Bitcoin reached a yearly low of $20,111 on 15th June, and the market is exceedingly looking weak. The FOMC meeting looms over the collective financial market today and it is rumored that the Fed Reserve will push the interest rate by another 0.75%. While it seems like the worst is in, more correction might surface if these other conditions start factoring in.

Low profits for Miners will twist their arms?

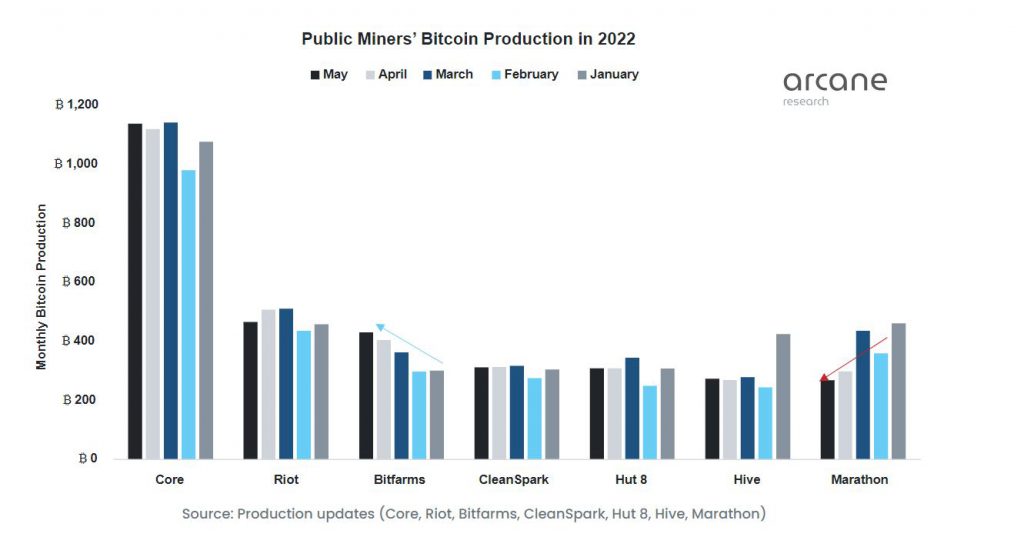

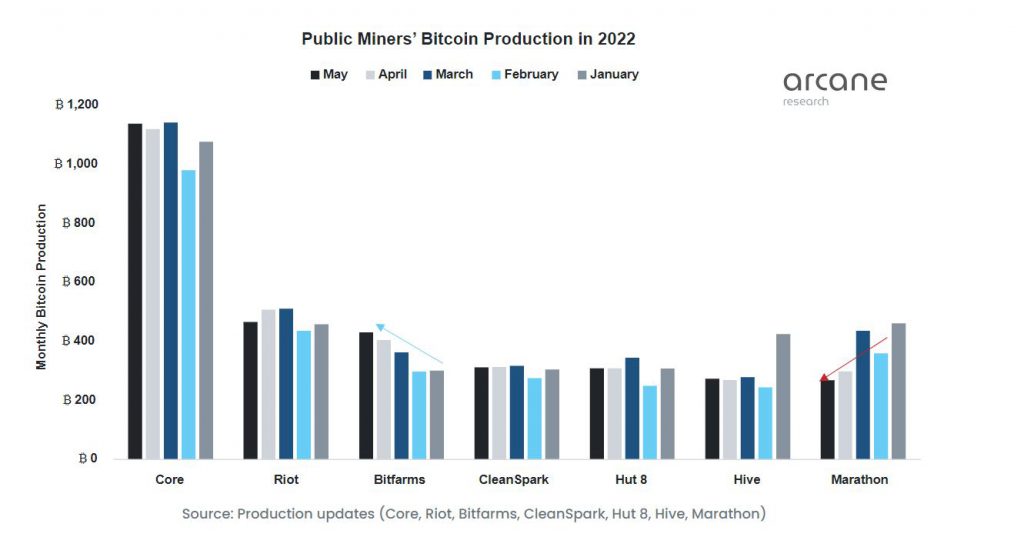

With increasing mining difficulty and decreasing Bitcoin price, public miners are now releasing less Bitcoin into circulation. According to Arcane Research, public miners had lofty plans for 2022 in terms of bitcoin production. However, the current scenario indicates a different outlook.

According to the chart above, most of the companies are producing less Bitcoin than in January 2022. Marathon is a prime example, whose BTC production dropped from 462 BTC to 268 BTC in May, a 42% decline. However, Marathon’s issues were due to delays in energizing its machines at its new Texas facility. Bitfarms, however, has continued to keep its production up since January.

Now, the issue is, that the cost of production is going down and mining Bitcoin is becoming less and less profitable. It hasn’t reached an alarming state yet but miners might be compelled to sell if things go further south.

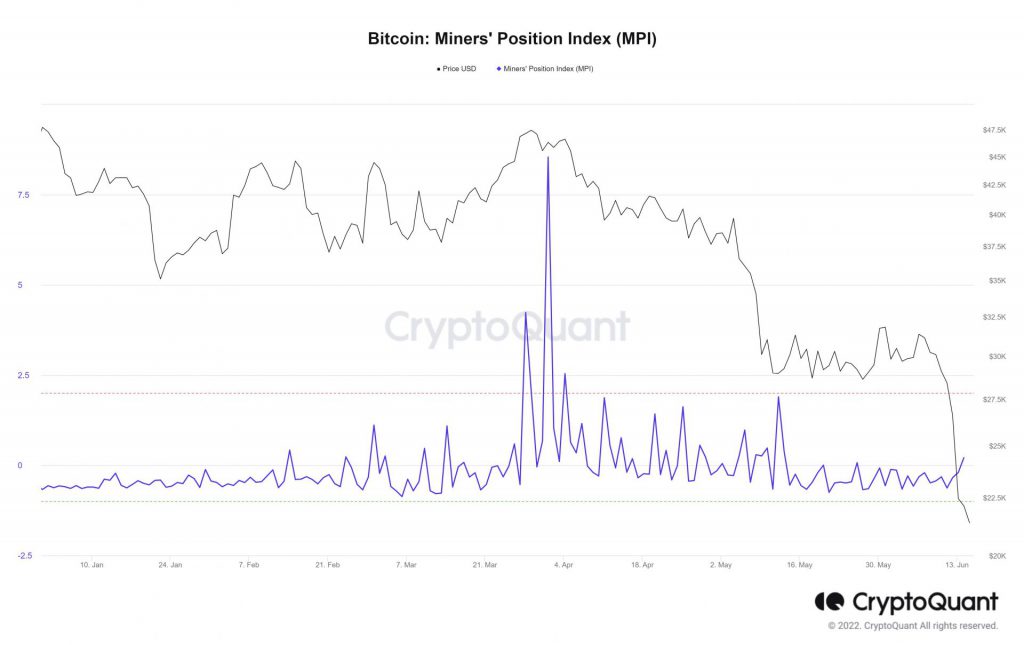

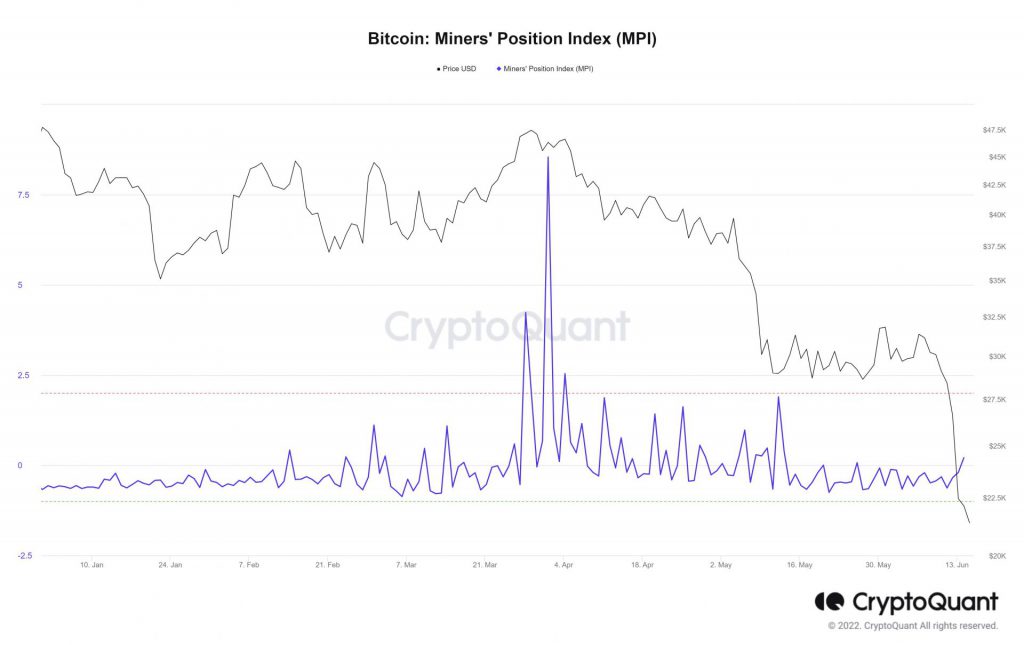

Bitcoin Miner Position Index is also rising

According to CryptoQuant, Bitcoin MPI has registered a minor spike, indicating some selling pressure from the miners, but it hasn’t risen to significant levels. Although, it is important to note that miners are also burdened with low revenue now. Watcher Guru reported on a miner stress report recently discussing various changes over the past few weeks.

What’s the worst that can happen?

One particular unpleasant market condition would be If Bitcoin loses its 2017 support at $19500. Just as Bitcoin dropped from $31,000 to $20,000 in a few weeks, a similar situation can take place with a drop-down to the 2019 high of $13,970.