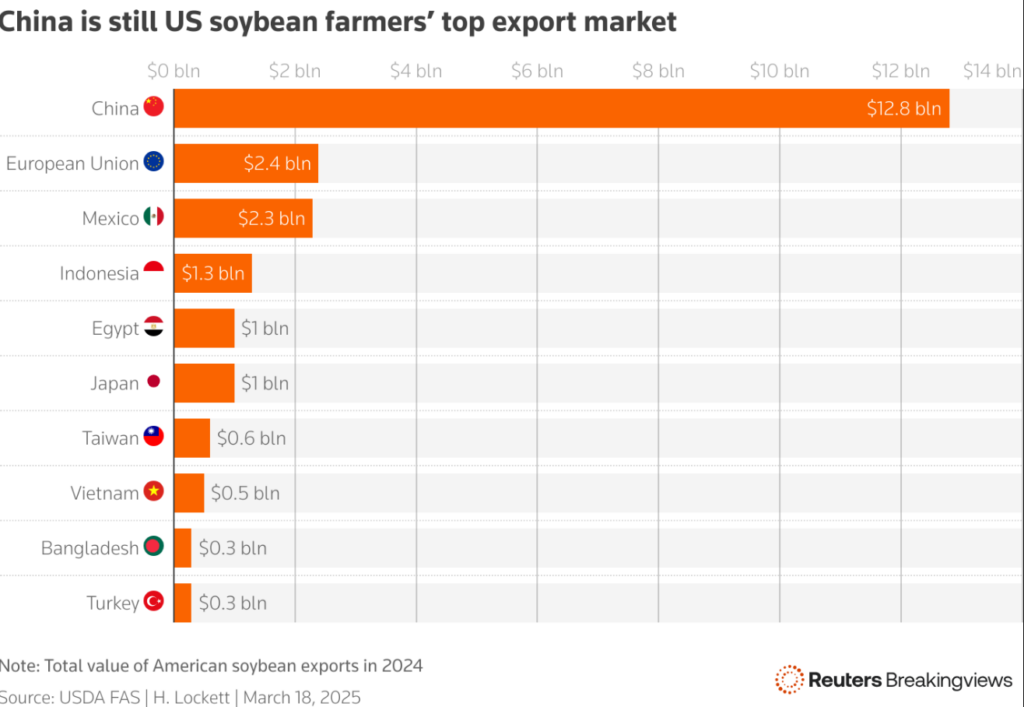

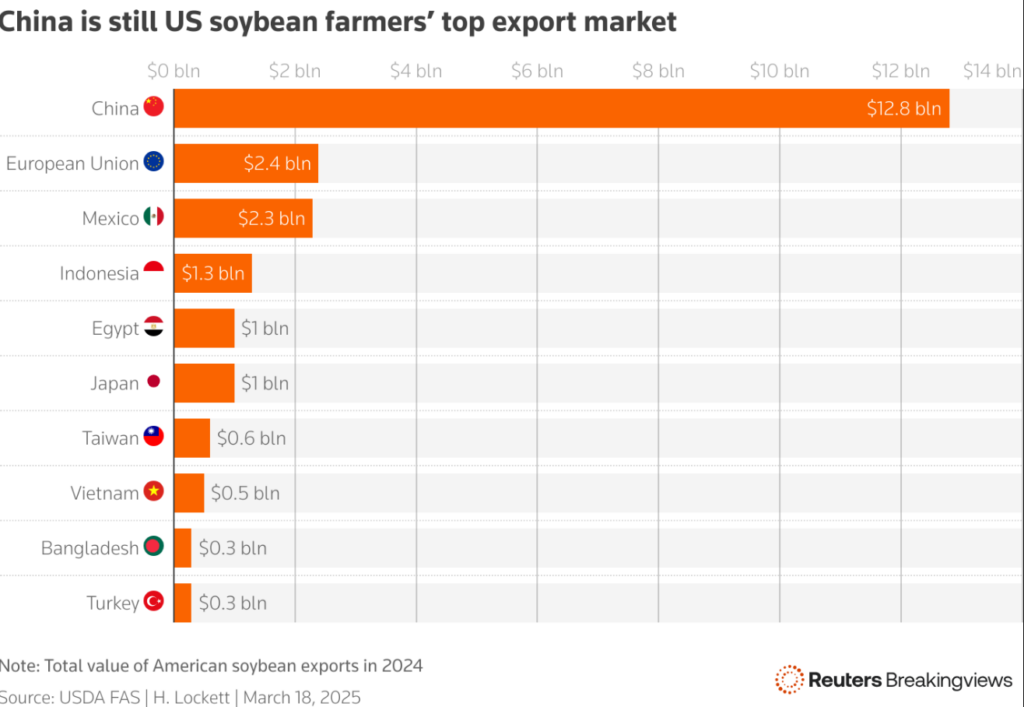

China tariffs on US agriculture have escalated recently as Beijing imposed retaliatory measures worth $21 billion targeting American farmers. Right now, these tariffs, which range from 10% to 15%, have been implemented as a direct response to President Trump’s recent 20 percentage point increase on Chinese imports. The impact on US agricultural exports has been immediate, and also quite severe, with soybean farmers particularly vulnerable since they sold more than half of their total exports to Chinese buyers in 2024.

Also Read: Ripple: How Much XRP Should You Hold For Life-Changing Returns?

Escalating Trade War: China’s Retaliatory Tariffs Deepen US Agricultural Woes

The trade war between the United States and China continues to intensify, and it is creating ripple effects across American agriculture. While President Trump campaigned on promises of 60% tariffs on Chinese imports, his administration has so far raised levies by just 20 percentage points. Beijing’s response has been calculated, and primarily targets US farmers through both tariff and non-tariff measures.

Soybeans Under Siege

China tariffs on US agriculture have hit soybean producers especially hard, and the impact is continuing to unfold. At the time of writing, data shows that China purchased approximately $12.8 billion of American soybeans in 2024, which far exceeds other markets such as the European Union ($2.4 billion) and Mexico ($2.3 billion).

Beyond the tariffs, Chinese officials have also suspended import licenses for three US soybean companies, including farmer-owned cooperative CHS, citing harmful fungus detections. These retaliatory tariffs and additional non-tariff barriers represent a significant threat to commodity prices and farm income across the country.

Bank of Singapore Chief Economist Mansoor Mohi-uddin stated:

“The People’s Bank of China could permit a drop of as much as 10% in a worst-case scenario.”

Corporate Fallout

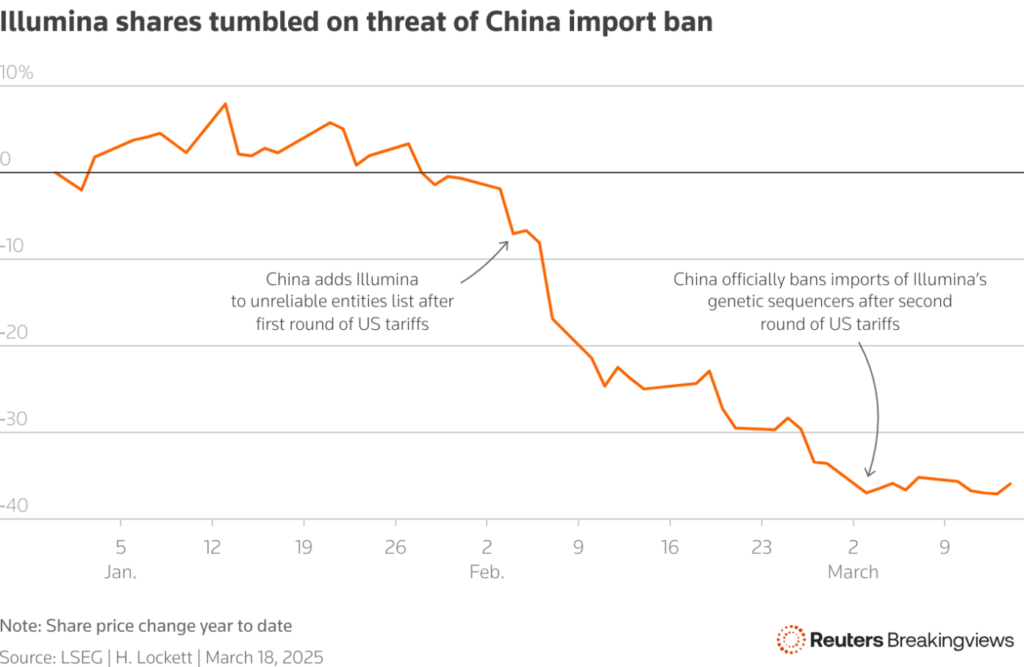

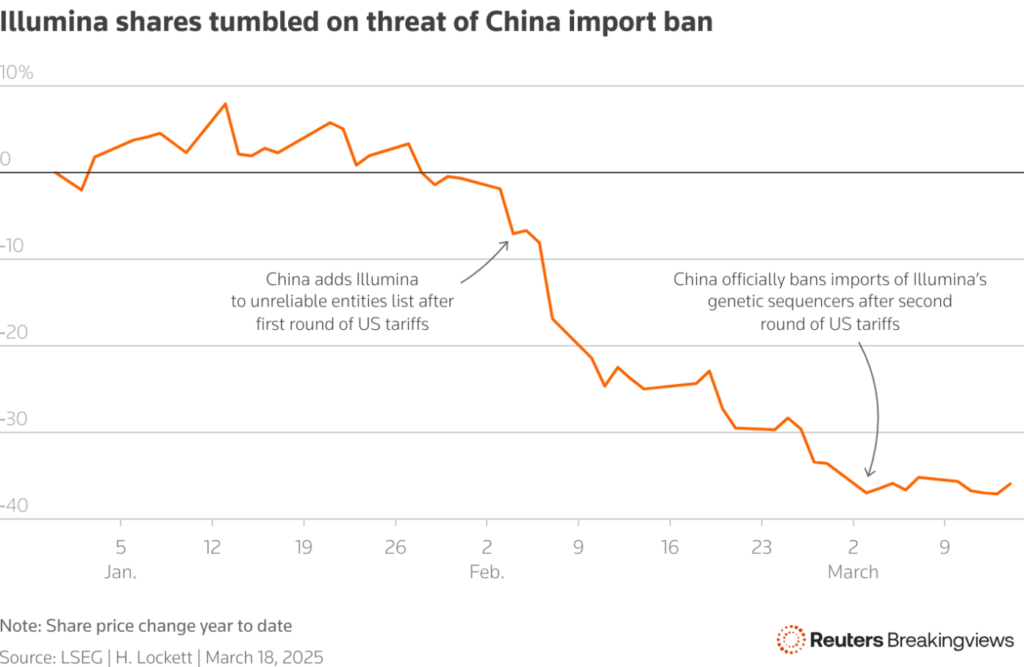

China tariffs on US agriculture are just one component of Beijing’s response to the trade tensions. The dispute has also expanded to target American companies that are dependent on Chinese markets. For example, China’s ban on Illumina gene sequencers became official on March 4, and this contributed to an approximately 35% drop in the company’s shares this year.

Also Read: SEC Officially Drops Ripple $XRP Lawsuit

These actions warn other US companies with significant Chinese exposure, such as Tesla and Apple. US agricultural exports remain vulnerable as Chinese customs officials can and do throttle imports through detailed inspections, a tactic they have used previously against other trading partners.

Potential Escalation Paths

If tensions escalate further, China has additional options for retaliation that could impact US agricultural exports even more. Currency adjustment represents one possibility, and restrictions on rare earth metals exports could affect multiple American industries as well.

The most concerning threat to commodity prices would probably be if China restricts exports of rare earth metals, which China produced approximately 70% of in 2024, according to the US Geological Survey. These metals are essential for manufacturing everything from semiconductors to electric vehicles, and many other products.

Also Read: CoinEx Listing Pi Coin: What’s Next After 19.3% Price Drop?