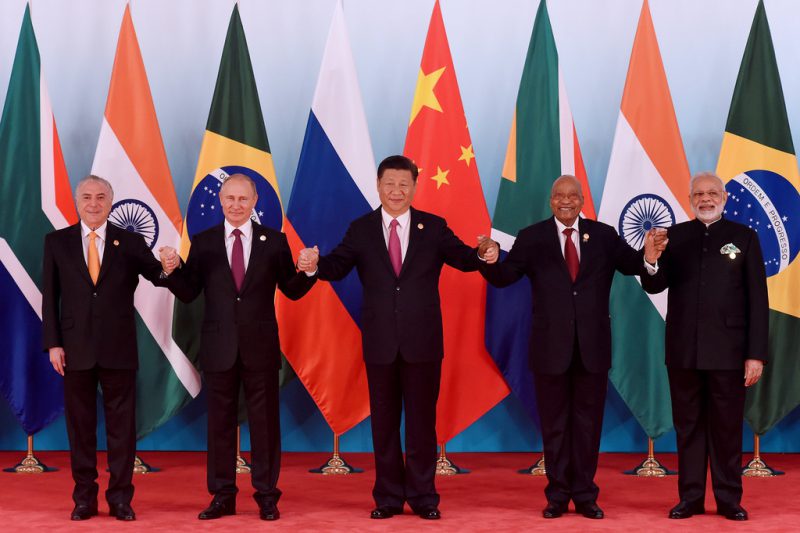

BRICS & the Quest For Financial Power Against the U.S. Dollar

BRICS elbowing the U.S. dollar on a global scale might not be a reality anytime soon. In simple words, the exchange of currency on a global scale happens only when both parties have something in value. If one party does not want a new currency and prefers the dollar, BRICS could be hindered in transactions.

If the other country (non-BRICS) prefers the new currency, it comes with an added risk of losing its intrinsic value. A new currency will take an ample amount of time to solidify its value and might not happen in a relatively short period.

Also Read: Will the U.S. dollar Collapse Now That BRICS Are Developing Their Own Currency?

On the other hand, countries in the East are not as united as that in the West. BRICS countries- India and China are at loggerheads and political turmoil between the two repeatedly engulfs the nations.

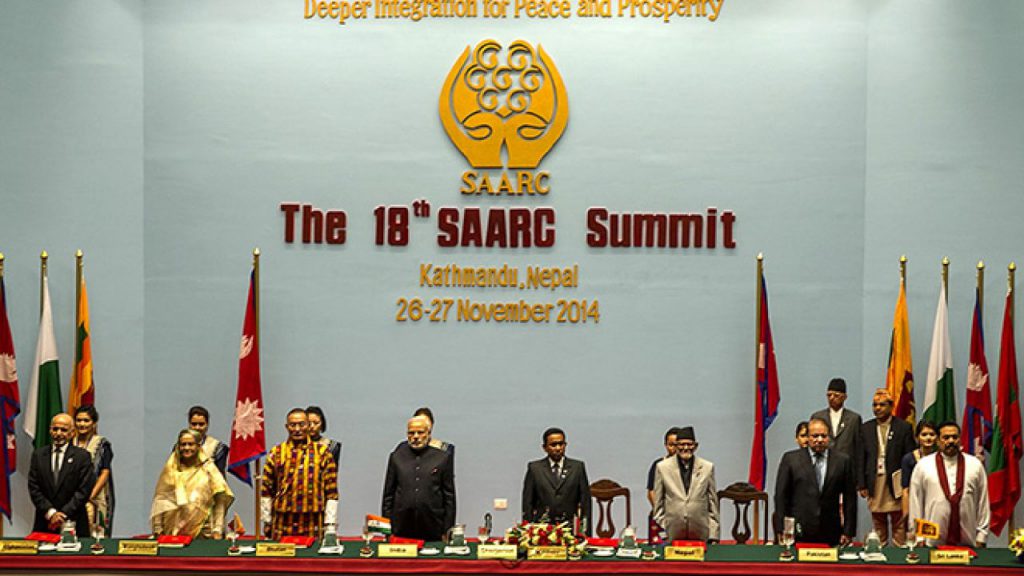

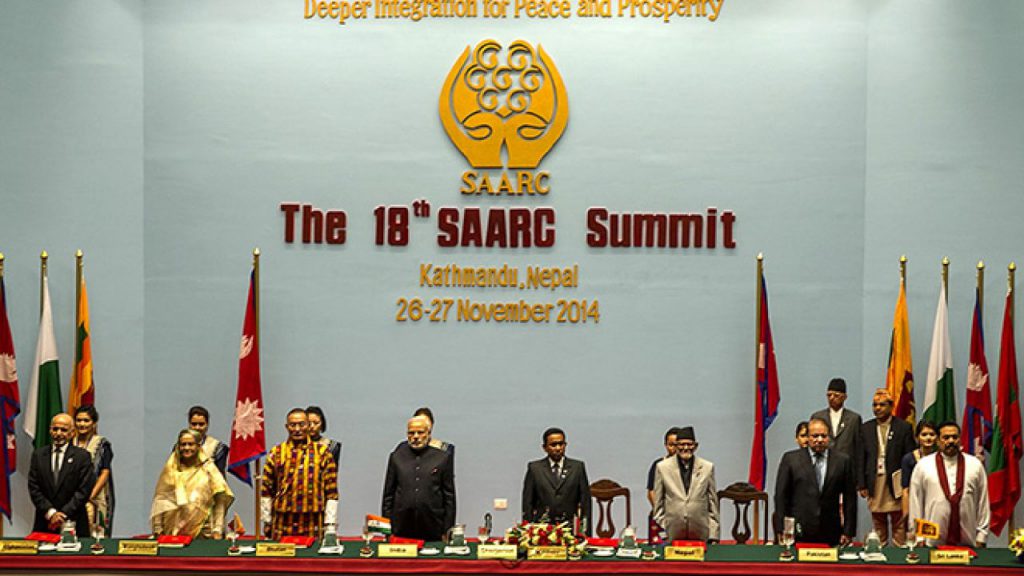

For instance, the South Asian Association for Regional Cooperation (SAARC) was created in 1985 consisting of Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan, and Sri Lanka. The motto of SAACR is ‘Deeper Integration for Peace and Prosperity.

However, SAARC now highlights an unfortunate picture as India and Pakistan have been at a crossroads for more than a decade. Sri Lanka is suffering from a financial disaster while Afghanistan remains a war-torn nation. Maldives faced an economic crisis last year and it is reeling from the after-effects. Therefore, SAARC is now conveying the opposite of its initial objective.

In conclusion, there is no guarantee that the BRICS countries will join hands tomorrow as they do today. If one thing that countries in the East need to vigorously work upon is ‘unity first and policy next’. Until then, the demand for the U.S. dollar on a global scale will remain strong despite the current headwinds.