American FinServ company Robinhood has been in the news for several reasons. A day back, for instance, discussions were going out about its potential acquisition by FTX. However, the crypto exchange’s exec SBF cleared the air by asserting that no talks were going on between the two companies. Alongside another development, Robinhood went on to onboard several new cryptocurrencies and expanded its presence in the market. As reported yesterday, Chainlink was one of the tokens listed on the platform.

On the listing announcement, LINK rallied by around 9%. The green streak, however, couldn’t continue. The dumping followed, and the token closed at a level lower than it opened on Wednesday.

Ripple effects that followed

A host of Chainlink’s metrics noted substantial spikes on Wednesday. Santiment brought to light that 80.8 million cumulative unique LINK tokens were moved by addresses Tuesday, breaking a 5-year record. Highlighting the previous instance when such a spike was seen, the analytics platform tweeted,

“Its opening trading days in September, 2017 were the only time we’ve seen more.”

The circulation metric shows how many unique tokens were transacted during a day. The surge noted should be taken with a grain of salt because the transaction knife usually cuts both ways.

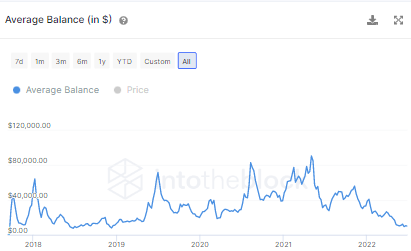

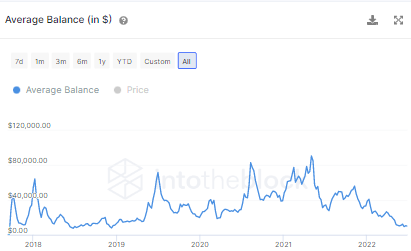

Also, there is not much buy-side bias in the market now. In the shorter timeframe windows, sellers had the upper hand compared to the buyers. The average HODLer balance was hovering around historic lows, supporting the said narrative.

Despite the circulation pump registered on Wednesday, Chainlink’s network activity remains low on the macro frame. Per data from ITB, the active addresses did note a slight spike. However, the same intensity wasn’t notable, for similar upticks have been stated a couple of times in June before this. The new addresses, on the other hand, continue to remain flat.

Well, the Robinhood hype has withered away, and the current state of metrics collectively points out that LINK is in a rut.