Although recent gains have kept Chainlink’s head above water, its bearish bias remains evident on the daily chart. However, a crucial move would create a bullish distinction for LINK, after which a new high would be in sight. At the time of writing, LINK traded at $17.2, up by 2% over the last 24 hours.

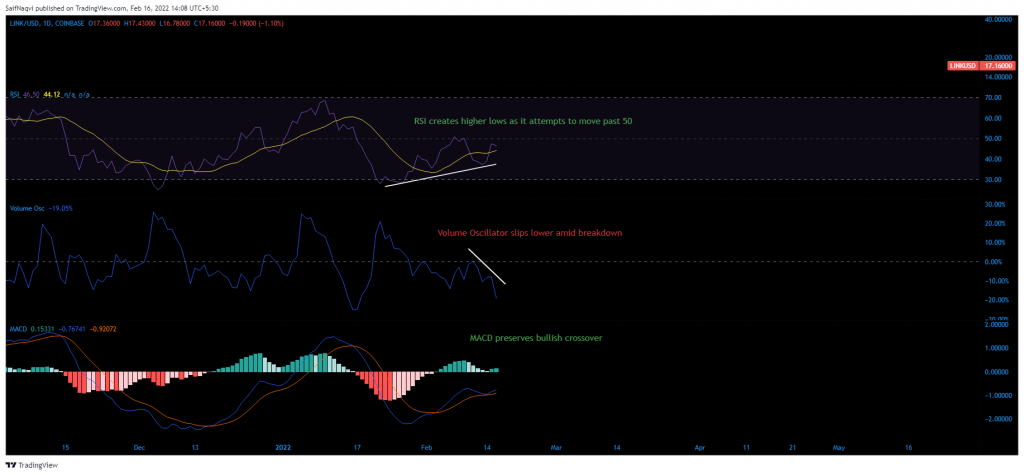

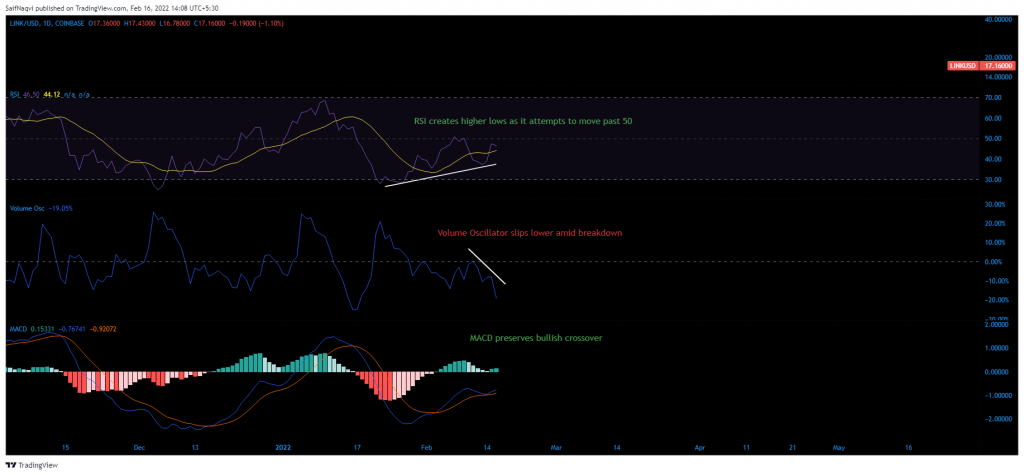

Chainlink Daily Chart

Chainlink’s price was amidst a throwback after an up-channel breakdown soured its second week of February. Yesterday’s gain of 9% offered some respite to bullish traders and there was reasonable evidence to suggest that LINK would maintain its form during the week.

This was because LINK’s up-channel breakdown was preceded by low sell volumes. A closer look at the volume oscillator showed that the index slipped lower as the breakdown took effect. Trading volumes offer a great insight into breakdowns or breakouts. Normally, the price continues to trend in the breakout direction if the move is followed up by good volumes. However, a move on low volumes creates ‘false breakouts’, increasing the chances of a directional price change.

If so, a shift back in the channel would likely see LINK form a new higher high at the 78.6% Fibonacci level ($21). A close above the daily 20-SMA (red) would help confirm the outlook as momentum shifts behind the buyers, although some resistance can be expected around the $19-mark. The prediction was backed by the daily RSI which has been forming higher lows in its attempt to overtake 55 for the first time since January 22. The same was further reinforced by a favorable MACD after avoiding a bearish crossover.

On the flip side, Chainlink’s bearish bias would return if its price is rejected at the daily 20-SMA (red). The resulting move would see LINK shift back to an earlier demand zone between $14.3-$13.4 following a 17%-22% correction.

Conclusion

The daily 20-SMA (red) holds key to Chainlink’s bullish outlook. A successful close above the short-term MA could extend to a fresh peak of around $21. However, caution must be maintained if the price fails to close above $17.