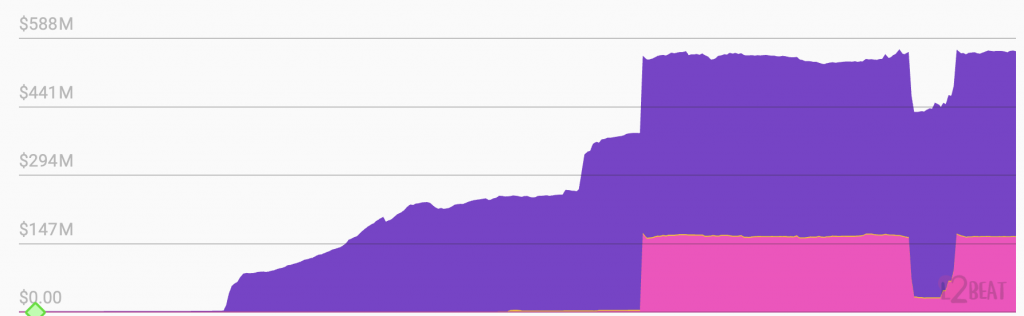

Layer-2 networks have been taking the front stage. Coinbase, a well-known cryptocurrency exchange, capitalized on this trend by introducing the Base platform. In the past week, it has significantly influenced the decentralized finance [DeFi] market with its impactful actions. The total value locked [TVL] of the network managed to surge to a high of $558 million. Recent data indicates that the value locked on the Base network has experienced a remarkable 25.23% surge over the past week.

Furthermore, despite a promising beginning in October, the Base network has witnessed a significant decline in transaction activity. To put this into perspective, on Oct. 2, Base processed 1.3 million transactions, but today it stands at just 520,000 transactions.

This development comes as a surprise, especially considering the series of hacks that Friend.tech faced. Base’s prosperity has primarily stemmed from the significant volume linked to its association with Friend.tech.

Also Read: BASE Absorbs Friend.tech Hype, But For How Long?

Exploring the Reasons Behind Coinbase Base’s TVL Spike

Recently, Circle, the issuer of the USDC stablecoin, revealed its initiative to introduce USDC to the Base platform. This move was part of Circle’s strategic plan to elevate the utility of USDC by incorporating it as a native token on multiple blockchains, eliminating the need for Ethereum token bridges. The key catalyst behind this substantial growth was the re-minting of native USDC on the network on Oct. 4. This led to an impressive surge of 470.55% to reach a total of 159 million USDC.

It should be noted that initially, Coinbase users and Circle account holders faced limitations in directly transferring USDC from their exchange accounts to the Base network. Instead, Base users had to rely on a bridged version of USDC referred to as “USDbC” to facilitate U.S. dollar transactions.

In addition, Switzerland’s tokenization company, Backed Finance, recently extended its tokenized short-term U.S. Treasury offering on Coinbase’s Base. This development occurred just two days ago.

Also Read: Base Beats Solana With 111% Rise in TVL Since August