Over the past few days, a host of coins from the space—like PERP, ADA, and LRC—have broken above their downtrend channels. A few have rallied post that, while a few continue to consolidate. Chainlink was one of the latest tokens to re-create the same scenario on its chart.

Towards the end of March, LINK defied its downtrend and sneaked above the bearish trendline. By continually staying above the same, it flashed a concrete bullish breakout signal at the beginning of April.

However, things have not gone as anticipated. The token has remained rangebound and has only been trading around $17-$18 of late. Per data from CMC, Chainlink appreciated by 2% on the weekly window but managed to negate the same by posing losses on the daily frame. At the time of press, Chainlink was priced at $17.35.

Are whales HODLing back Chainlink?

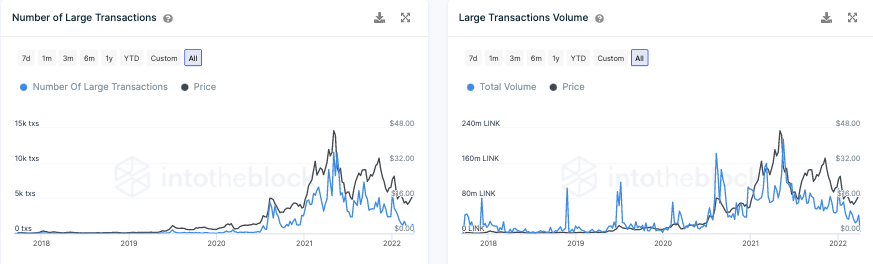

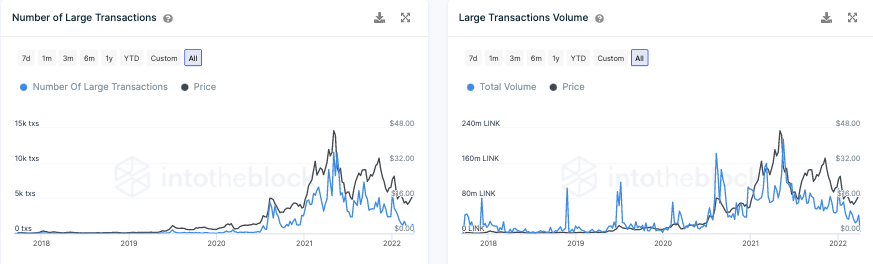

It is a known fact that the top 1% of the addresses control around 4/5th of LINK’s total circulating supply and such participants mostly indulge only in large transactions. More often than not, a rise in their activity aids Chainlink in climbing up on the charts, while their inactivity reflects negatively on the price.

ITB’s charts highlighting the number and volume of txns >100k re-emphasizes the same. Now, as can be noted below, the state of both the metrics has only been deteriorating over the past few weeks, providing Chainlink’s price no cushion on which it could stand up and climb.

State of the network activity

Parallelly, the network activity also remains to be unsatisfactory at the moment. The number of new and active addresses on Chainlink has hardly witnessed any bump of late and continues to revolve merely around 2.18k and 786 respectively.

The aforesaid numbers talk for themselves and bring to light the waning interest of market participants concerning Chainlink.

Thus, it becomes quite obvious that the whale inactivity and malnourished network activity together are keeping Chainlink grounded to $17-$18. So, only when they improve, would LINK be able to truly commence its next leg up.