The BRICS economic alliance has seemingly prioritized its de-dollarization efforts, leading the United Arab Emirates (UAE) to seemingly prioritize local currency over the US dollar in new oil deals. Indeed, the country is said to be on the hunt for new oil deals, coinciding with greater de-dollarization across the bloc.

The UAE was one of six countries included in the BRICS’ first expansion effort. Specifically, the nation joined Saudi Arabia, Egypt, Ethiopia, Iran, and Argentina. Now, reports have surfaced signaling the country’s attempts to find new oil trading partners. Ultimately, such a development could have massive implications for the greenback.

Also Read: Why is the Indian Rupee Crashing Against the US Dollar

UAE Could Prioritize Local Currency Over US Dollar in New Oil Deals

Over the last twelve months, the BRICS bloc has seen impressive growth. Indeed, its rising prominence culminated in an expansion effort. Announced at the 2023 summit, the effort saw six countries join forces with the already five-member states. Now, its plan to end Western currency dominance is coming to fruition. Subsequently, one of its newly indoctrinated members could greatly help that goal.

Specifically, the Financial Times reports that a BRICS member country, the UAE, is seeking new oil deals that could have massive implications on the US dollar. Indeed, the report noted that the country had planned on utilizing the COP28 Summit for the observation of prospective oil deals

Also Read: BRICS De-Dollarizaiotn Plan Gaining Steam in Developing Countries

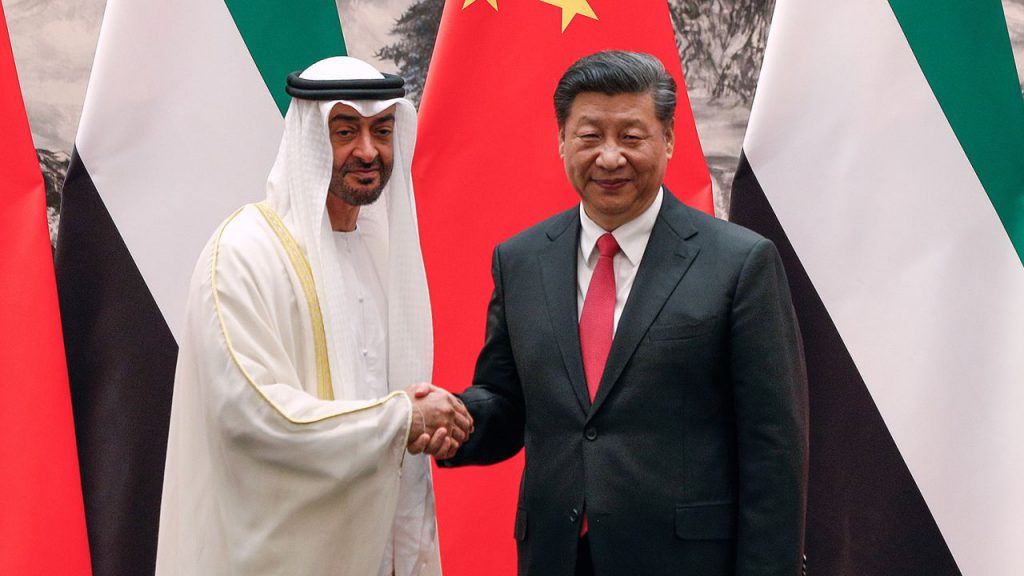

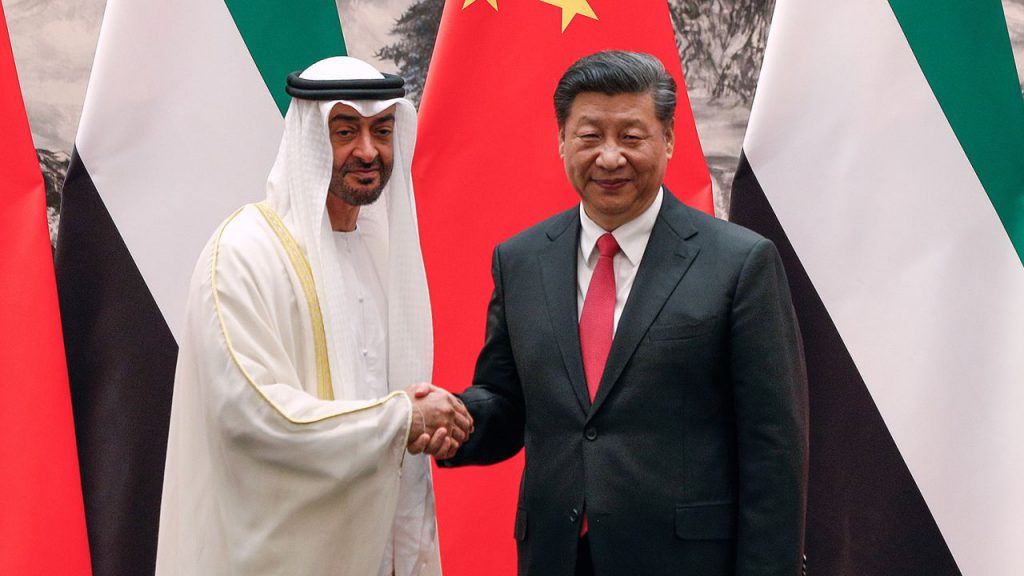

The report notes that the UAE “planned to use meetings about the COP28 summit it is hosting later this week to pitch oil and gas deals to foreign governments,” according to sources. Additionally, it stated that the country is set to discuss potential deals with 15 countries, including China, Russia, and Egypt.

Those three nations are already included in BRICS and align with de-dollarization plans. Specifically, both China and Russia have implemented their own solidified plan to move away from the dollar in trade. Susbeuqnlety, such an action by the UAE would be massively important to those goals.