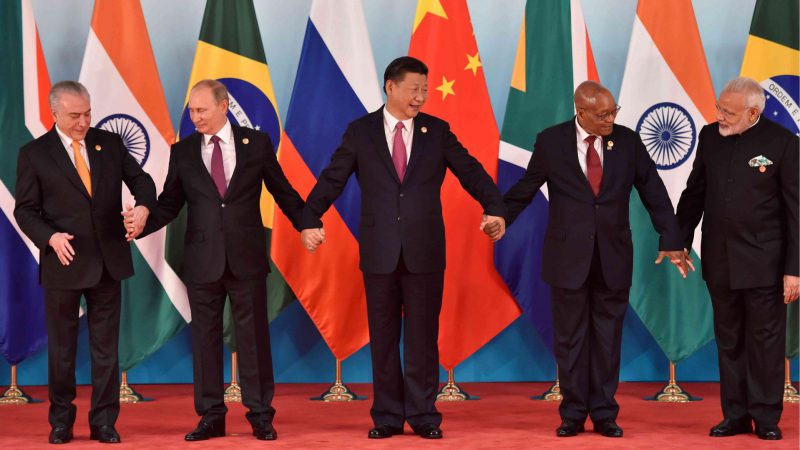

With the BRICS bloc actively discussing expansion, could Argentina join the collective and adopt the BRICS currency? Currently made up of Brazil, Russia, India, China, and South Africa, various countries have submitted membership requirements to add to the ranks. of the BRICS nations.

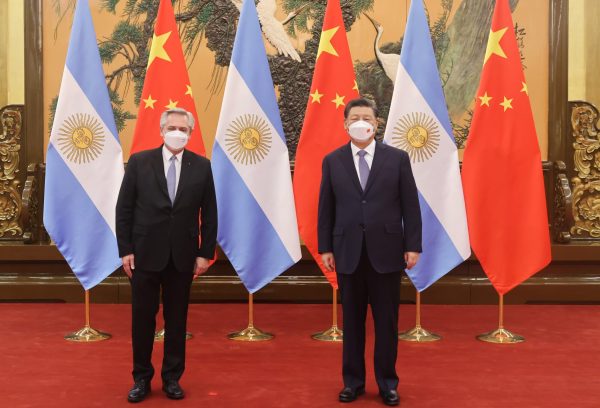

Now, South America’s second-largest economy could join the growing collective. Specifically, the nation has already announced its adoption of the Chinese yuan over the US dollar. Further solidifying its alignment with the BRICS nations’ de-dollarization efforts of the past few months.

Argentina to Join BRICS?

The international power balance has continued to shift, and a multipolar world is undoubtedly forming. Subsequently, nations are setting their allegiances, with a host of countries attempting to join the economic bloc that has already surpassed the G7 nations in GDP (PPP).

Now, it appears as though the BRICS collective could add Argentina to its collective, with the nation potentially adopting the BRICS currency. Moreover, the nation’s economic standing in South America would make it a tremendous asset to the BRICS collective and its rapid growth.

However, the country has also struggled with its own economic crisis. Specifically, inflation in the country grows to greater heights with every passing week. Thus, leads to a potential necessity for the nation to seek the potential assistance of a growing economic bloc.

Additionally, Argintina’s economic condition is due in large part to its debt levels, according to the International Monetary Fund, lessening access to the US dollar, and a horrific drought. Conversely, inflation has reached 104%, with the hope to combat it coming from US dollar holdings.

BRICS Currency

Alternatively, Argentinian economist, Gisela Cernadas, spoke about the dire circumstances facing the country. “Argentina has been suffering for an extended period of time from a structurally unbalanced current account,” she stated. “This means that the country needs more US dollars to function than what it has.”

Moreover, Cernadas explained that the state of the nation is “structurally unbalanced,” financially. Subsequently, de-dollarization could provide it the relief it requires. Specifically, trade with China will likely lessen the burden the US dollar currently holds.

Interestingly, the switch to executing a trade in the Chinese yuan seems like a logical step toward a BRICS currency. Moreover, its agreement with China signals a cooperative stance between the two nations.

Even more interesting is that Argentina will elect a new president in October. This could have serious implications for the political landscape of the country. Thus, providing. another opportunity for the nation to cement its allegiance in the multipolar world.

The BRICS currency is currently in development. Moreover, it is expected to have an agreement reached by the end of this year. It will be interesting to see what part Argentina plays in that, and how they could benefit from its creation.