Chainlink’s ETF launch news actually drove LINK up by 5% right now as Bitwise investment strategy filed what’s being called the first U.S. spot cryptocurrency ETF filing for Chainlink. The Link price surge happened after Bitwise’s historic SEC filing, and it’s creating some significant Chainlink market impact across different trading platforms.

Chainlink ETF Launch Sparks 5% Price Surge With Bitwise Strategy

Bitwise Asset Management actually submitted a Form S-1 with the Securities and Exchange Commission for this groundbreaking Chainlink ETF launch. The cryptocurrency ETF filing is proposing to use Coinbase Custody as the custodian, which would enable direct LINK token exposure through regulated investment vehicles.

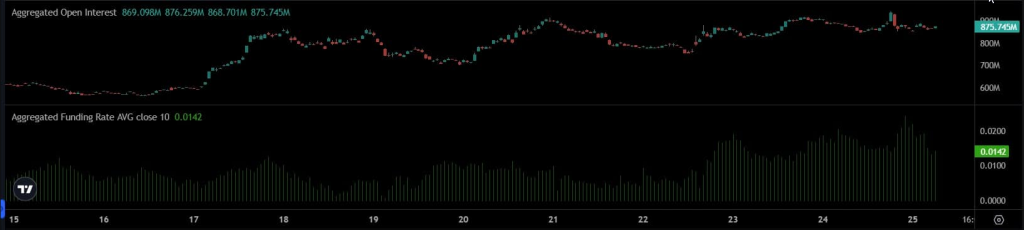

The Link price surge was pretty much immediate, with LINK climbing from around $22.94 to $24.29 following the announcement. This particular Bitwise investment strategy marks the first real attempt to bring spot Chainlink exposure to traditional investors through an ETF structure.

Also Read: Bitwise Files Chainlink ETF Application With SEC

The Chainlink market impact went beyond just price action, as the filing represents some legitimization of institutional demand for oracle networks. SBI Group’s recent partnership with Chainlink also supports this institutional adoption trend, focusing on tokenized real-world assets along with stablecoin reserve verification.

Altcoins Under SEC Review Right Now

Several altcoin ETFs are still under SEC review until October 2025, but the Chainlink ETF launch filing comes during what seems like favorable regulatory conditions. The cryptocurrency ETF filing could actually enable pension funds and institutional managers to access LINK through compliant investment products.

Also Read: SEC Postpones Bitwise ETF With XRP, BTC, SOL & More After Approval

At the time of writing, this represents a pretty significant development for the crypto space. The Bitwise investment strategy focuses on passive management without staking rewards, which addresses regulatory concerns while maintaining direct price exposure.

This approach positions the Link price surge within broader institutional adoption trends as oracle infrastructure gains some mainstream recognition. The Chainlink market impact reflects growing demand for utility-driven crypto assets beyond Bitcoin and Ethereum, with the Chainlink ETF launch potentially setting a precedent for similar oracle network investment products.