2024 was always poised to be a massively important year for the United States. With BRICS set on establishing a multipolar world, experts have stated that the US is on a “dire” economic path with its GDP poised to plummet significantly. Indeed, the upcoming presidential elections should have several implications for the country’s financial standing.

The BRICS alliance has firmly embraced de-dollarization throughout the last several years. Moreover, they have only grown more prominent since 2022. As the bloc embraces its first expansion effort since 2001 last year, its status should only keep growing. Therefore, the questions facing the US economy, and its dollar, will only grow more concerning.

Also Read: BRICS: India To Use Cryptocurrency For Trade, Abandon US Dollar

BRICS May Benefit From US Economies Troublesome Trajectory

The West and the Global South are a tale of two journeys. For the latter, growth and progression have dominated its plans. Moreover, they have embraced some of the fastest-growing economies on the planet. However, the West is facing increased trepidation about its worrisome position.

That may only magnify as 2025 approaches. With the BRICS entrenched in an anti-West position, the US economy faces a “dire” economic path that could greatly affect its GDP and deficit. Specifically, the 2024 presidential election will yield very different, but radically concerning, fiscal policies.

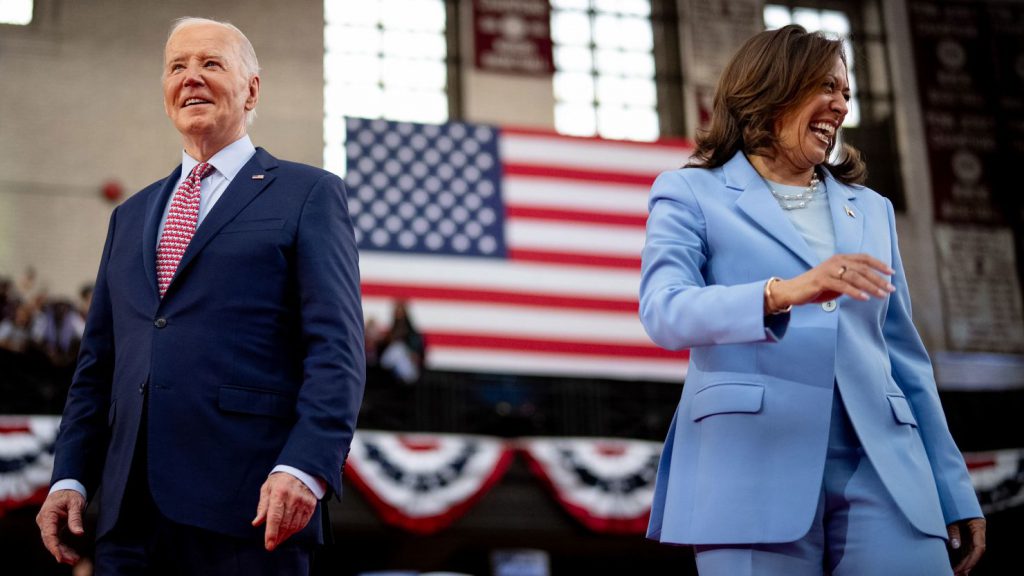

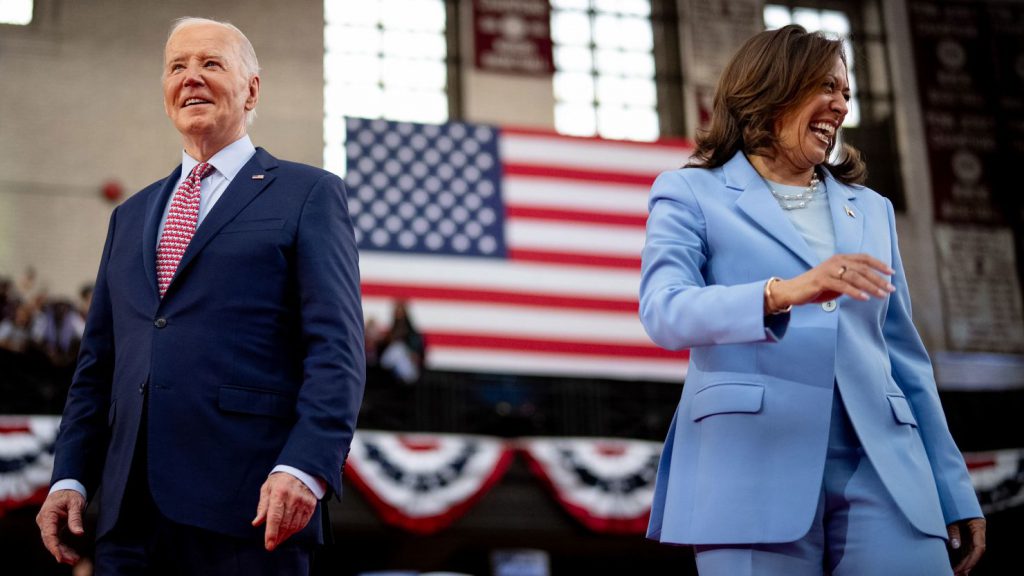

Both Donald Trump and Kamala Harris are set to face off for their seat in the Oval Office this November. Yet, according to University of Pennsylvania Wharton School professor Kent Smetters, both candidates have discussed financial plans with tremendous downsides.

Also Read: BRICS Makes Huge Announcement On Expansion: New Country Will Join Soon

“You’re naturally going to have a negative impact on the economy,” Smetters told Fox Business. “That doesn’t mean it’s a bad policy. It just means that that is one of the trade-offs.” However, it doesn’t change the reality that the US is headed for a concerning position.

For Kamala Harris’s plan, the deficit would be projected to grow $1.2 trillion. Moreover, the nation’s GDP would decrease by 1.3% over the next decade. Additionally, economic growth would slash 3% by the year 2054. Trump’s plan has similar downsides. Indeed, his would raise the deific by $4.1 trillion, and drop the GDP by 2.1% in the next two decades.

“We are on a fiscal path right now that is really dire,” Smetters said. “And neither candidate is really calibrating on that. Neither of them wants to talk about the spendage.” Furthermore, the nation should be further threatened by continued moves to lessen US dollar usage internationally.