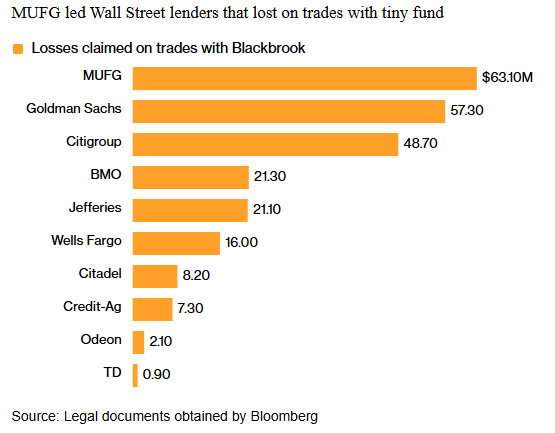

Citigroup‘s trading loss has hit Wall Street hard right now, while major banks including Goldman Sachs and also Japan’s MUFG suffered collective losses of around $2.6 billion from trades with Blackbrook Capital. The Citigroup trading loss, along with similar hits to other institutions, occurred back in early 2020 when banks arranged short Treasury positions for the small fund. MUFG led losses at $63.10 million, and Goldman Sachs posted $57.30 million, while Citigroup recorded $48.70 million in damages.

Citigroup, Goldman & MUFG Trading Losses Raise Bank Counterparty Risk

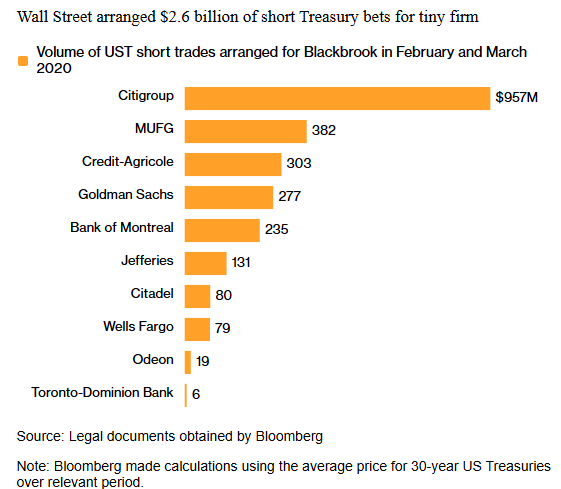

The Citigroup trading loss and also broader bank counterparty risk issues actually emerged from arrangements that were made during February and March 2020. Wall Street arranged around $2.6 billion in short Treasury bets for Blackbrook Capital, and Citigroup handled the largest volume at $957 million. MUFG arranged 382 million, and Goldman Sachs handled 277 million as well.

How Major Banks Lost Billions

MUFG trading loss topped all institutions at $63.10 million, making Japan’s megabank the hardest hit. The Goldman Sachs trading loss actually reached $57.30 million, and the Citigroup trading loss stood at $48.70 million. Bank of Montreal suffered $21.30 million, and Jefferies lost $21.10 million, while Wells Fargo also posted $16.00 million in losses.

Also Read: [Related Article 2]

Bank Counterparty Risk Exposed

The trading desk losses highlight some critical gaps in bank counterparty risk assessment right now. Several institutions in fact undertook exposure to one small fund at the same time and this casts an uncertainty as far as risk management practices are concerned. The Goldman Sachs trading loss and, as well, the MUFG damage, together with Citigroup’s hit, show that even advanced institutions may fail to calculate the counterparty risk.

Credit-Agricole arranged 303 million in trades and also lost $7.30 million. Smaller banks such as Citadel, Odeon and Toronto-Dominion played their part as well with losses in the trading desk of as low as 8.20 million and as low as 0.90 million respectively.

The event not only highlights the difficulty of dealing with bank counterparty risk in unstable markets but also how more risk evaluation systems should be designed in the financial sector.

Also Read: [Related Article 3]