The crypto market has been in its bearish phase since the end of last year. While investors who have conviction—a.k.a. diamond hands—largely remain to be unaffected by the said conditions, weak hands have been selling.

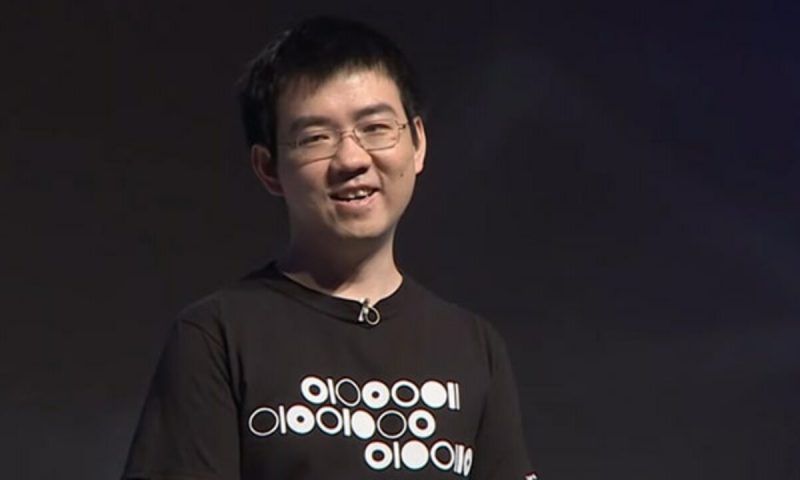

Alongside, new entrants like institutions have remained quite skeptical to step into the arena. Resultantly, they’ve been looking beyond the crypto space. Per one such latest development, Chinese crypto billionaire Jihan Wu has expanded into the physical asset space. According to a recent Bloomberg report, Wu’s crypto cloud mining service platform Bitdeer purchased Le Freeport—a high-security storage and display facility in Singapore. To do so, the company has reportedly spent around S$40 million [$28.4 million].

Per Bloomberg’s unnamed sources, the transaction was “private.” Wu acquired the repository for fine art, precious gems, and gold and silver bars, from shareholders led by Swiss art dealer and founder Yves Bouvier, the people said.

Wu confirmed the transaction in a text message in response to queries from Bloomberg News. The purchase took place in July, according to records with the accounting regulator.

According to Bloomberg, the price Wu paid represented a “sharp discount” to the S$100 million costs incurred to build “Asia’s Fort Knox.” Furthermore, as per a letter signed by Freeport’s Chief Executive Officer—Lincoln Ng,

The new owners are “fully committed” to supporting the Freeport Group with a view to expanding and improving the facilities and services.

The lack of institutional crypto engagement persists

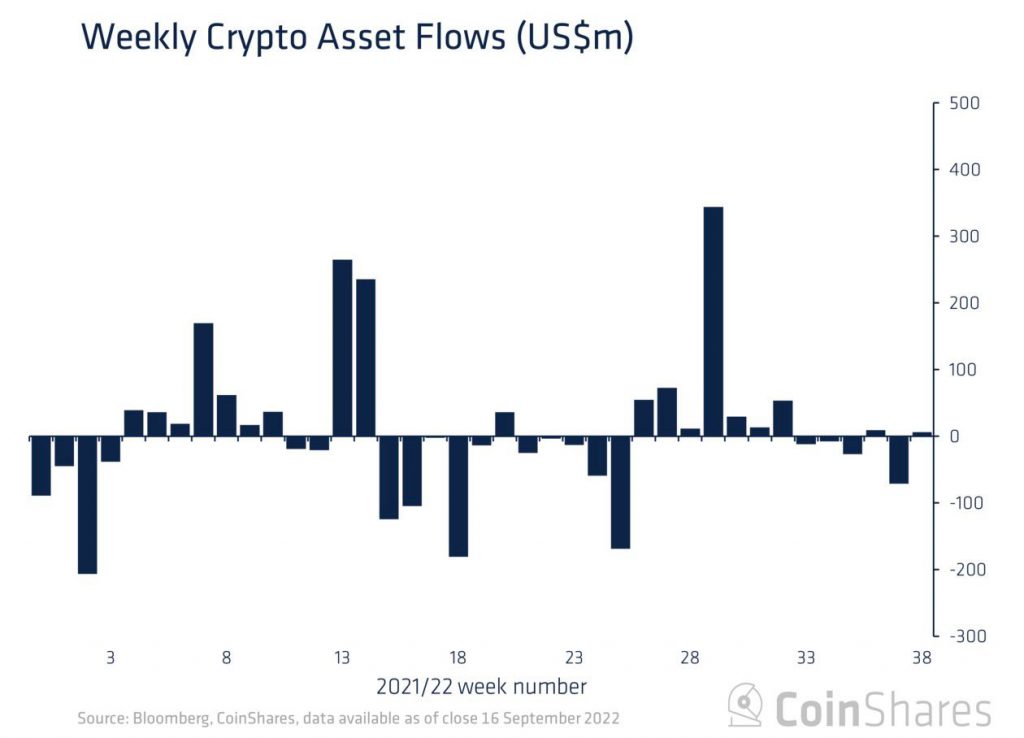

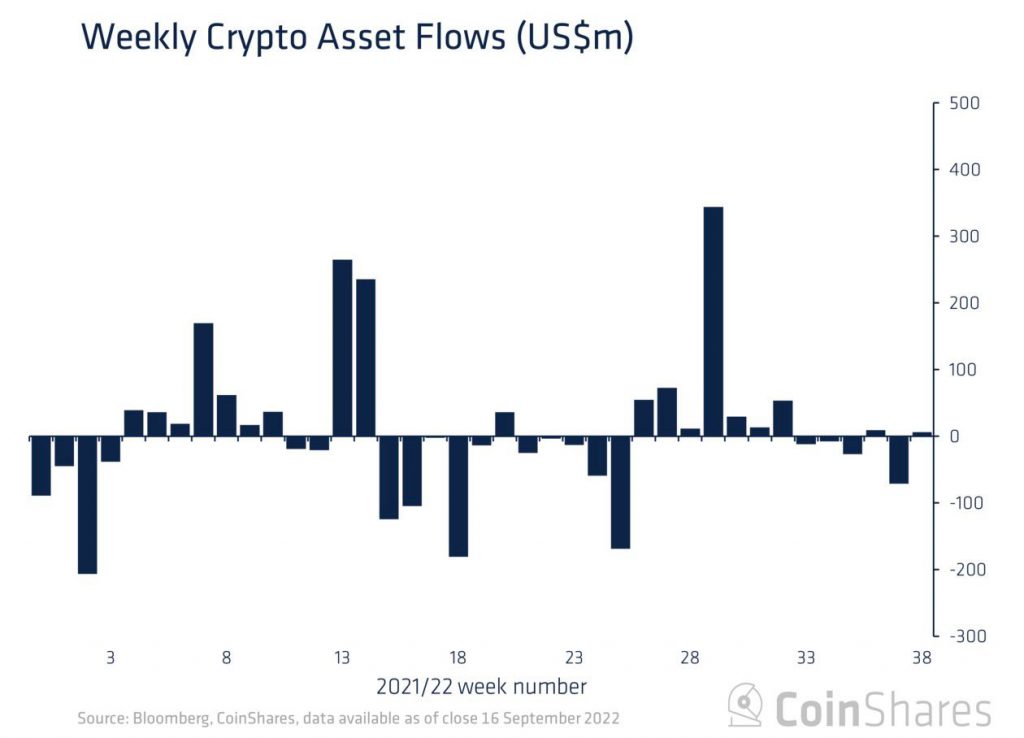

Even though events like the Merge have taken place within the ecosystem of late, investments by institutions into crypto-based investment products have been malnourished.

The flows last week remained positive but depicted a mere net figure of $7 million. While inflows into Bitcoin summed up to $17 million, Ethereum investments noted outflows worth $15 million. Altcoins like Cardano, Solana, and XRP noted minor inflows worth $0.1 million, $1.4 million, and $0.3 million respectively. The same suggested that institutional players remain cautioned.

Elaborating on the same, CoinShares’ latest weekly report highlighted,

The mixture of positive and negative flows by provider and asset suggests a continued lack of engagement amongst investors at present.