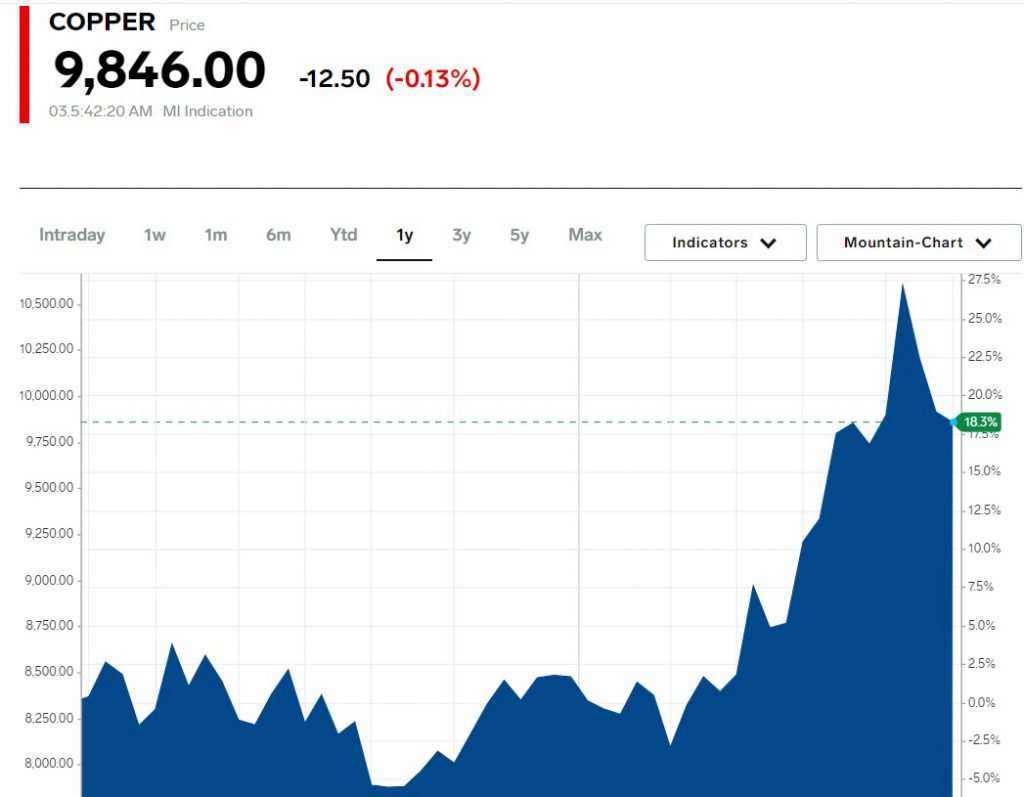

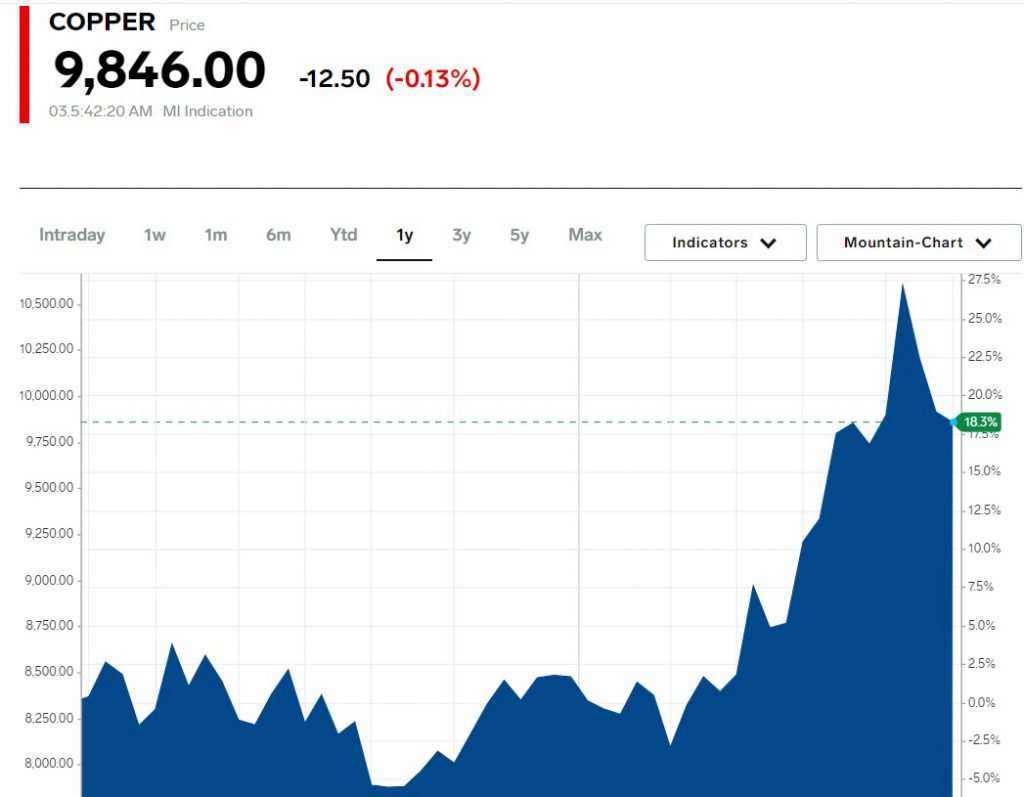

Copper prices touched a high of $10,800 last month delivering stellar profits to investors in 2024. This year alone, the metal skyrocketed more than 27% and is among the top-performing assets in the commodity market. The metal is scarcely available but in high demand to meet industrial and productional needs across the globe. The high demand is what’s driving its price up and investors are making the most out of the development.

Also Read: Central Bank Predicts Gold Prices Could Begin to Decline

However, copper prices shed most of the gains that it generated last month and are trading below the $10,000 mark. The chart shows its price hovering around the $9,867 range and is down by nearly 0.01% in the indices. Should the brief dip be seen as a buying opportunity or is there more downside to the metal? In this article, we will highlight if this is the right time to enter the commodity or not.

Also Read: Gold Attracts Sellers This Week: Should You Buy Now?

Should You Buy Copper As It Dipped Below $10,000?

The slowdown in the US jobs market in April made the US dollar dip inadvertently affected the commodity markets. The ripple effect was seen in gold and copper as the jobs data fell short of expectations. US employers created only 143,000 jobs, much below the 245,000 expected mark. In addition, a rise in global inventories for copper led to the decline of its price in June this month.

Also Read: U.S. Dollar Nurses Losses After Asian Local Currencies Stabilize

Copper production has seen an uptick since the end of May and industries can meet the rising demand. “The copper market seems much more sufficiently supplied than some traders had hoped for,” said Carsten Menke, the Head of Research at Julius Baer.

He explained that a rapid turnaround in copper prices hereon would remain difficult. He cautioned investors to wait and watch before taking an entry position into the metal. “Hence a rapid turnaround of copper prices thus looks unlikely in our view and we rather expect the market to consolidate during the summer months,” he summed it up.

Also Read: $1,000 Investment in Copper 10 Years Ago Is Worth This Much in 2024

In conclusion, investing in copper now is a risk as industries can meet the demand. Since the commodity market works on a supply and demand basis, an entry position now could be risky. It is advised to remain cautious before investing in copper currently.