The US stock market is currently trending in green. After the Federal Reserve’s decision to cut rates, investor sentiment has become moderately robust, and investors are keenly exploring stocks that may deliver apt results. In this wake, one analyst has pointed out a lucrative stock, Netflix, that can deliver returns of up to 22%.

Also Read: Cryptocurrency: 3 Evergreen Coins To Buy For Occasional Gains

Buy Netflix Stock

Netflix has emerged as the ultimate entertainment giant in digital streaming. Despite intense competition from other potential giants in the space, the stock has maintained its value, beating all odds.

JP Morgan Analyst Doug Anmuth shares how Netflix can be the next massive stock, considering its price pattern and project trajectory. Speaking about the new brewing concepts, Anmuth shared how Netflix is building its ad tier from scratch and is leaving no stone unturned to bring original ideas and themes into its ecosystem.

In addition, Anmuth adds how Netflix can deliver stellar returns in 2025, primarily due to its ability to monetize its ad tier section. The expert later opines how Netflix can generate up to 10% of revenue solely from its ad revenue, excluding subscriptions.

Anmuth later concluded by reaffirming the NFLX buy rating with a stock price target of $750. At press time, NFLX is trading at $705. The expert’s analysis and rating have a success rate of 71% and deliver average returns of up to 16%.

Also Read: Solana: ChatGPT Predicts When SOL Will Reclaim Its $259 Peak

TipRanks Forecast for NFLX

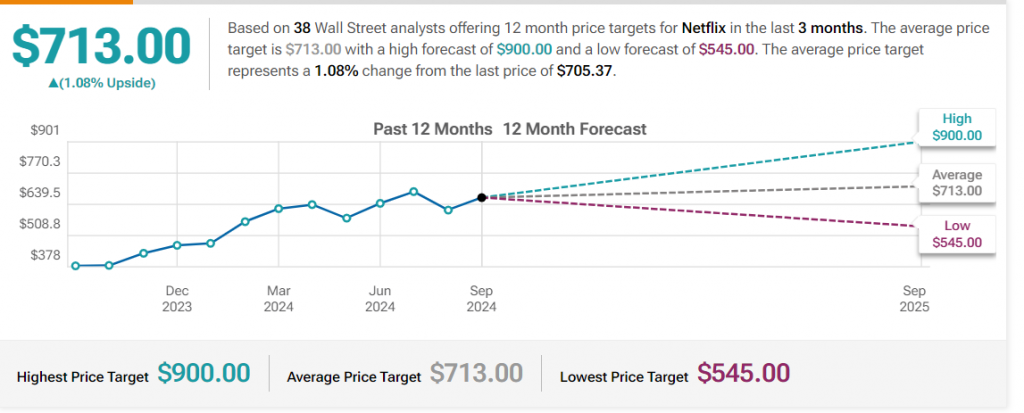

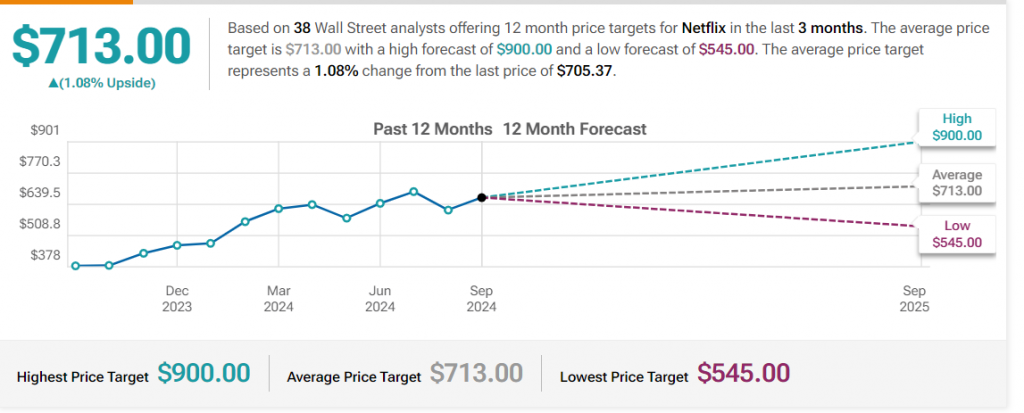

According to a leading stock market portal, TipRanks, Netflix’s average price target is around $713, which can be deemed moderately high. The portal forecasts that NFLX will reach an all-time high of $900 in the next 12 months and can also drop to hit the $545 price level if it plummets soon.

“Based on 38 Wall Street analysts offering 12-month price targets for Netflix in the last 3 months. The average price target is $713.00 with a high forecast of $900.00 and a low forecast of $545.00. The average price target represents a 1.08% change from the last price of $705.37.”

Also Read: Telegram to Share User Data for Legal Requests After CEO Arrest