Gold experienced a dramatic crash on Monday as the charts turned red making the prices fall to $2,022. The price of gold fell sharply close to 24 points and dipped nearly 1.5% in the indices. If the commodity markets continue their downturn, gold prices could dip below the $2,000 mark in January leading to lower prices next month in February 2024.

Also Read: US Dollar Index Falls Dangerously Low: Could Slip Below 100

Now that the prices of gold are down by nearly 20 points, can the precious metal rise in February 2024? In this article, we will highlight a price prediction for gold for the month of February 2024.

Gold Price Prediction For February 2024

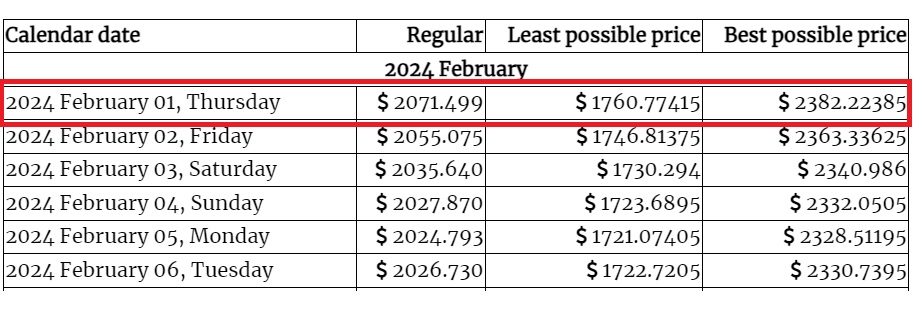

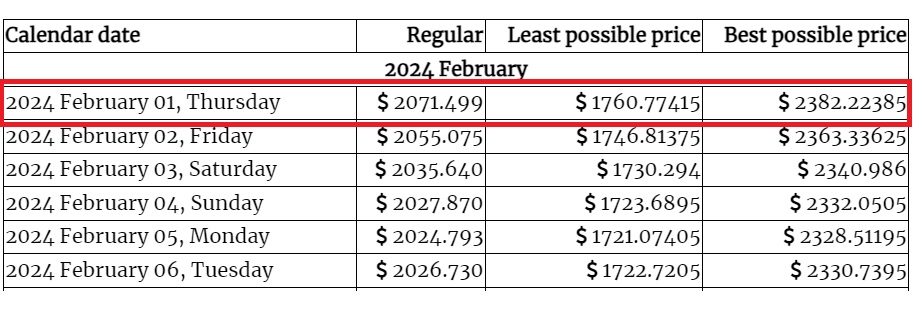

Leading on-chain metrics and price prediction firm Gov Capital has predicted that the average moving price for gold on February 1, 2024, could stand at $2,071. That’s an uptick of approximately 2.5% from its current price of $2.022.

Also Read: 4 Indicators Suggest the S&P 500 Index Could Head South

According to the price prediction, if the markets turn turbulent, gold could also dip to the $1,760 level. That’s only when the worst-case scenario arises making the markets tank south. However, if the gold and commodity markets pick up steam and rally, the highest possible price gold could reach is $2,382. That’s a return on investment (ROI) and an uptick of nearly 18% from its current price of $2,022.

Also Read: US Markets Ready for a 20% Plunge, Investors Urged To Remain Prepared

Gold prices started 2024 on the front foot as it nearly touched $2,100 in early January. However, the prices began to dip thereafter and are now feared to fall below the $2,000 mark. The yellow metal is experiencing a roller-coaster ride this month after the US Treasury yields delivered higher returns.

Also Read: BRICS: Morgan Stanley Downgrades The U.S. Dollar

The US Treasury bonds delivering higher returns impact the prices of both the stock and the commodity markets, including gold. The US stock market dipped last week after Apple Inc., shared fell sharply due to higher Treasury yields.