BRICS member China is serious about de-dollarization and is doing everything possible to stop the US dollar’s rise. From forging new trade partnerships in local currencies to convincing developing nations to ditch the US dollar and having an upper hand in trade deals, China is calling the shots on how cross-border transactions must be settled. Read here to know how many sectors in the US will be impacted if BRICS ditches the dollar for trade.

Also Read:10 New Countries Might Join BRICS in 2024

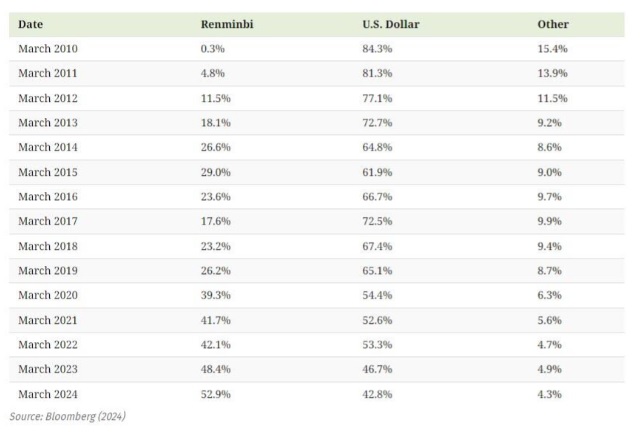

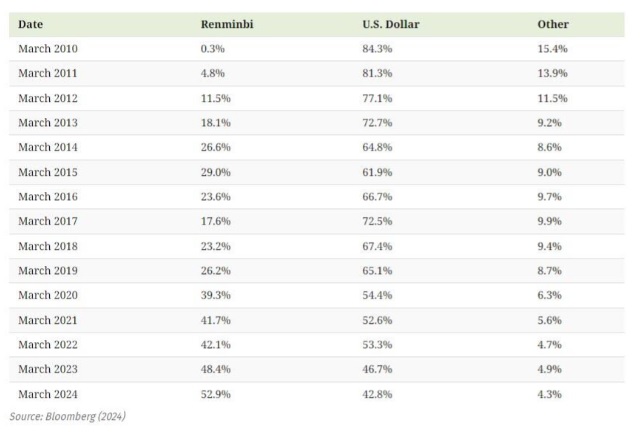

China is showing BRICS and other developing countries how the de-dollarization agenda must be executed on a global scale. The latest data shows shocking results about how the Chinese yuan has penetrated against the US dollar globally. As of March 2024, 52.9% of all trade in China has been settled in the Chinese yuan and not the US dollar. Only 42.8% of trade in China is settled in the US dollar, which is a drastic low.

Also Read:ASEAN: Malaysia Calls For Asian Monetary Fund To Derail US Dollar

BRICS: China Gets Serious on De-Dollarization, Pushes Yuan Ahead For All Transactions

The development is alarming and if other BRICS members follow the Chinese footsteps, the US dollar will be in jeopardy. The US dollar thrives on supply and demand and if local currencies are used in maximum transactions, the currency will begin to decline in the forex markets. Also, China is showing BRICS and the world that the first step in de-dollarization is to reduce dependency on the US dollar.

Also Read:China Advances De-Dollarization Agenda At the SCO 2024 Summit

Moreover, in 2010, 84% of trade in China was settled in the US dollar and 0.3% in the Chinese yuan. The tables have turned in 2024 after the BRICS alliance kick-started the de-dollarization initiative. Not just China, but even its BRICS counterpart Russia is increasingly using the Chinese yuan for cross-border transactions. Local currencies aim to be in the driver’s seat of the economy by pushing the US dollar on the backseat.