Bitcoin [BTC], the world’s largest crypto asset has witnessed impeccable growth in terms of both adoption and price. Despite 2022’s slump, the community seems optimistic about the asset hitting greater heights. Back in 2021, during the peak of BTC, prominent asset manager Fidelity made a highly bullish prediction about Bitcoin. However, the current scenario raises the question of whether this forecast remains valid and applicable.

Fidelity’s Prediction for Bitcoin

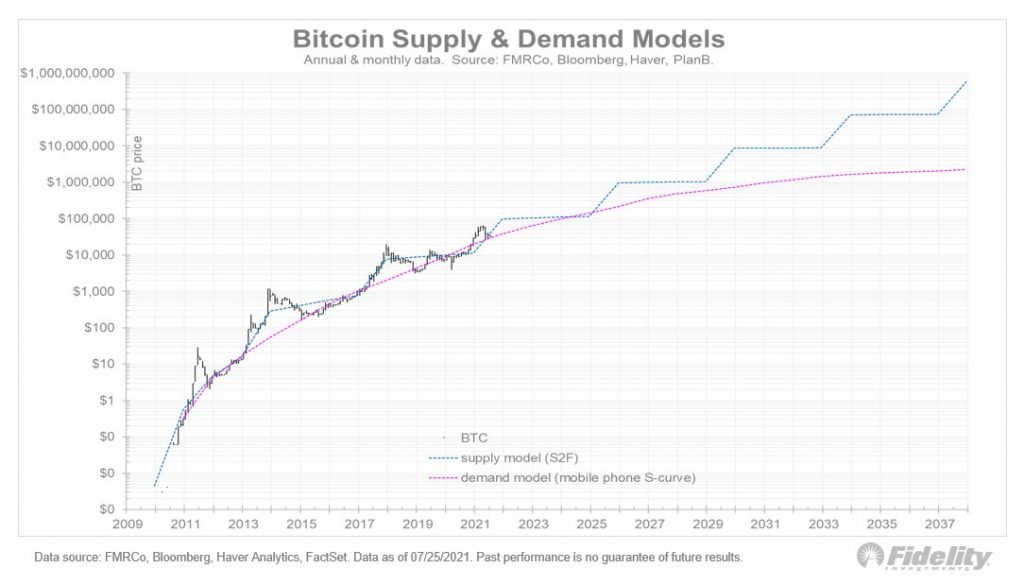

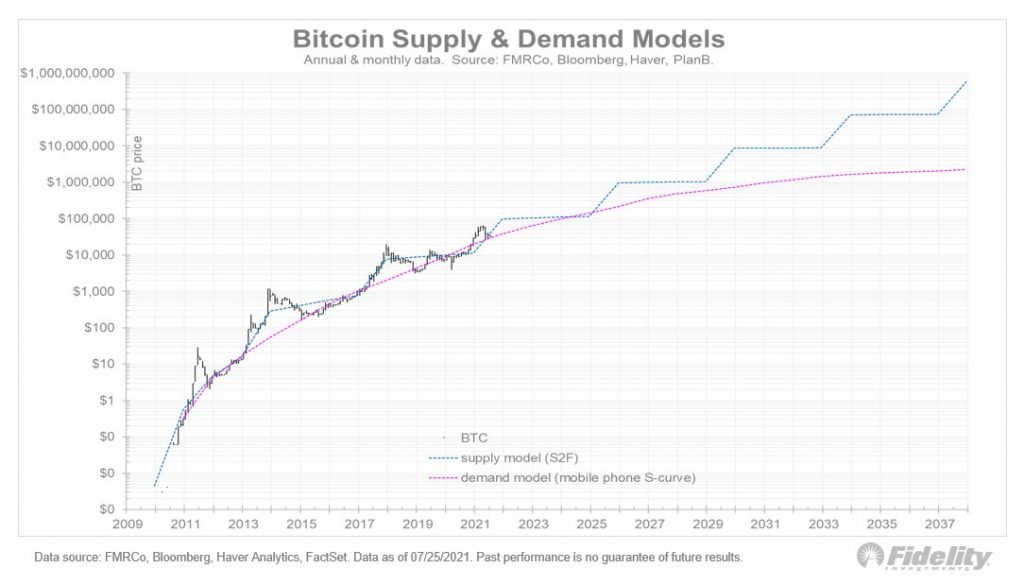

Jurrien Timmer, the Director of Global Macro at Fidelity, put forth the notion that Bitcoin has the potential to reach a value of $1 billion in roughly two decades, specifically around the year 2038. To support his forecast, Timmer employed a combination of models and charts, with a particular focus on the stock-to-flow model and his own demand model. These analytical tools formed the foundation of his primary prediction.

The above demand model employs Metcalfe’s Law. According to this, “the number of its users grows linearly, a network’s value [or, by inference, the bitcoin price] grows geometrically.” This means that the utility and adoption of Bitcoin are expected to grow more rapidly compared to its network of users, exchanges, ATMs, and participating retailers. Therefore, this model predicted that BTC will reach $1 million by 2030.

In contrast, Timmer’s stock-to-flow supply model noted the event of significant price surges during each halving event. Consequently, when considering this model in conjunction with other factors, it foresees a price range of $1 million to $10 million for Bitcoin by the year 2030.

Timmer’s demand model is more inclined towards reflecting the bottom of Bitcoin’s price. On the other hand, the stock-to-flow model seems to provide a better approximation for the peak of the king coin. However, it is worth noting that the disparity between these two models widens significantly beyond the year 2030. The reason behind this gap is expected to be the changing value of the dollar.

How Changes in the Dollar Value Could Influence Bitcoin

Timmer proposes that the value of the dollar undergoes fluctuations over time when compared to other assets. For instance, if $1 was invested in stocks during the 18th century, its present-day value would be about $4 billion. Similarly, Timmer implied that if $1 million is invested today, it could grow to $1 billion in a span of twenty years.

This further revealed that the purchasing power of the dollar has significantly reduced due to factors like inflation and depreciation. Thus, Timmer’s statement implied that keeping a fixed amount of dollars for many years may lead to reduced purchasing power due to the asset’s changing value.

Over the last few years, an increasing number of companies are taking over the $1 trillion market capitalization mark. As a result, it is foreseeable that in 20 years, the concept of a trillion-dollar valuation will become more common. So much so that individuals themselves could be worth a trillion or even more. The scale of numbers may even reach the quadrillion range.

So is this milestone still achievable for the king coin?

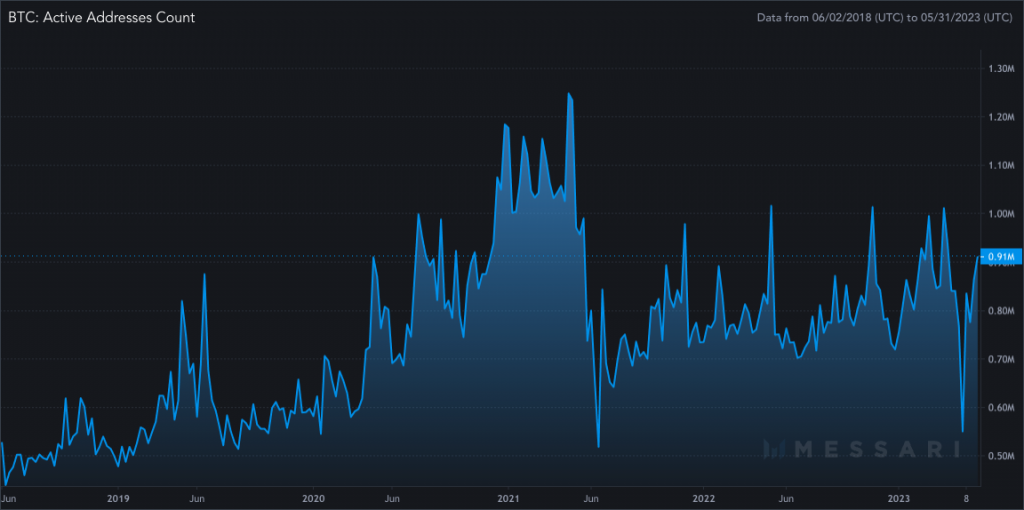

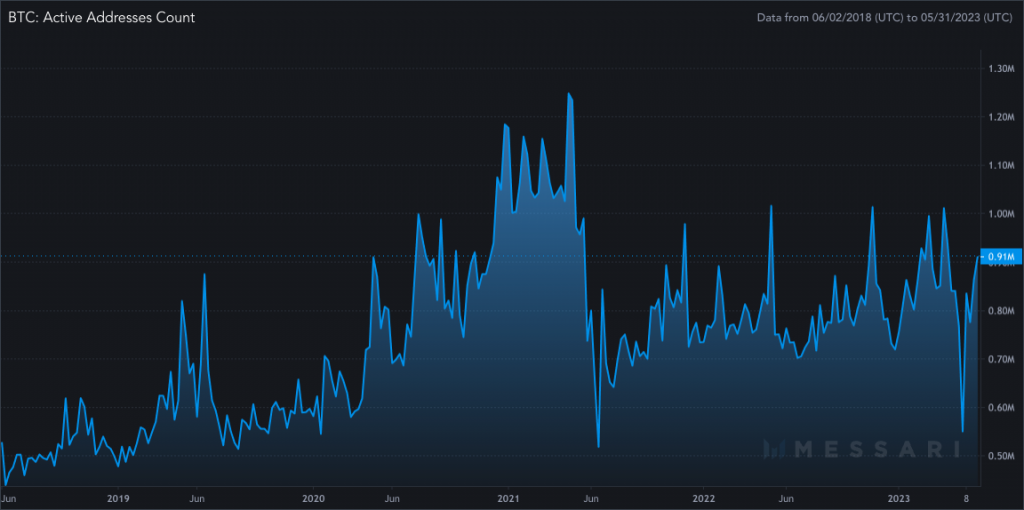

Despite Bitcoin’s historical growth, it has recently faced a significant setback. Bitcoin’s network activity has diminished, and it has fallen behind in comparison to the Cardano [ADA] network. For example, the number of active addresses in the Bitcoin market has experienced a notable decline when compared to the levels seen in 2021.

Higher network activity, like increased transaction volume or active addresses, is viewed as a positive indicator of the growing adoption of Bitcoin. This can create a sense of confidence among investors, potentially leading to rising demand and a positive effect on price.

Although Timmer’s prediction may be considered far-fetched and lacks empirical evidence, it doesn’t completely dismiss the possibility of Bitcoin reaching such levels. The concept of de-dollarization has gained stature, shifting global attention towards alternative currencies. This shift in focus is expected to drive the demand for assets like gold and crypto such as Bitcoin. With BRICS pushing for the fall of the dollar, the BRICS currency and Bitcoin are expected to garner momentum.