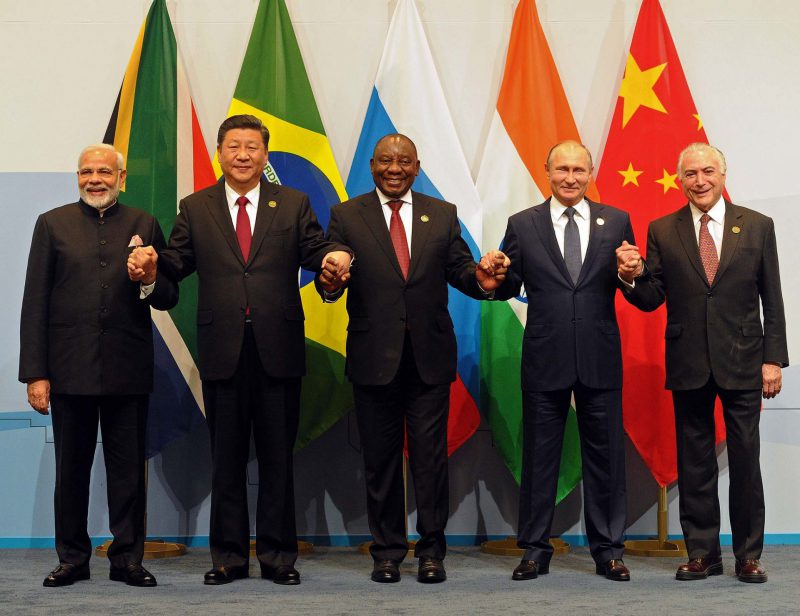

The United States faced fresh economic threats from China, Russia, Brazil, and India calling to stop the dollar from reigning international trade. Other nations see accumulating the USD as a risk that could hinder their internal growth, as the dollar is attached to massive debt exposure. BRICS countries and many other African nations are showing less desire to hold the U.S. dollar.

A financial analyst predicted that if BRICS launch their currency, African nations could adopt and push the USD aside. Read here to know how African countries are on the sidelines to eliminate the dollar’s supremacy.

Also Read: BRICS Advancing To Eliminate U.S. Dollar Financial System

Other Countries See U.S. Dollar As Debt

Billionaire Ray Dalio said in a recent interview that countries are beginning to show less interest in the U.S. dollar. He added that Central Banks are considering plans to eliminate USD transactions and give priority to their native currencies.

Dalio said that dollars are “debt” and other countries indirectly become a part of the debt and now want to move away. The hedge-fund manager said that countries are now feeling that if China and Russia can do it, so can we.

Also Read: Will the U.S. dollar Collapse Now That BRICS Are Developing Their Own Currency?

“Dollars are debt,” said Dalio and continued, “In other words, when one holds a dollar, a Central Bank, they hold a debt asset. Generally speaking, the world is holding a lot of U.S. dollar-denominated debt. So the holders of that would say, ‘I’m already overexposed to USD-denominated debt.’ And so there’s less of an eagerness to buy the debt”.

The supply and demand to settle payments in USD is declining as Russia and China are facilitating transactions via Yuan. This added extra burden on the dollar and is facing a dire situation of chain reaction from other countries. You can watch Ray Dalio’s take on the upcoming decline of the dollar below.

Also Read: Will the U.S. dollar Collapse Now That BRICS Are Developing Their Own Currency?