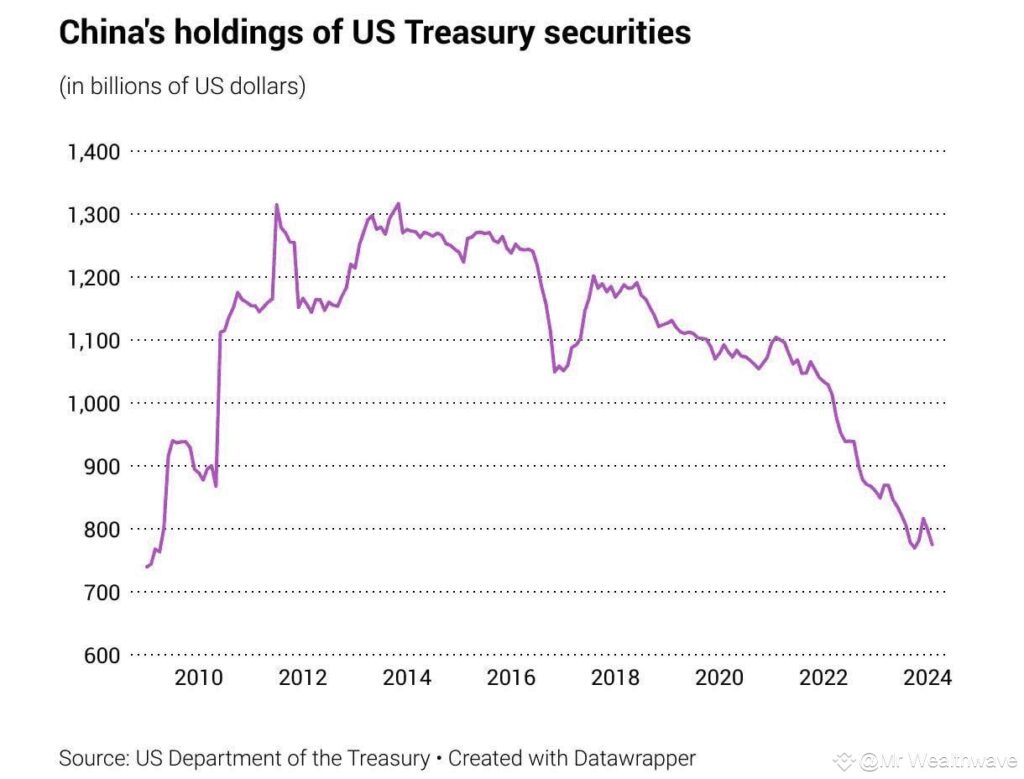

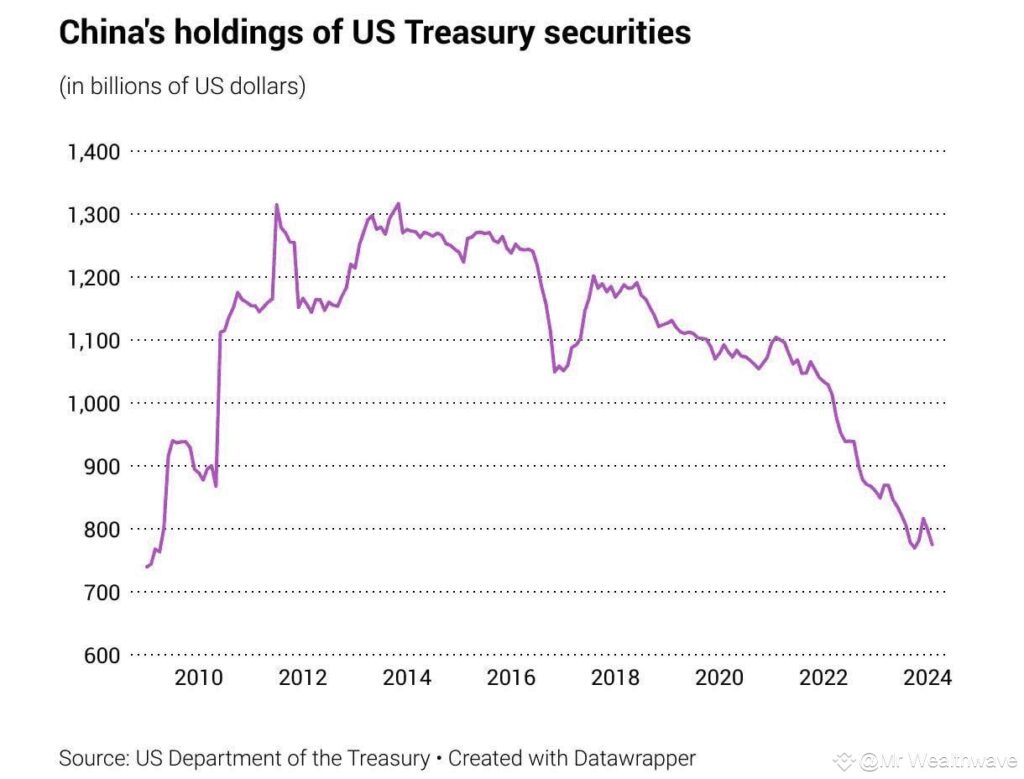

Leading financial analyst and gold proponent Peter Schiff explained on X how China could easily crash the US dollar now. His bold statements come after China recently dumped $23 billion worth of US Treasuries and trimmed its dollar holdings. China held $1,350 billion worth of US Treasuries in 2012 and steadily cut the holdings for over a decade. It now holds only $760 billion worth of US Treasury bonds and is diversifying its reserves with gold.

Also Read: UK Tests Offline CBDC Payments—What This Means for Bitcoin and Privacy Coins

China Could Bring the US Dollar in Just 3 Steps, Says Peter Schiff

Veteran analyst Peter Schiff explained that the US could lose the trade wars if China just pulls three strings. He said that China needs to dump all its US Treasuries and replace its central bank reserves with gold. The move will reduce the power of the USD and bring inflation in the homeland if the White House fails to import the USD.

Also Read: US Dollar Index Falls to 99.3: A Historic Signal for Major Market Moves

The development could lead to the US dollar facing a deficit as the currency needs to maintain its demand in the global supply and demand mechanism if China dumps the Treasuries, it could create an imbalance in the currency markets.

Secondly, Schiff explained that China could revalue the Chinese yuan and peg it to gold instead. Gold, he explained is a much safer and reliable asset than the US dollar as it does not come with debt. Pulling that move could make interest rates in the US soar while the same would decline for the Chinese yuan.

Trump said that our trade deficit with China is China's problem to solve. The solution is clear. China needs to dump all its Treasuries and U.S. dollars and buy gold. Then, revalue the yuan higher and peg it to gold. The dollar will crash versus the yuan. U.S. interest rates will…

— Peter Schiff (@PeterSchiff) April 7, 2025

Making the US dollar weaker this way could make the Chinese people buy more goods than their American counterparts. “So, the Chinese will get to consume all the goods they produce. Americans will experience massive inflation and a collapse in our living standards. As we will have few goods left to buy with our depreciated dollars,” he wrote.

Also Read: Gold Hits $3,245—Echoes of 1980s Rally, But Built to Last