Owing to the back-to-back collapses of firms from the crypto space, investor confidence has been shaken. As a result, companies providing trader-investor services that have managed to stay afloat, do not have very high profitability expectations.

In a recent interview with Bloomberg, Coinbase CEO Brian Armstrong said that the exchange’s revenue is set to slash down by around half this year. Drawing parallels with last year’s numbers, he said,

“Last year in 2021, we did about $7 billion of revenue and about $4 billion of positive EBITDA, and this year with everything coming down, it’s looking, you know, about roughly half that or less.”

Coinbase previously indicated it could see a 2022 loss of no more than $500 million based on adjusted EBITDA. At that time, the company did not provide a full-year outlook for overall revenue. However, Bloomberg noted that Armstrong’s estimate was in line with the approximately $3.2 billion expected by analysts.

It’s a known fact that transaction fee is Coinbase’s major revenue stream. A whopping 88% of the company nearly $7.4 billion in revenue in 2021 came from charging fees on transactions from retail traders.

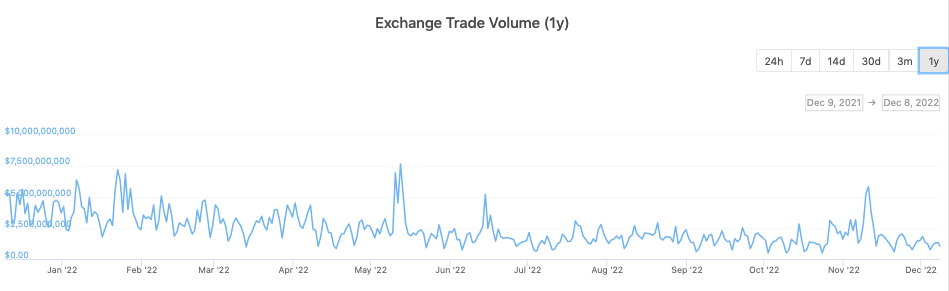

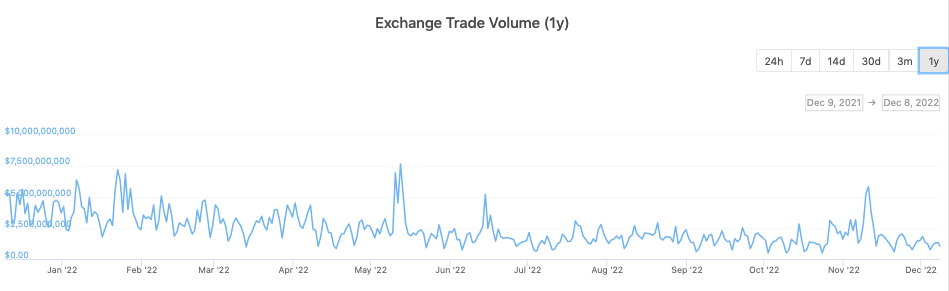

Despite sporadic rallies, the volume settled on Coinbase has been on a downtrend. As illustrated below, the exchange-traded volume has been hovering around the $1 billion mark of late when compared to January’s $2.5-$5 billion. Thus, if the monotonous trend continues, then Coinbase’s revenue would be hit even more.

Also Read: Coinbase Hires, Promotes 4 Senior Executives to Foster European Expansion

Coinbase Stock

Coinbase’s stock price has traded in red for the most part of this year. According to the latest numbers, COIN has depreciated by $209.79 since the beginning of 2022 and is down 83.57% year to date. At Wednesday’s close, it was priced at $41.26 and remained unchanged during the after-trade hours.

Also Read: Coinbase Stock Price hits new all-time low of $40.61