China is arm-twisting Australia to settle trade deals in its local currency, the Chinese yuan, but Australian banks are not ready for the transition. This comes after the Communist country made Australia’s leading multinational mining and metals company, BHP, accept a deal in October to settle a third of its spot iron ore sales to Chinese customers in the yuan. The Xi Jinping administration clearly leveraged its iron ore purchasing capacity, as it has an upper hand in the imports it makes.

A report from The Conversation cites that China wants to change the invoicing to Australia from the US dollar to the Chinese yuan. Banking systems that settle payments in the middle of these transactions are not accepting the deal. Financial centers earn fewer fees and deposits, and lose out on lending business that naturally comes with the trade. Also, iron ore is the backbone of Australia and conducts businesses worth over $100 billion a year.

Also Read: Nvidia Gets New Bullish Stock Price Target (NVDA)

China Wants Iron Ore Deals With Australia in the Chinese Yuan, Banks Show No Interest

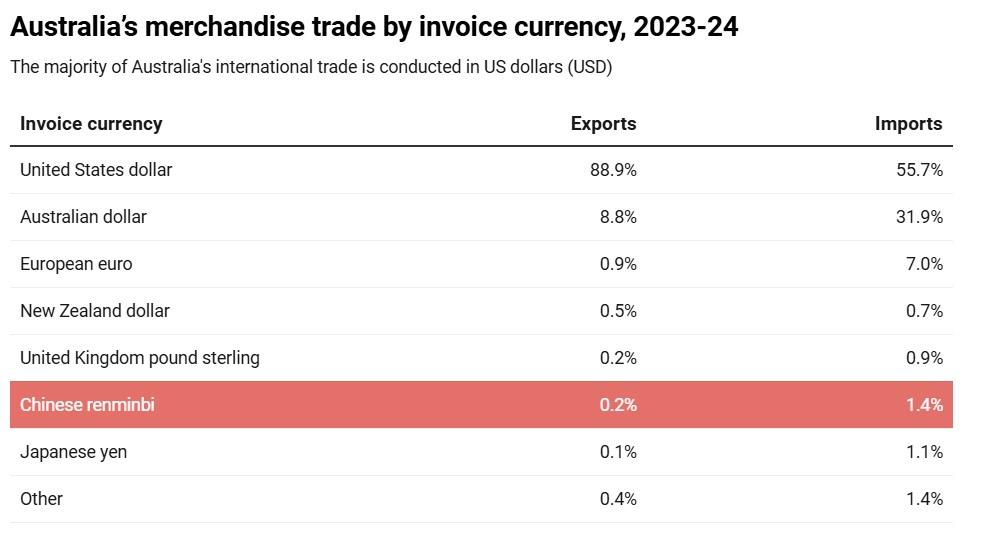

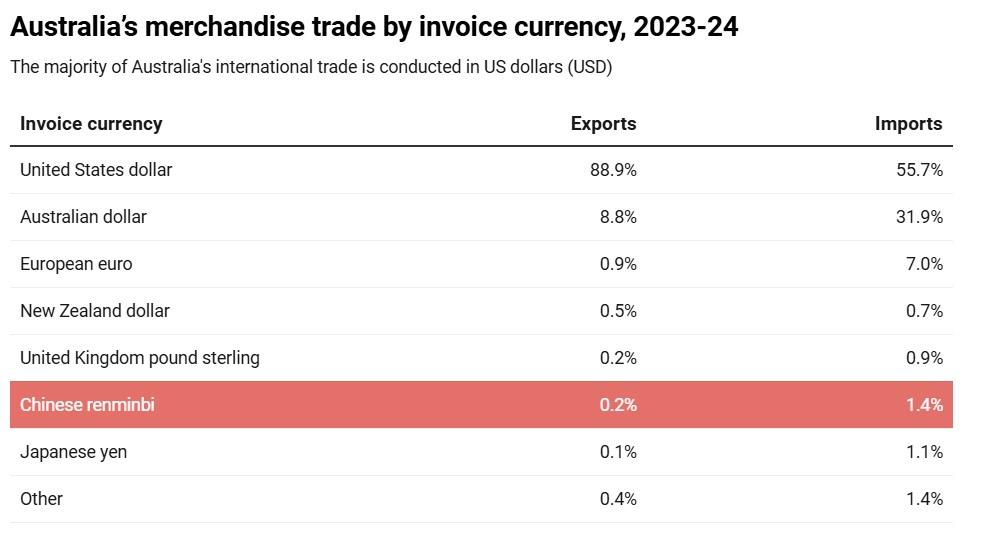

The latest data from the Australian Bureau of Statistics on invoicing data shows that China is among the top five trading partners with Australia. However, the settlement data shows that Australia pays only 0.2% of all trade deals in the Chinese yuan. That’s 0.2% for exports and 1.4% for the overall imports. This is very meager, and the US dollar takes the top spot at 89%, followed by the Australian dollar at 32%.

China wants Australia to increase its Chinese yuan payments as the Xi Jinping administration is keen to internationalize the currency. Australian banks are wary of these transactions as their balance sheets could be negatively affected. Financial institutions in Australia will lose out on their share of fees, and only China’s banking system could benefit. In conclusion, bypassing the US dollar for the Chinese yuan will only prove non-beneficial for Australia.