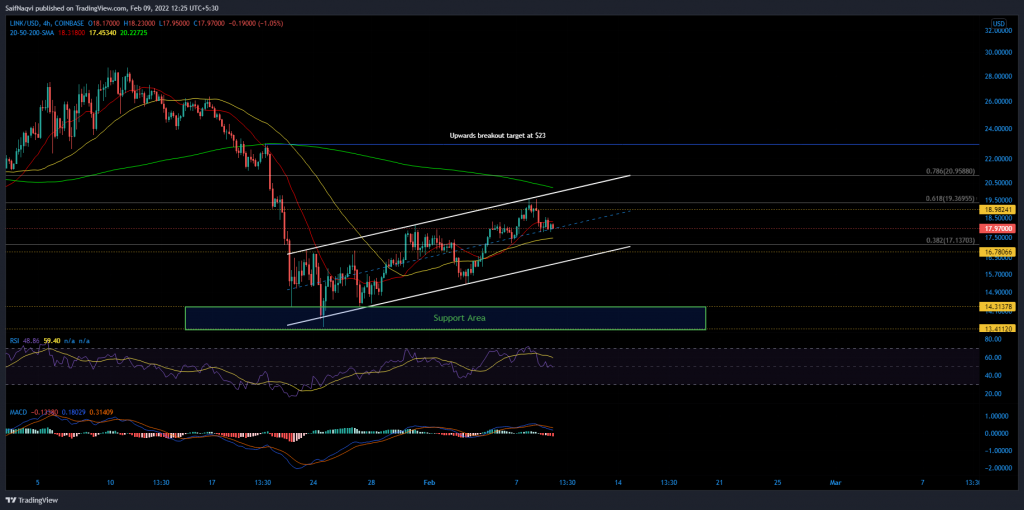

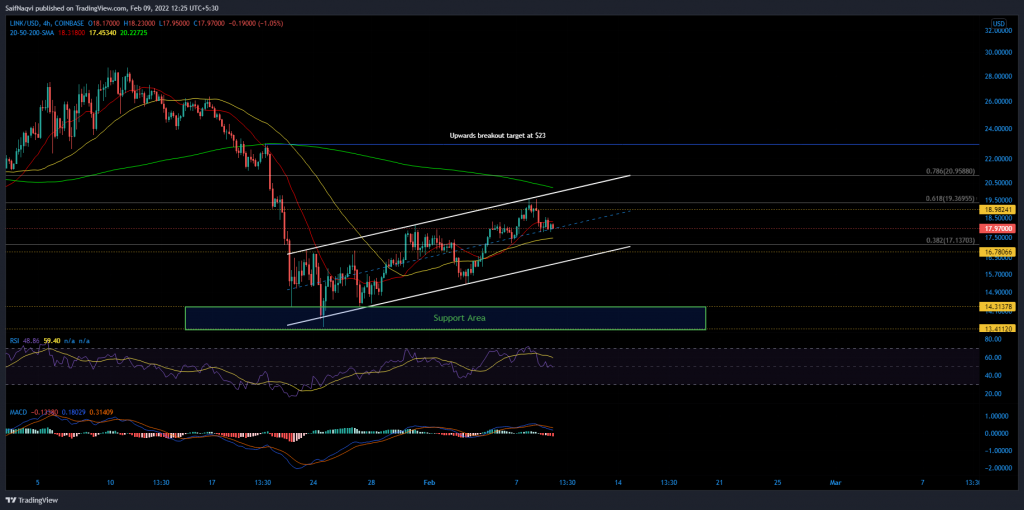

Most alts were grappling with trading outflows on Wednesday after Bitcoin lost ground on $44K during early hours of trade. The global market cap took a 1.7% hit over the last 24 hours and dropped to $1.98 Trillion at the time of writing. As a result, Chainlink moved south and eyed a fresh higher low within its up-channel.

Chainlink 4-hour Time Frame

With a moderate weekly ROI of 5%, Chainlink may have left its investors frustrated as other alts outperformed over the weekend. A tepid start on Monday saw LINK form a higher high at the upper trendline and then gradually shift towards the mid-line of its up-channel. Since a breakout was negated and the price slipped below its 20-SMA (red), sell-side momentum was expected to dictate LINK’s near-term.

Luckily, the region between $17.7-$16.7 was riddled with defensive options. The 4-hour 50-SMA (yellow), hourly 200-SMA (not shown), and daily 20-SMA (not shown) made the support zone significant by adding extra support layers.

A bullish rebound would from there would encourage LINK to form a fourth high at the upper trendline around $19.8. Additionally, a breakout above the 4-hour 200-SMA (green) could transition to a 15% hike as the price travels through a pocket of low liquidity.

In either case, a bearish outcome cannot be discounted. Should, Bitcoin slip below its 20-SMA around $42,900, a greater altcoin sell-off would take effect. In such a case, LINK’s price could shift back between $13.4-$14.3 demand zone through a breakdown.

Indicators

The 4-hour RSI hovered close to 50 after slipping by a few index points. Since a larger uptrend was in play, there was a good chance that the RSI could find support around its mid-line. The same would keep LINK’s price grounded within its channel.

On the flip side, the MACD’s bearish crossover was a cause for concern. A move below equilibrium would invite short-selling and pressurize LINK’s near-term defenses

Conclusion

Going forward, Chainlink bears were expected to mount attacks at LINK’s near-term defenses. Should the sell-side force a close below $16.7, chances of a breakdown would be high. Hence, long setups should be avoided on a shorter timeframe, and shorting would be a safer call.