The US Dollar has continued its 20-year decline amid the BRICS de-dollarization efforts. Indeed, the currency has seen its standing as a global reserve currency challenged by a shift in international sentiment. The prevailing ideology among global nations has sought to lessen international reliance on the greenback.

Subsequently, that idea has continued what has been a long downturn for the dollar. However, it could fast-track in the coming year. As the BRICS bloc continues to promote local currency settlements and its potential native currency, those nations will gradually opt for other currencies to utilize outside of the dollar.

Also Read: BRICS: ‘Joint Currency’ Could Be Launched To Challenge US Dollar

BRICS Bloc Continues US Dollar’s Decline as Global Reserve Currency

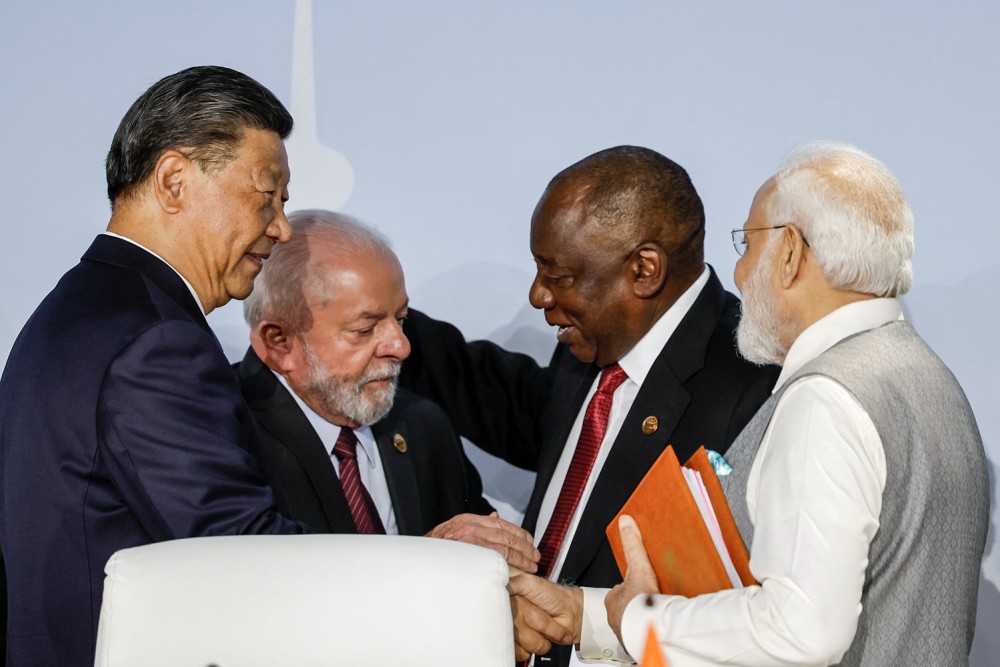

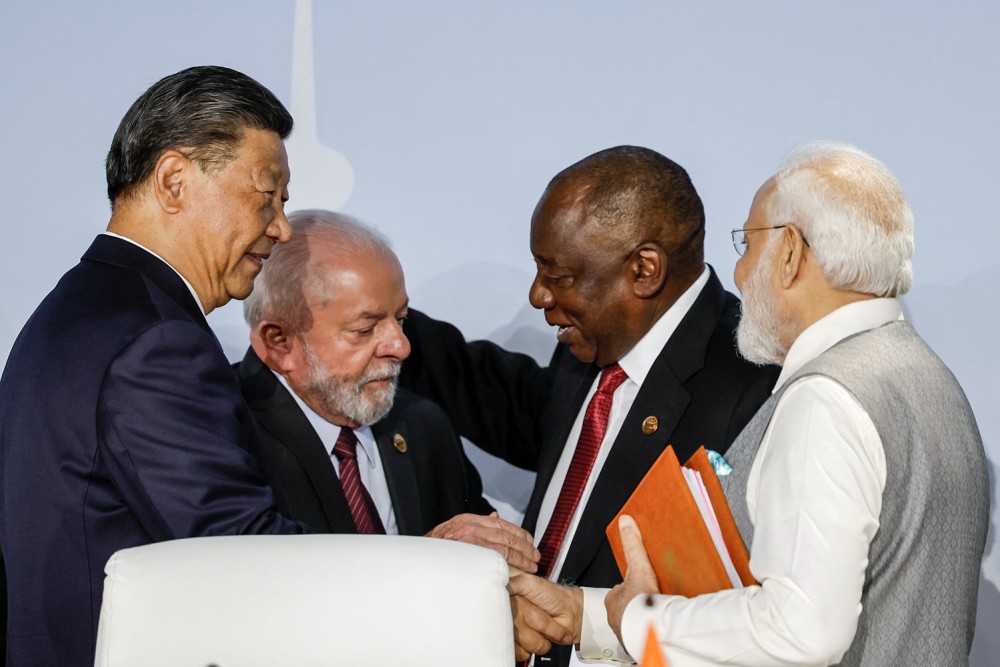

Throughout 2023, the BRICS bloc made numerous headlines for its various initiatives. Among those was its inaugural expansion effort. There, it introduced five new nations to its bloc, a move made official on January 1st, 2024. Thereafter, it continued its de-dollarization plans, making major headway throughout the year.

According to data from Wolf Street, the BRICS actions are helping the US Dollar continue its 20-year decline amid a global shift in perspective. Specifically, the figures show an overall decline in US dollar-denomiat4ed foreign exchange reserves to 59.2%. Moreover, that should continue to trend downward.

Also Read: Will BRICS Currency Replace the US Dollar?

Central Banks across the globe are still holding $6.5 trillion in total US dollar-denominated assets, but that appears more out of necessity. The global reserve share has decreased from 66% in 2014 to its current rate. Additionally, the data shows that the greenback is losing ground to a host of smaller currencies gaining usage across the world.

The Euro represents 19.6% of the global reserve, while the Japanese Yen and British Pound represent 5.5% and 4.8% respectively. Thereafter, all other smaller currencies note around 3.9% of the share. This is still more than the Chinese yuan and Australian dollar.

This development certainly notes the fruits of BRICS activity. The economic alliance has sought ways to increase local currency usage. Subsequently, the smaller global south nations have found their currencies begin to grow in prominence. Altogether, it could provide continued geopolitical implications in the form of shifting multipolar perspectives. Ultimately encouraging the US dollar’s continued, albeit gradual, decrease.