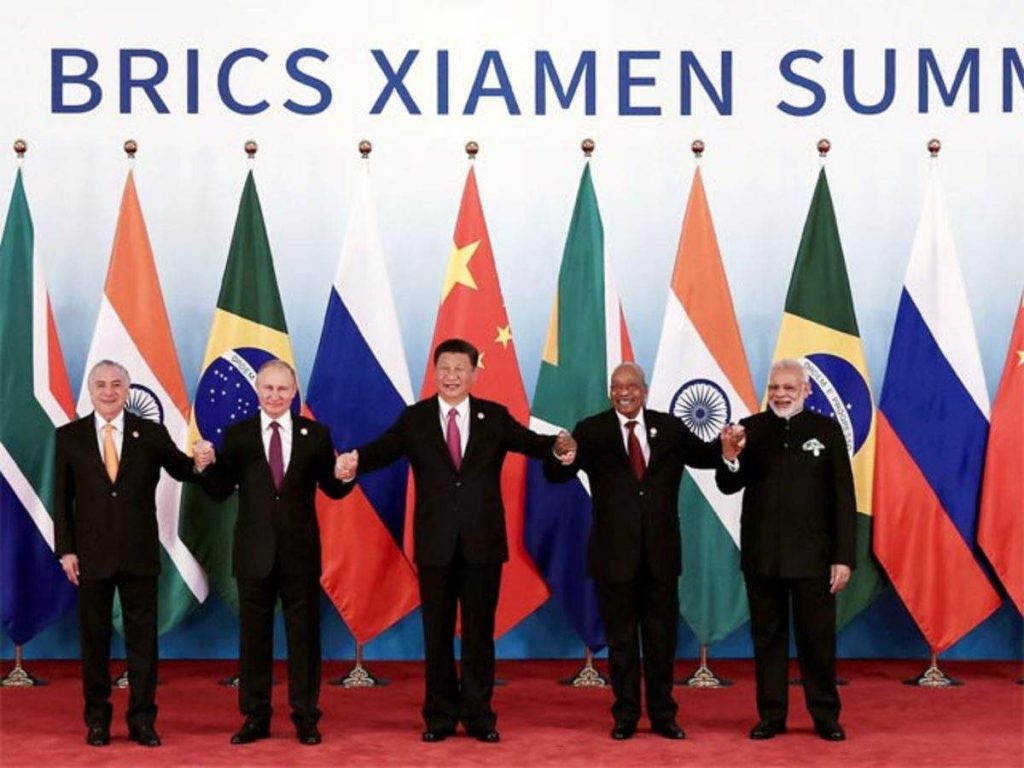

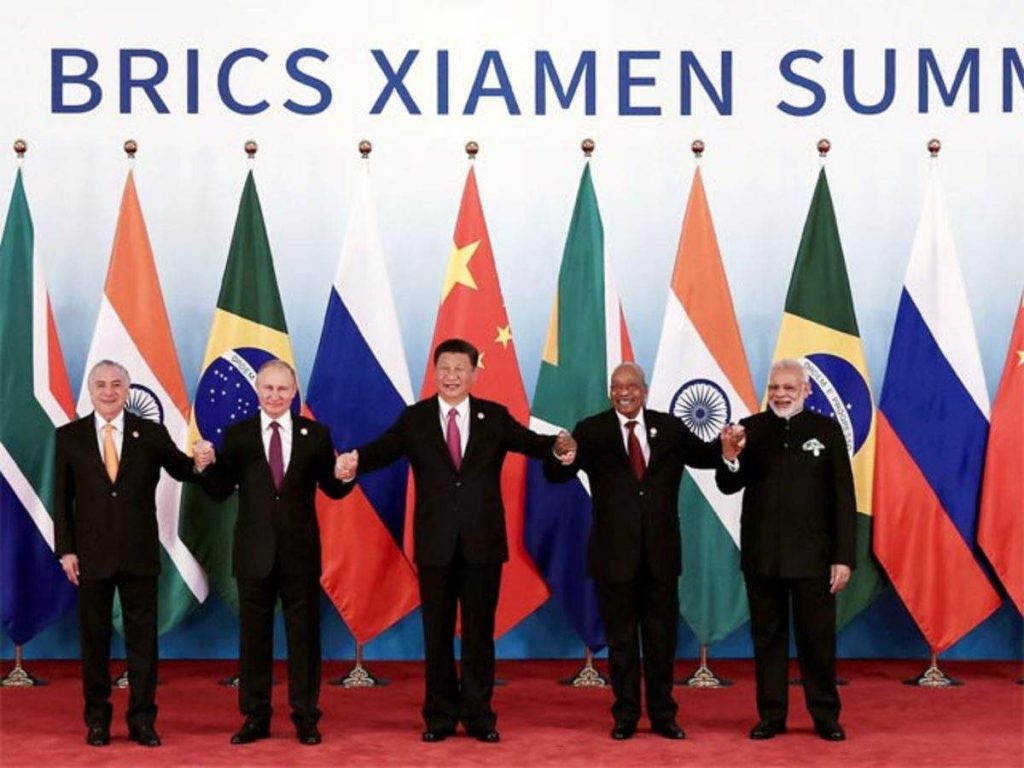

With the BRICS Annual Summit set to take place in August, two topics will dominate the discourse. First will be the potential expansion of the bloc, with a host of countries seeking membership. Then, there will be a discussion of the BRICS currency and the hope that it could one day replace the US dollar.

The developing currency could be vital to combating global economic concerns from Western sanctions. Subsequently, the BRICS New Development Bank is poised to introduce the new currency as a trade currency for the bloc. But its potential challenge to the US dollar could eventually come.

The BRICS Currency Purpose

For months, talk of a BRICS currency has been present. Indeed, amid Western sanctions and possible sanctions, it had enormous potential. Now, following a foreign ministers meeting that took place last week in Cape Town, and the annual summit on the horizon, those discussions are fully forming.

BRICS members and their allies have already turned to the greater utilization of national currencies. A practice that feels like a precursor to an alternative currency, de-dollarization, is in full bloom. Yet, it appears as though the BRICS currency could be more than just a trade settlement currency and could target the US dollar.

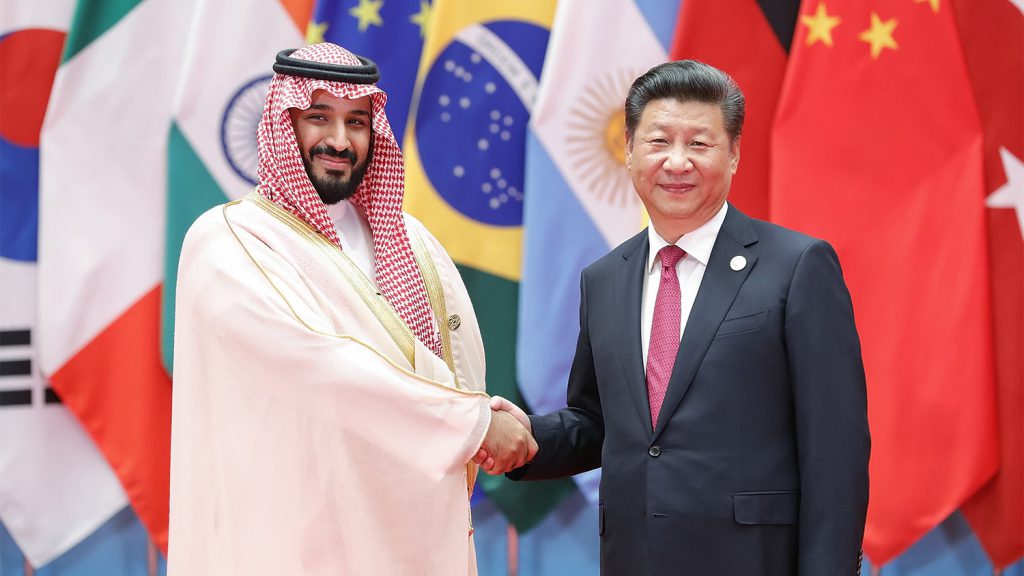

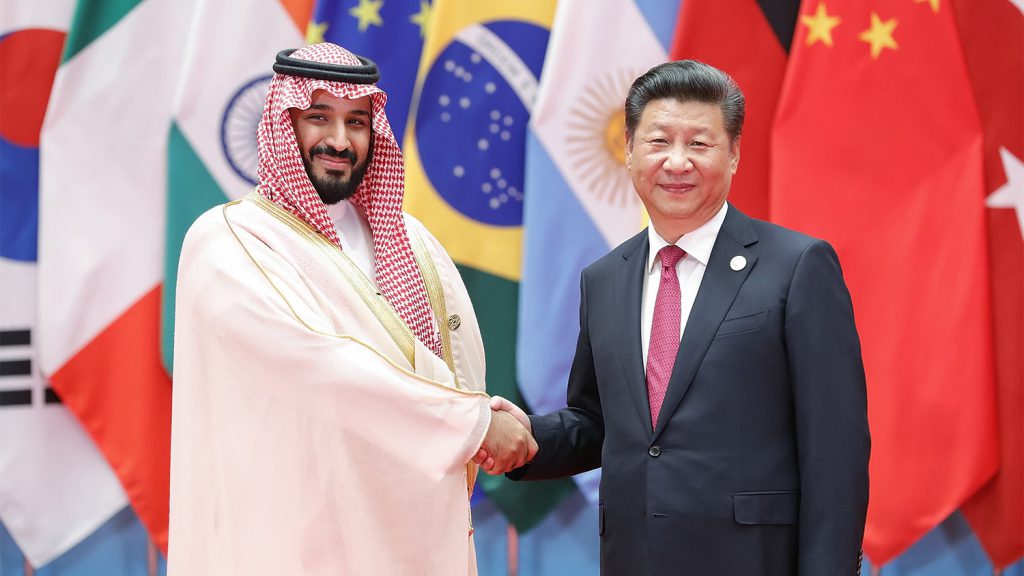

Whether it is backed by gold or another fiat currency, there is no denying the quick embrace from various countries. From Brazil to Iran, the Global South is seeking any reason to do away with its over-reliance on the US dollar. Specifically, its purpose for creation is to continue the bloc’s quest for multi-polarization.

Its integration into the bloc’s operations would satisfy developing countries’ exhaustion with Western dominance. Indeed, exhaustion was exacerbated by the weaponization of American currencies. Facilitating the need for an alternative, a currency controlled by the global south as a collective.

How Would it Work?

The purpose and hope behind a BRICS currency are understandable, but how it functions would be a totally different dilemma. However, it is clear that the New Development Bank is seeking to create an alternative to the International Monetary Fund (IMF) or the World Bank. Two entire that have been complicit with the weaponization of Western Currencies.

Thus, this development bank would seek to continue its multipolar expression through a currency that would be used for trade purposes. Moreover, it would allow the countries within the bloc to use their own national currencies, with the BRICS alternative acting as a unit of account for trade settlements.

This currency would then replace the role that the dollar plays in those same instances. However, that could be just the beginning of the currency’s use cases. Eventually, there is hope that a BRICS currency could challenge the US dollar’s global reserve status.

Now, that may seem far-fetched, but it becomes much more plausible when considering the size of the bloc. Not only does it already encompass more than 40% of the global population, but it is bound to grow rapidly. More than 20 countries have already submitted membership requests to join the bloc, with expansion all but assured.

Could it be Possible?

Russian Foreign Minister Sergey Lavrov had a very interesting note at the recent BRICS ministerial meeting in Cape Town. Specifically, he discussed the various BRCIS member states, and what their contributions mean. Then he stated, “As BRICS membership expansion grows, it may get more interesting, offering more possibilities.”

The US dollar has been in the driver’s seat since World War II. Indeed, the Bretton Woods agreement verified the currency’s place in the world, and that has remained unchanged for decades. Thus, it is important to understand the context of how difficult usurping its relevance would be.

However, the potential of a BRICS currency is undeniable, despite the potential for it to replace the US dollar being unknown. Especially when considering the disdain brewing for unipolarity in the global order and the potential voice that countries could find in adhering to the BRICS currency developments.

With the kind of expansion unfolding currently, anything seems possible. Moreover, the countries led by China, and Russia, maintain an influence and power capable of at least beginning to reach that potential. Conversely, if the US dollar is not able to fully be denied as a global reserve currency, it is at least time to accept that the days of unipolar world power are coming to an end.