Cardano was vulnerable to yet another decline this week if its price closed below an important support boundary. With negative funding rates another persistent issue, Cardano investors may have to completely rely on a Bitcoin rally to get the most out of their ADA tokens.

After a lackluster performance last week, Cardano’s troubles could continue to anguish investors once again. The price was fast approaching the lower end of $0.86-$0.80 support and a breakdown to $0.75 threatened to put a significant number of holders at losses.

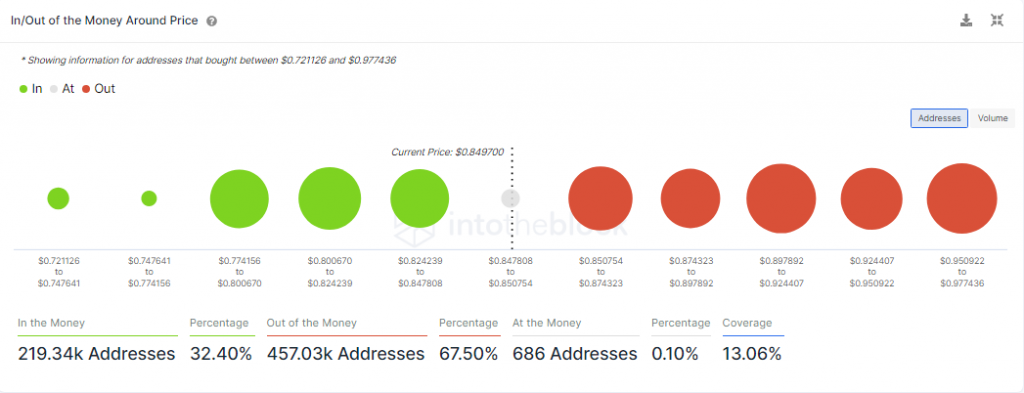

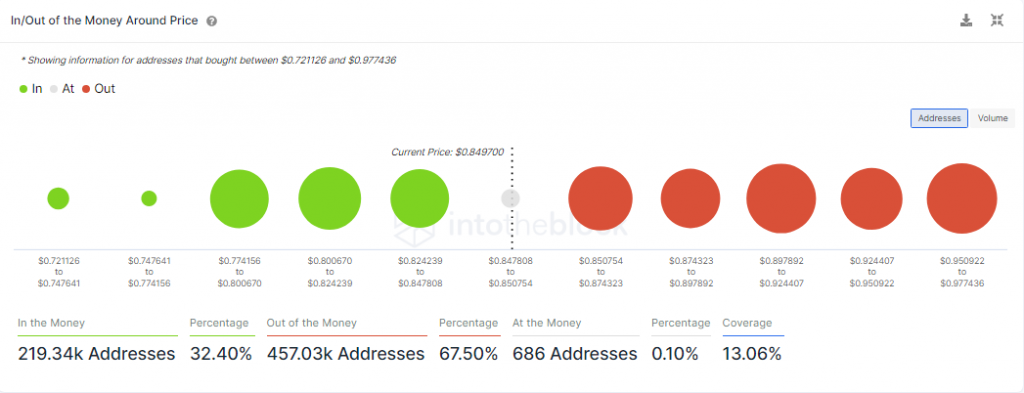

According to IntoTheBlock, nearly 80K out of the recent 250K addresses bought ADA between $0.80 and $0.82. These holders may mitigate their losses and deleverage their positions once a candle breaks below $0.80.

As Cardano neared this make-or-break scenario, sentiment on exchanges was not encouraging for those expecting a relief rally. The average funding rates across exchanges have remained negative over the past few days, suggesting that future traders were making more short than long calls. While this has mostly been the norm in 2022 thus far, April’s rates were negative more often than not, unlike in March when they did rise above 0% before a few relief rallies.

Cardano Daily Chart

Should bears force a close below $0.80, another 4%-7% decline can be expected this week, with the next support available between $0.77-$0.75. The unfavorable outlook was supported by a crossover between the 50-SMA (yellow) and 20-SMA (red), which threatened to ramp up the bearish presence going forward.

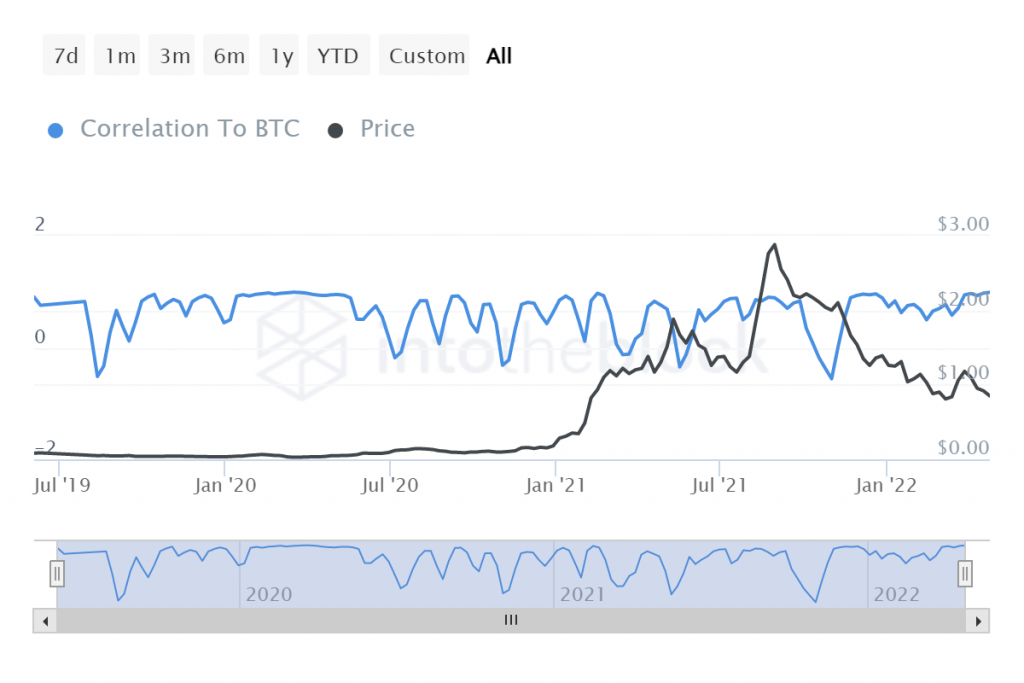

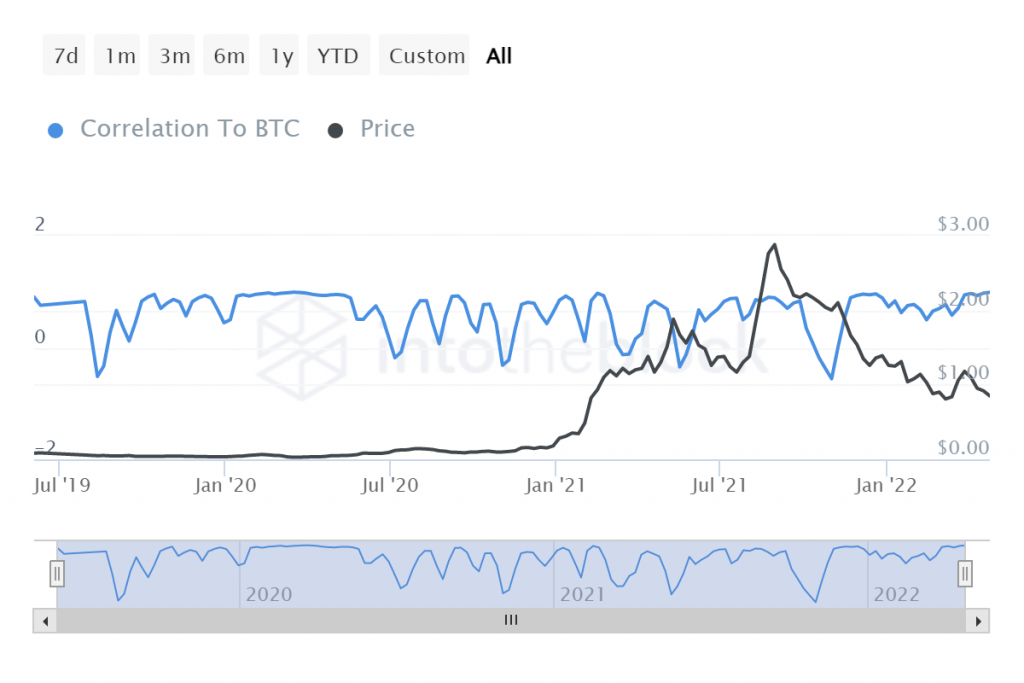

Although Cardano’s current market condition looked woeful, there could be some light at end of the tunnel. Presently, ADA shared a high 0.97 correlation with Bitcoin, meaning that a king coin rally might be able to safeguard Cardano investors from a bearish outcome. With BTC eyeing a potential rebound from around $37,500, ADA’s value could hold above $0.80 and nudge to higher levels in a risk-on broader market. In either case, a move above $0.91 could be difficult unless sentiment changes across most fronts.