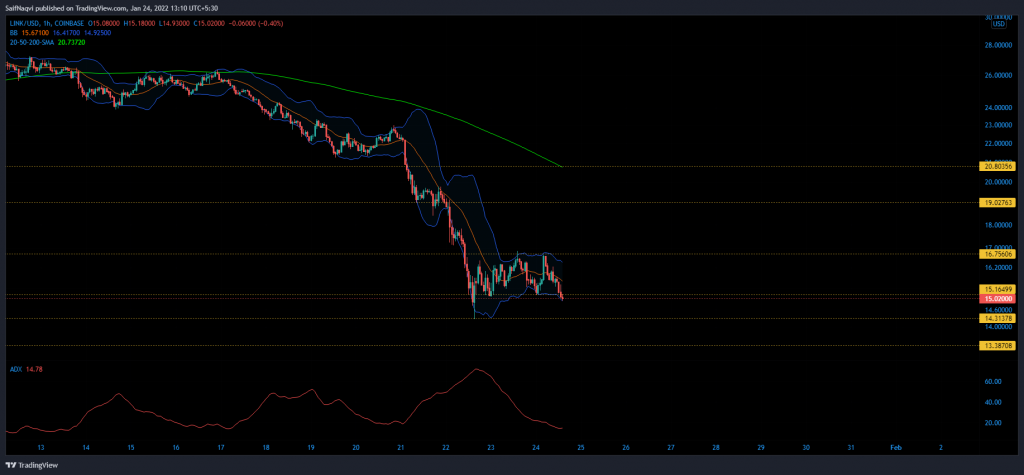

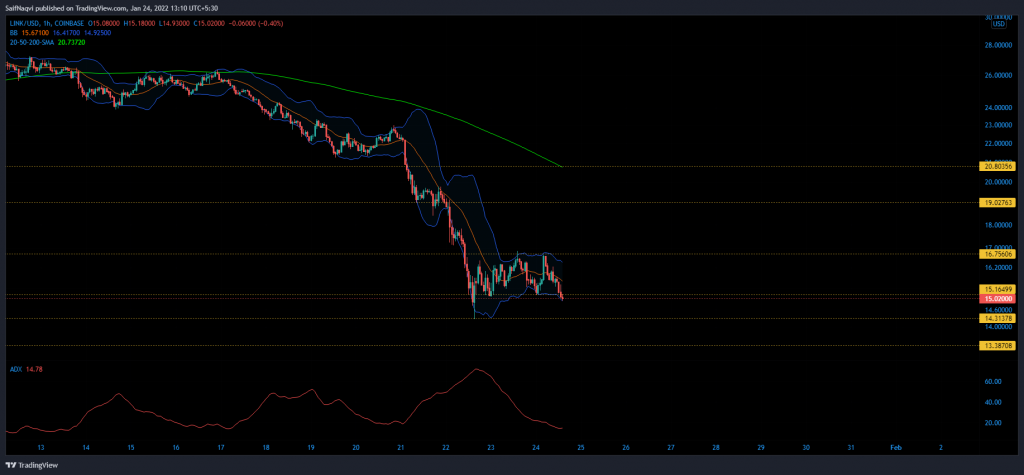

Chainlink is currently in a buildup phase as buyers and sellers look to contest ground between $16.7-$15. Taking into account LINK’s drastic sell-off last week, bears hold all the aces and a bullish recovery would depend on certain conditions. At the time of writing, LINK traded at $15, down by 9% over the last 24 hours.

Chainlink 4-hour time frame

Like most alts in the market, Chainlink was unable to fend off a relentless bearish attack last week and reported a 50% decline between 16 and 22 January. The damaging sell-off completely negated LINK’s fantastic start to January, during which its price peaked at $28.7.

A rebellious Sunday did see LINK post gains in line with the broader market but the upside was limited to $16.7 as sellers denied an extended recovery. Over the short term, the power struggle was expected to continue between $15-$16.7 levels as both buyers and sellers hunted for momentum.

If sellers do drag the market below $15, LINK would call upon its immediate defenses between $14.3-$13.4. A double bottom at $13.4 on the weekly time frame would set up LINK for a bull run once again.

Meanwhile, a breakout above $16.7 would beckon bullish arguments. In either case, LINK would have to climb by 24% and flip its hourly 200-SMA (green) to overcome its bearish bias.

Indicators

LINK’s lateral phase was backed by the contracted nature of its hourly Bollinger Bands. Tight Bollinger Bands indicate low market volatility and lateral movement. A price swing is observed once the candles consistently trade on the extreme ends of these bands.

Moreover, the Average Directional Index clocked in at 12- its lowest reading since 17 January. An ADX reading below 25 highlights a weak directional trend and reinforces consolidation.

Conclusion

Chainlink was expected to consolidate between $16.7 and $15. A weak ADX and a constricted Bollinger Bands disallowed for any major price swings over the next 24 hours. Once the stalemate concludes, LINK would be more vulnerable to another decline rather than a bullish rebound.