The 89th ranked token—Compound—noted one of the loftiest gains over the past day. The Robinhood listing event was, perhaps, the catalyst that triggered Compound’s rise. After noting a 10% rise in just the past 24 hours, COMP was seen exchanging hands around $132 at the time of press.

Compound’s fundamental box: Checked or unchecked?

The state of Compound’s Loan-to-Value [LTV] ratio isn’t really a cause of concern anymore. Simply stated, this metric computes the ratio of the loan to the value of an asset purchased. Eventually, the risk is gauged based on the likelihood of whether or not the liquidity would be sufficient to cover the loan balance.

So, if users provide liquidity to protocols that have higher LTV values, it essentially means that they’re enduring more risk. On the contrary, protocols with lower LTVs are considered to be safer options.

Now, as can be seen from the chart attached below, this metric had been on a downtrend for Compound since mid-January this year. However, it recently spiked to 28% on 4 April. Over the last couple of days, curiously, the LTV subsided and had been hovering in the 14% to 17% range of late, indicating that Compound has been able to HODL its horses and put up a decent show.

The total-value-locked or the TVL, on the other hand, has been able to remain flat and not dip below $6 billion. The same is a positive sign, given the fact that this metric was hanging loose and descending since mid-November last year.

As such, the TVL represents the cumulative value of all the assets locked up on protocols, may it be via staking, lending, or liquidity pools. So, as and when users make new deposits or withdraw their assets, this number keeps fluctuating. Keeping the current state in mind looks like Compound applied brakes at the right time.

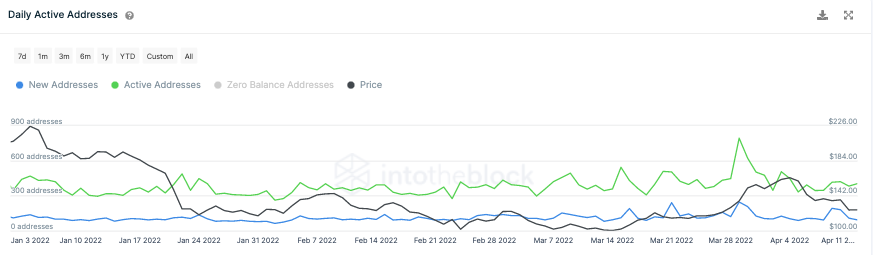

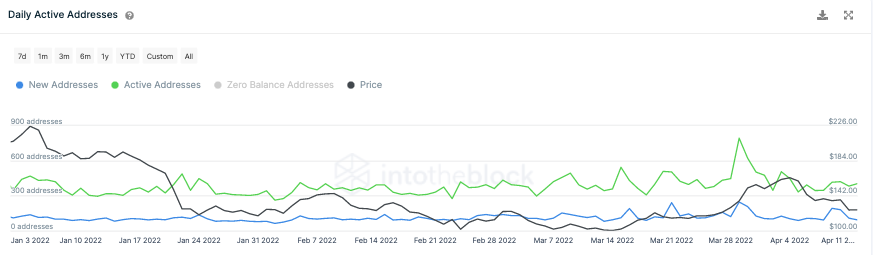

On the network front too, the number of new and active addresses have been able to put on the seatbelts and remain steady. A couple of spikes have been noted of late, but Compound’s deviation from the same hasn’t been that steep.

At the time of press, there were about 403 active addresses while the number of new addresses stood close to 90.

On the whole, Compound’s strong fundamental legs have complimented its native token’s recent price pump quite well, and if the legs get even stronger with time, COMP’s long-term growth would be shielded.