They say, “History repeats itself.” Well, in a manner, that statement HODLs true for Bitcoin. The largest crypto asset is known for following its cyclic traditions and past precedents. However, with the market dynamics evolving, the footsteps haven’t been cent percent conjoining of late.

Even so, a few thumb rules remain to be the same and Bitcoin has been maintaining its sanctity by honoring and conforming to them. So, in this piece, we will consider one such crucial factor and analyze where Bitcoin could possibly halt next.

Bitcoin’s ‘diminishing duration’ trend

The realized price is technically one of the most reliable on-chain analysis metrics. As such, the price is arrived by dividing the sum of all coin values at the time when they were last moved by the circulating supply.

More often than not, the realized price has acted as strong support during bear markets. In fact, it has also provided signals of a market bottom formation whenever the market price has traded below it.

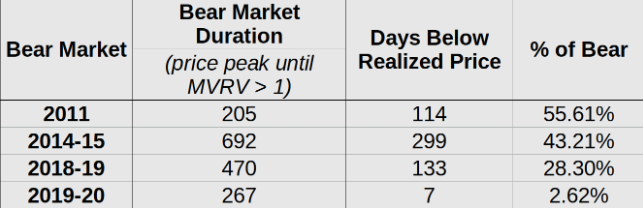

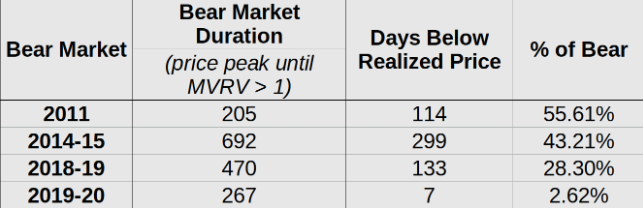

In 2014-15, Bitcoin remained below the realized price for about 200 days, while subsequently in 2018-19, the number shrunk to 133. The most notable deviation was, nevertheless, noted in 2019-20 when Bitcoin remained under the realized price for merely a week.

Chalking out the said trend, Glassnode noted,

“It can be seen that over time, each bear cycle has spent less relative duration below the realized price. This may be in part a result of general market awareness of its existence.”

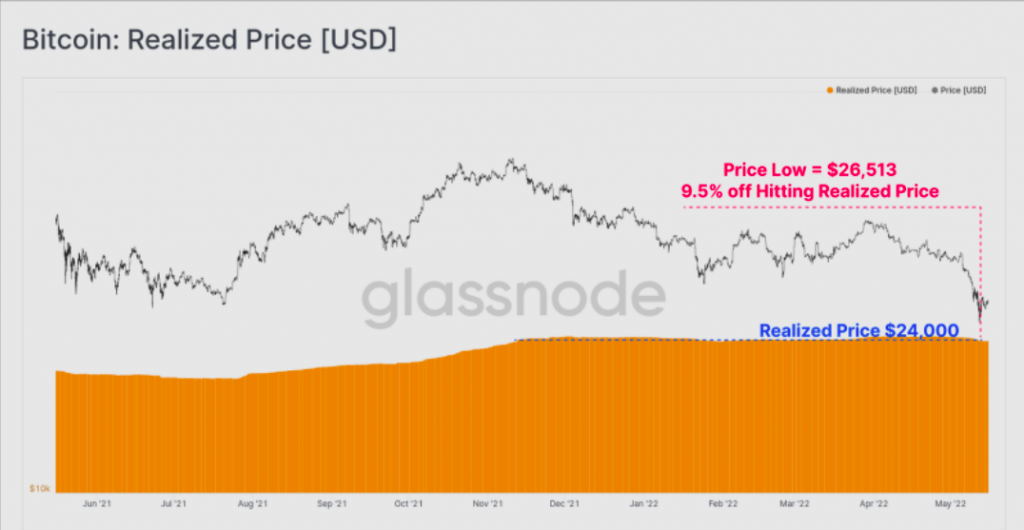

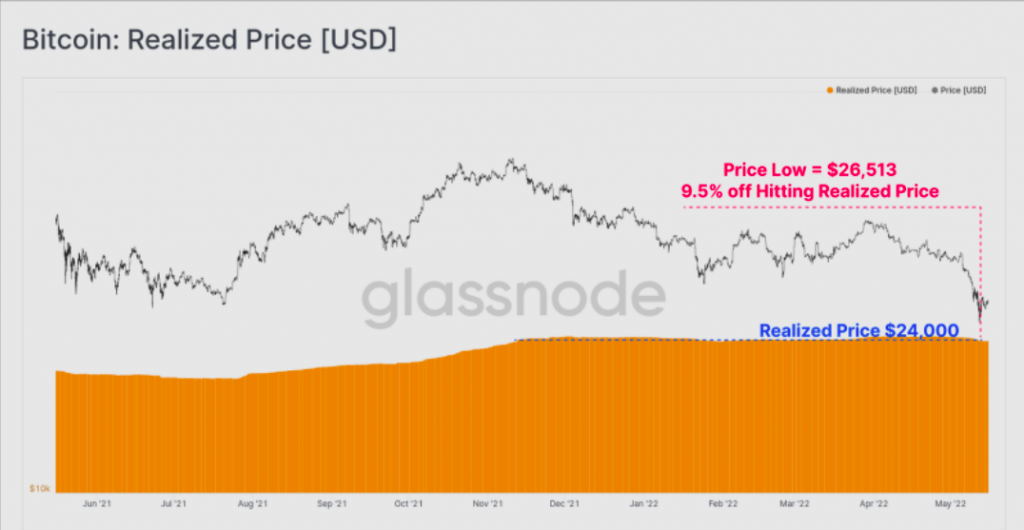

Last week, when Bitcoin fell to its weekly multi-year low of around $26k, the realized price stood at $24k. Further, as the market reacted to the LFGs Bitcoin sales, and the macro-stablecoin de-pegging, the spot prices fell within 9.5% of the Realized Price.

As a result of the aforesaid aggregate realized losses, Bitcoin’s realized cap declined by $7.92 billion, representing a capital outflow from the Bitcoin network. The same ended up triggering the realized price to decline by $60 to $23,940.

From a technical perspective, the level around $28.8k is quite crucial for Bitcoin at the moment, for it has acted as strong support on multiple occasions in the recent past. If BTC fails to cling onto the same over the next few days, then 200 DMA [red] around $25k would be the next level where it would find solace.

Only when both the aforementioned levels are breached would Bitcoin fall below its realized price of $23,960. In such a scenario, if the ‘diminishing duration’ trend is followed, then Bitcoin would probably rebound from its lows within a few weeks at the most.