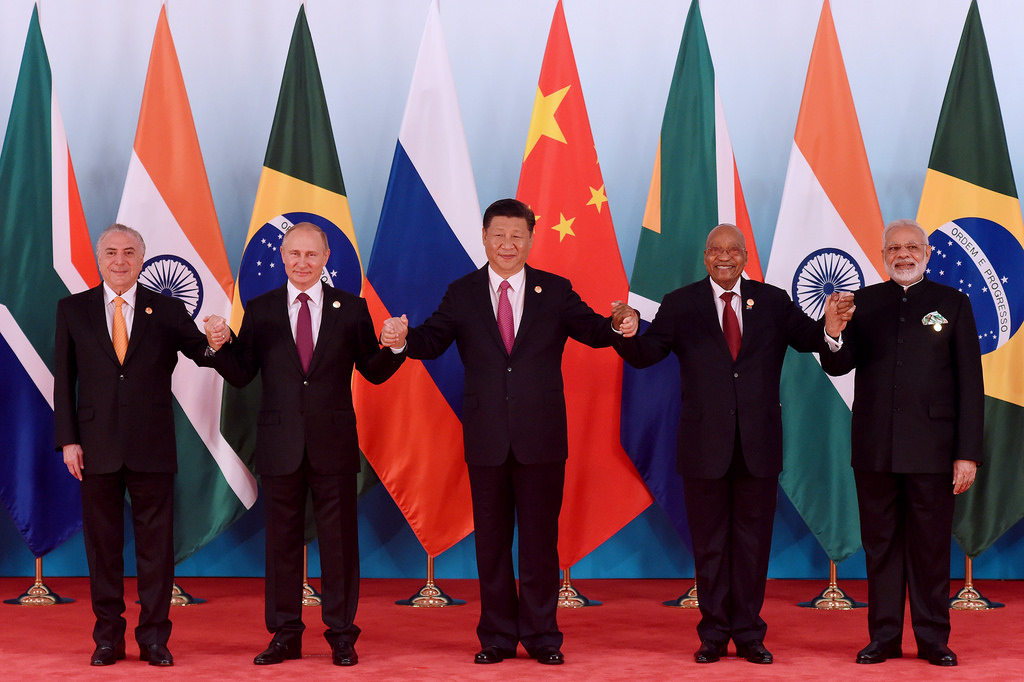

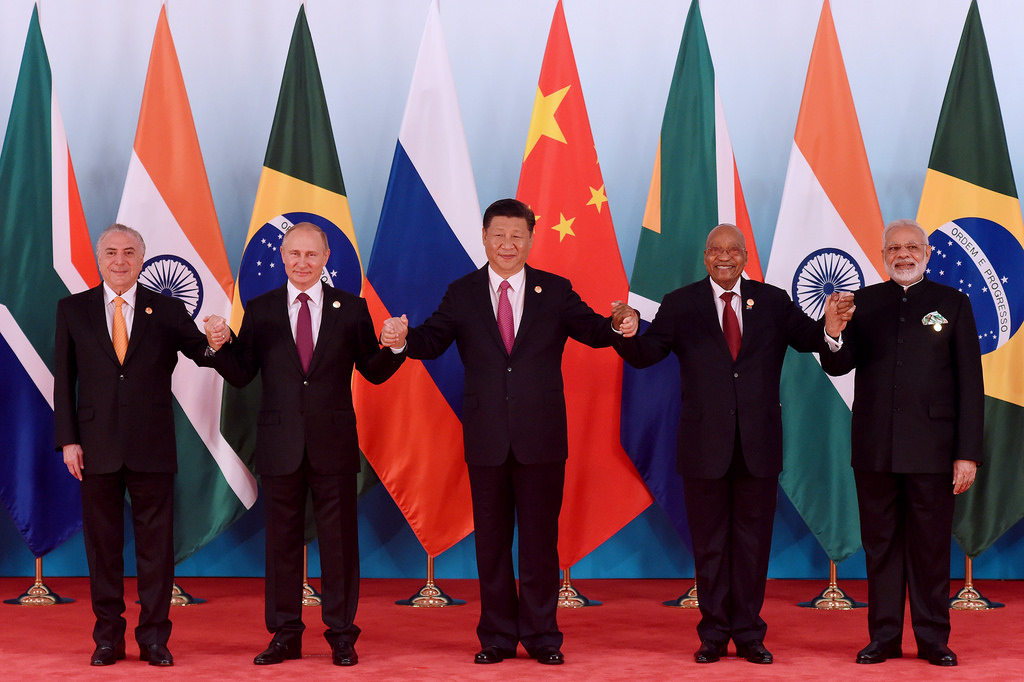

The BRICS alliance is marching towards its quest to dethrone the U.S. dollar from global reserve status. BRICS is looking to use local currencies for cross-border transactions, sidelining the U.S. dollar from global trade. BRICS has made it clear that its priority is to strengthen native economies and not provide fodder for the dollar.

Also Read: BRICS: China Targets U.S., Says America Is Obsessed With Hegemony

In addition, the bloc is also making progress in convincing other developed countries to follow suit. BRICS is moving towards making Asia, Africa, and South American countries put local currencies first and not the USD. The idea is to bolster all currencies and compete with the mighty dollar on the international stage.

Therefore, while all countries are banding together to strengthen their respective currencies, the U.S. dollar is watching from the sidelines in a ‘do or die’ situation. If the majority of nations end their dependency on the USD, the greenback will fall on a path of decline.

Also Read: BRICS: Ending Reliance on the U.S. Dollar Main Agenda of Summit

The U.S. will find little to no means to fund its deficit, leading to turbulence in the American economy. Read here to know how many sectors in the U.S. could be affected if BRICS stops trading in the dollar.

Can BRICS End the U.S. Dollar Supremacy?

It is too early to conclude that BRICS could end the U.S. dollar’s global supremacy. The USD remains the de facto superior currency and 59% of all international trades are settled in the dollar. The greenback is more reliable than the existing currencies in the markets that have yet to make a mark on a global scale.

In conclusion, the U.S. dollar is king and has survived several onslaughts in the last eight decades. Bringing the USD down needs more teeth and might not happen in a few years.

Also Read: BRICS: Warren Buffet Predicts How Long USD Will Remain Global Currency