The BRICS alliance is advancing to throttle the U.S. dollar from the global reserve status by launching a new currency. The soon-to-be-released currency could be used to settle global trade ending reliance on the U.S. dollar. The de-dollarization is moving at a rapid speed at a time when the U.S. is in a debt ceiling crisis.

Also Read: Europe Might Get Ready To Accept BRICS Currency

In addition, leading banks in America are collapsing and the markets remain under macro pressure. Several financial institutions have predicted a recession in 2023 that could tank the stock markets, real estate, and life in general.

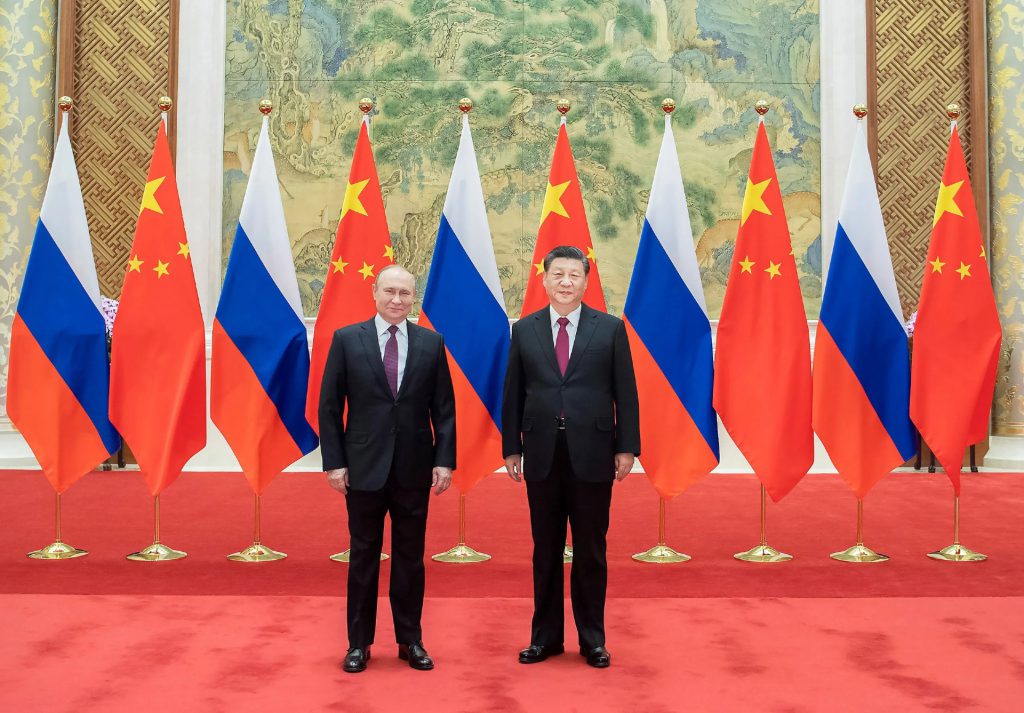

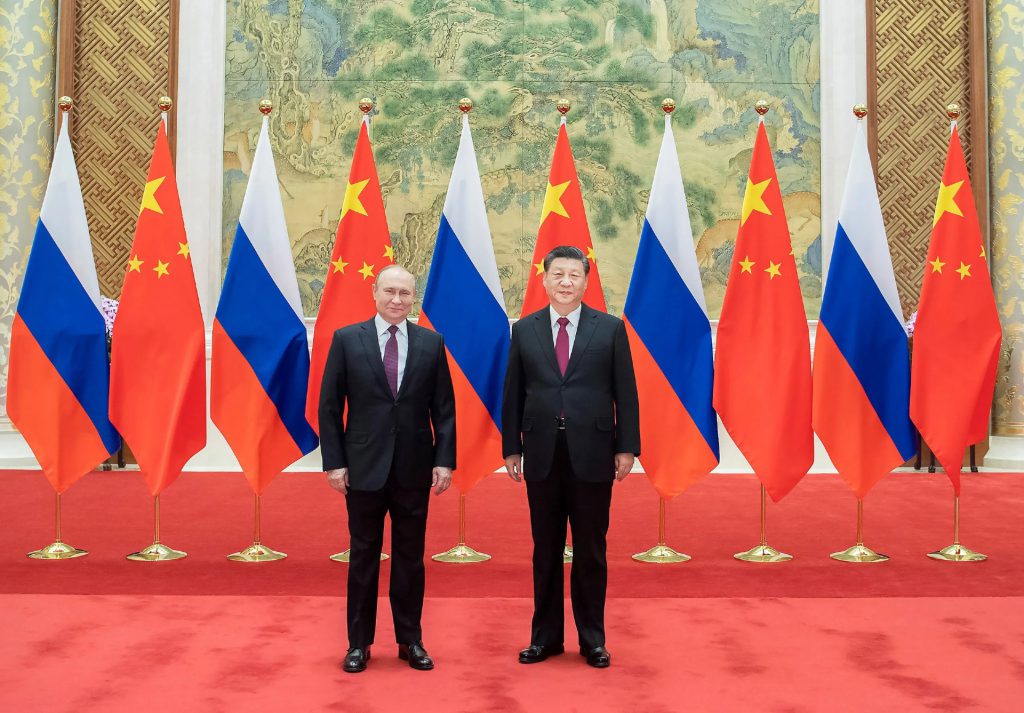

Then enters China and Russia. While their dream of taking over the world seemed unrealistic, it’s all falling into place as planned. Russia countered the U.S. sanctions by partnering with China and making BRICS challenge the Biden administration.

Also Read: Saudi Arabia To Challenge U.S. Dollar’s Supremacy by Funding BRICS Alliance

BRICS Powers China & Russia’s Dream to Take on the U.S. Dollar

The dream to take over the world could become a reality and cause nightmares in the U.S. in the long run. Russia and China are convincing other developing countries to join BRICS and accept the new currency to settle international transactions.

Also Read: BRICS: 16 Asian Countries Move to Ditch the U.S. Dollar

To no surprise, a handful of countries in Asia and Africa are showing interest in the BRICS currency. The U.S. dollar comes with the risk of debt and holding it as reserves could affect their local economies.

Russia and China are convincing the oil-rich Saudi Arabia to join BRICS and fund The New Development Bank (NDB). Saudi is in talks with the alliance to fund the bank and give the alliance a boost. If Saudi funds BRICS, the U.S. dollar could face challenges as the country is the largest exporter of oil.

BRICS could arm-twist European countries to settle oil with the new currency and not the U.S. dollar. When that day comes, the U.S. dollar could be on the path of decline with no quick recovery in sight.