Crypto exchange Crypto.com’s partnerships in the world of sports have been compounding with time. After already striking deals with Lakers, LA Clippers, Paris Saint-Germain, and pro hockey’s LA Kings, the exchange has now partnered with FIFA World Cup as an official sponsor of the tournament.

The mega sporting tournament is scheduled to take place in Qatar from 21 November to 18 December this year.

Further, in an attempt to increase brand awareness, Crypto.com will have its branding flashed throughout the tournament’s venue, as well as within the stadium’s broadcast view. The total compensation for the deal, however, remains to be undisclosed.

In an official statement, FIFA’s Chief Commercial Officer Kay Madati said that the deal would help in the growth of the “beautiful game” on a global scale. He added,

“Crypto.com has already demonstrated a commitment to supporting top-tier teams and leagues, major events, and iconic venues across the world, and there is no platform bigger, or with a greater reach and cultural impact, than FIFA’s global platform of football.“

Per Crypto.com’s Co-Founder and CEO Kris Marszalek, the deal would further drive awareness of Crypto.com globally. Elaborating on the same, the exec said,

“Through our partnership with FIFA, we will continue to use our platform in innovative ways so that Crypto.com can power the future of world-class sports and fan experiences around the world.”

Leaving aside the sport stands, where does Crypto.com actually stand?

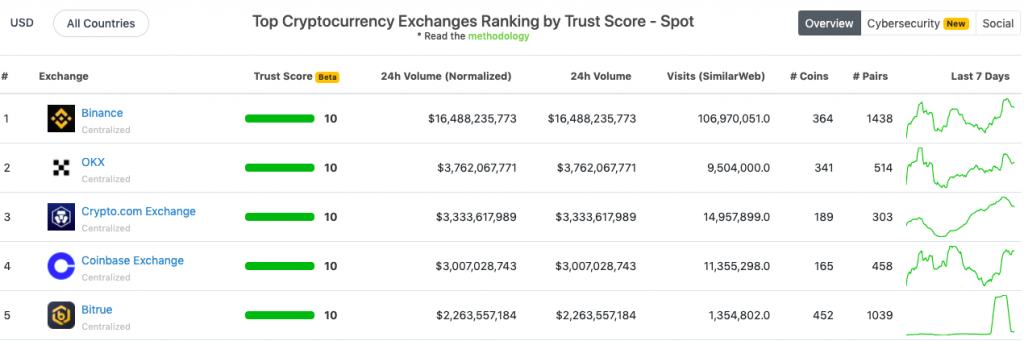

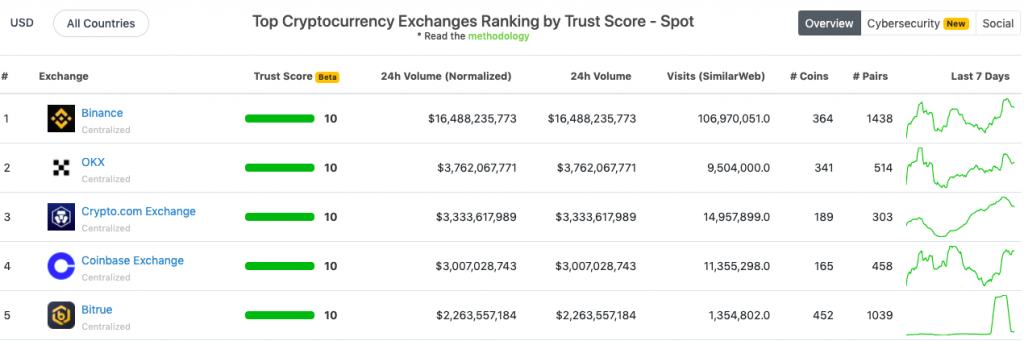

Currently, with respect to spot trading volume, Crypto.com only ranks below Binance and OKX. Over the past day, it dealt with over $3.33 billion in trading volume. In fact, on the weekly window, it witnessed one of the steepest inclines when compared to its counterparts like Coinbase or Bitrue.

Riding high on partnership puffery, Crypto.com has climbed up on the charts quite a few times in the recent past. Back in November, for instance, it pulled off a 244% rally.

Now, the said partnership with FIFA would undoubtedly aid the exchange in garnering more traction. In effect, we might witness a hype-induced CRO rally during the WC period. Going forward, if market participants end up staying back in Crypto.com’s field, then the rally might end up becoming organic. Thus, it’d be interesting to see how things pan out for the exchange and its native token.

At the time of press, CRO was trading at a 58% discount when compared to its $0.97 ATH.