Nvidia (NVDA) faced immense selling pressure in July as the sell-offs made its price slump to the $153 level. The sell-off came on Monday and Tuesday as NVDA is near its 52-week high of $158. It had a phenomenal run this year as it dipped 48% in Q1 but managed to recover all losses and is now +10.84% year-to-date. The profit bookings were expected as holding it above the 52-week high is considered a risky move.

Also Read: US Stock Market Defies Gravity, Doubters Turn Into Believers

After the dust settles, Nvidia shares could surge in value as the equity is among the top-performing assets since 2020. Its buying pressure has remained intact even when it dipped below the $100 mark in April. Both retail and institutional investors are relentlessly accumulating NVDA as the returns are stellar when it rebounds in price. Even at the $153 range, the equity is still available at a discount as it’s trading below $200.

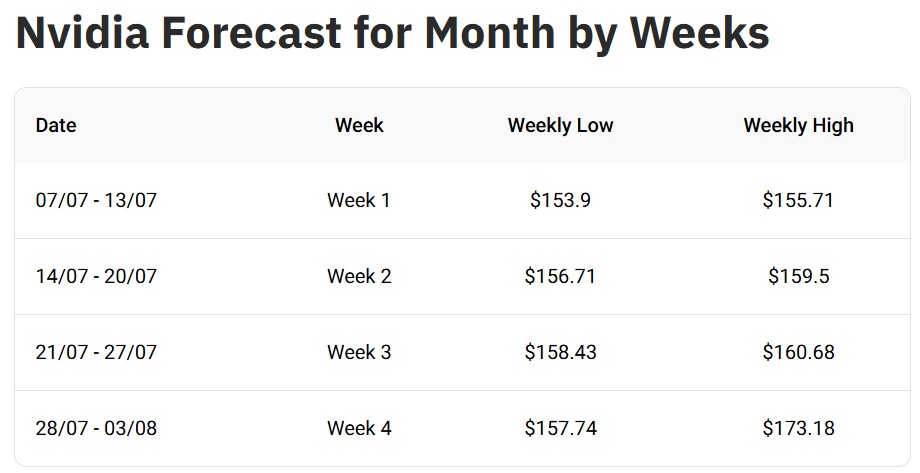

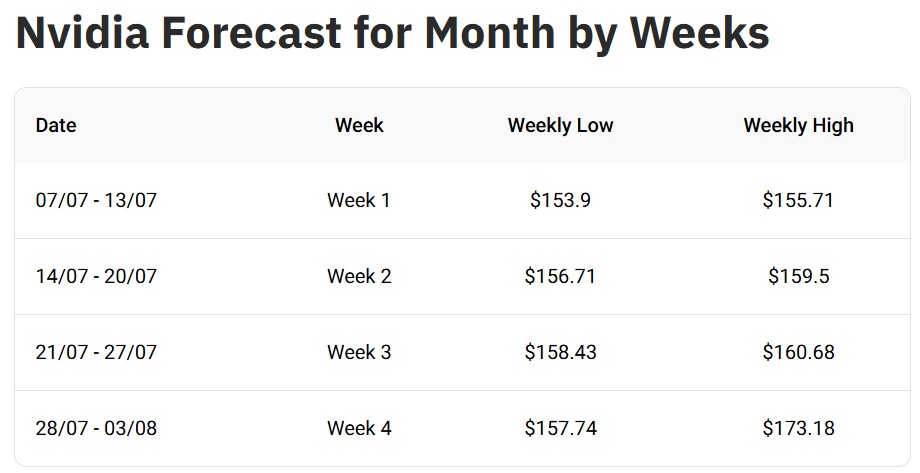

July 2025 Price Target For Nvidia Shares (NVDA): Potential 14% Profits

The latest price prediction for Nvidia shares indicates that it could deliver double-digit profits in July 2025. The recent forecast from the Traders Union indicates that NVDA could reach a high of $173 to $174 by the end of the month. That’s an uptick and return on investment (ROI) of approximately 14% from its current price of $153.

Also Read: 2 Dividend Stocks Down More Than 10% to Buy & Hold Forever

Therefore, an investment of $1,000 could turn into $1,140 if the price prediction turns out to be accurate. That’s stellar returns in just a month and not every asset can generate double-digit returns in a month. Nvidia shares can be on your must-watch list as the equity is primed for another leg up.

However, the markets need to gear up on July 9 and Trump’s 90-day pause on tariffs comes to an end. If the President decides to continue with the tariffs, Nvidia shares could begin to dip as they did in April. Even if it dips below the $100 mark again, taking an entry position there would be beneficial to your portfolio.