China tariff increase to 125% on US imports marks a dramatic escalation in the US-China trade war. The Chinese Finance Ministry announced Friday that tariffs on US goods will jump from 84% to 125% beginning April 12, intensifying economic tensions between the world’s largest economies.

BREAKING: 🇨🇳🇺🇸 China raises tariffs on US to 125%. pic.twitter.com/xa2V3cwpAw

— Watcher.Guru (@WatcherGuru) April 11, 2025

Also Read: 3 Infrastructure Tokens Under $2 With 10x Potential in 2025

Understanding The US-China Trade War Impact And Economic Fallout Of Retaliatory Tariffs

China’s Finance Ministry said:

“If the US continues to impose additional tariffs on Chinese goods exported to the US, China will ignore it. If the US insists on continuing to infringe upon China’s interests in a substantive way, China will resolutely take countermeasures and fight to the end.”

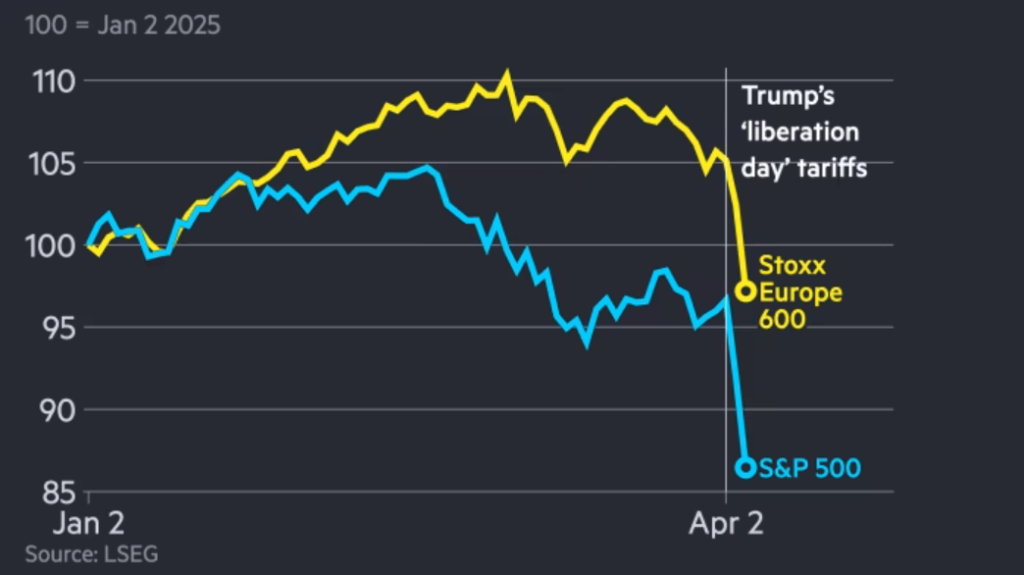

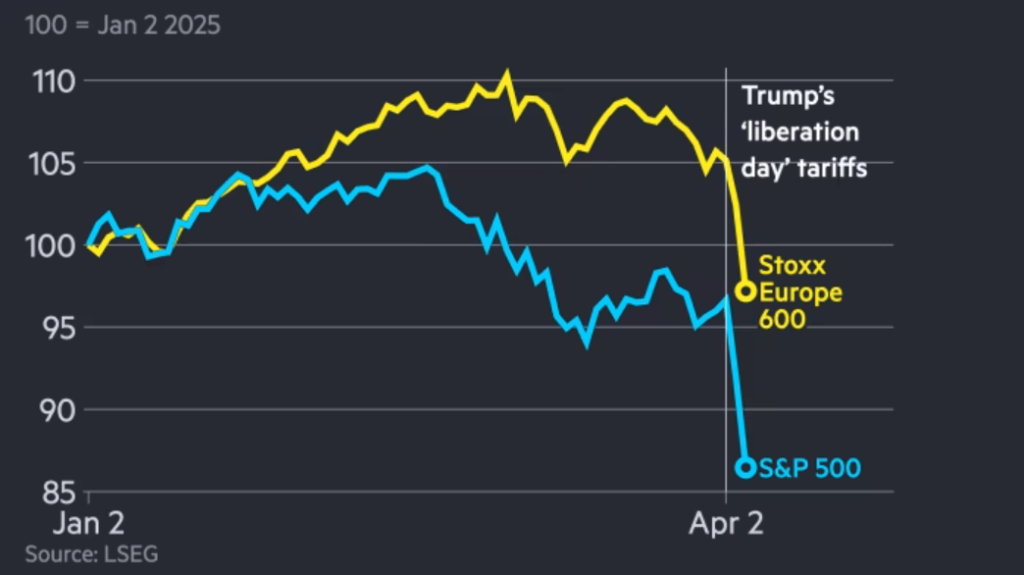

This China tariff increase comes in direct response to recent US actions. Markets reacted swiftly, with US stock futures falling and the Dollar Index losing 1.1%. Gold prices surged above $3,210 as trade tensions intensified.

Diplomatic Responses

China’s Commerce Ministry urged the US to take action, saying:

“China firmly opposes, condemns the US’ wanton unilateral tariff measures, has taken resolute countermeasures to safeguard own rights and interests.”

The ministry also called on the US to “take a big step forward in eliminating the so-called ‘reciprocal tariffs’ and completely correct its wrong practices.”

Also Read: Ripple and SEC Reach Agreement — April 16 Filing Canceled

Economic Impact

The China tariff increase will significantly affect US exporters relying on the Chinese market. American products will face substantially higher costs, with agricultural goods, manufactured items, and technology exports particularly vulnerable to these retaliatory tariffs.

Supply chains between the US and China are breaking down. Companies that work across both countries are rushing to change their plans as trade fights get worse.

Also Read: Pepe Coin: AI Predicts PEPE For Mid April 2025

Future Outlook

With China explicitly stating its willingness to “fight to the end,” resolution appears unlikely in the near term. The timing of this China tariff increase announcement, which came just before the weekend, gives markets such limited time to process the news, and also potentially leading to increased volatility in the coming days and weeks as investors try to make sense of the situation at this particular moment in time.

Both countries are standing firm right now, and the ongoing trade battle between the US and China will continue to affect global markets in the coming weeks. The possibility of additional punishment tariffs also remains a major worry for various companies and businesses that are currently engaged in international commerce, especially at this uncertain time.