Coinbase and Binance have been the victims of a recent lawsuit attack by the Securities and Exchange Commission. One after the other, the commission filed lawsuits against both exchanges, which shook the whole cryptocurrency realm.

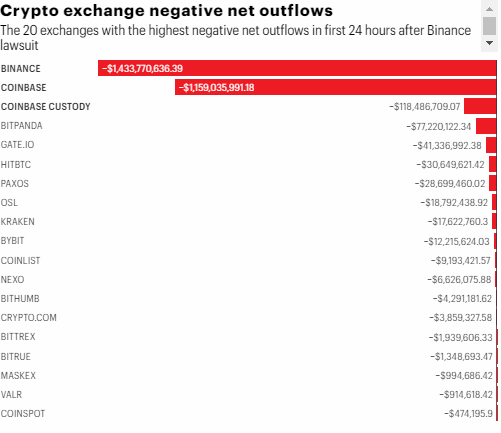

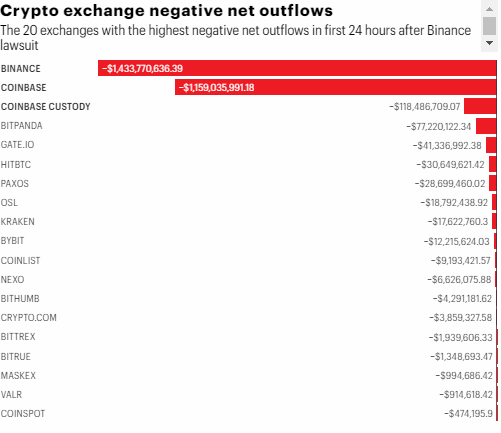

These two exchanges are the two largest players in the cryptocurrency realm. The duo has also been under the radar of several regulators recently. However, the back-to-back lawsuits have definitely spread FUD. According to the recent data from Nansen, Binance, and Coinbase witnessed over $1 billion in net outflows in the first 24 hours after the lawsuit.

Coinbase and Binance witness higher-than-usual outflows

Data from Nansen shows that Binance users withdrew $3 billion in assets and deposited only $1.57 billion. It has caused a negative outflow of $1.43 billion. This goes for Coinbase too, as the users withdrew $2.64 billion and only deposited $1.46 billion. This resulted in a negative outflow of $1.28 billion.

Despite the lawsuit, Coinbase CEO Brian Armstrong has conveyed that they will get the job done in court against the SEC. Armstrong has been fighting to create a proper regulatory framework for cryptocurrencies in the US. He also stated that he is proud to represent the industry in court.