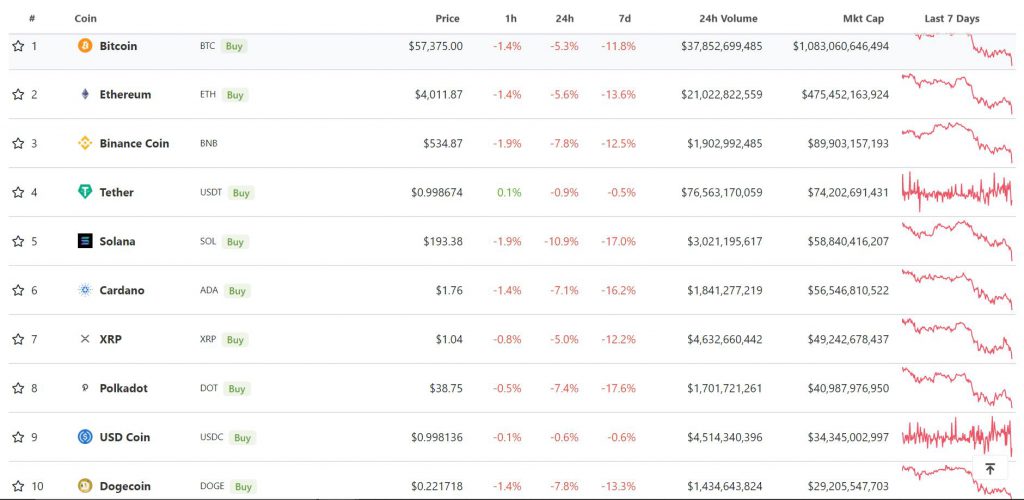

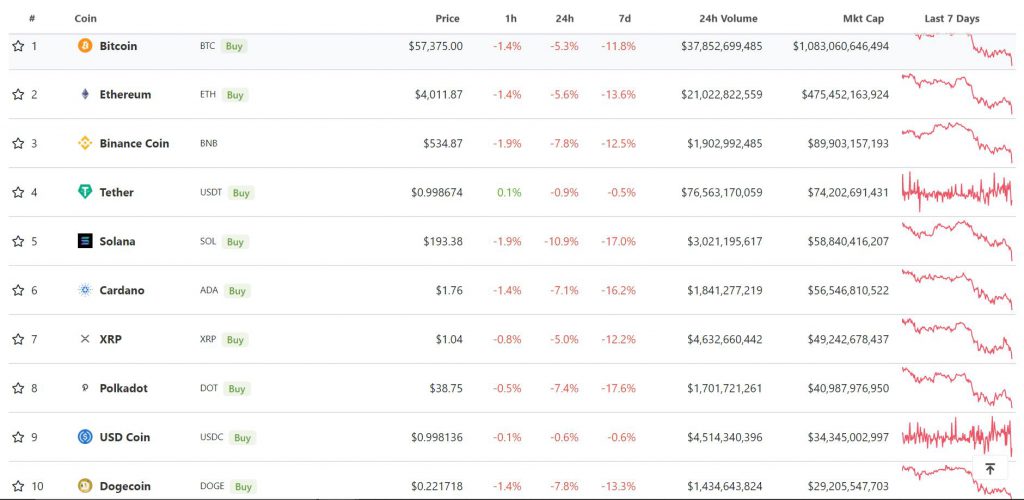

The collective crypto market is collapsing at the moment. Over the past few hours, the total crypto market cap was dropped by 2%, losing close to $150 billion. Over the past 48-hours, losses have tolled over $300 billion with Bitcoin dropping under $60,000.

This is the first major correction since the beginning of September, as the bullish momentum received a major halt. At press time, trading volumes are rising for each major tokens as selling pressure might be mounting on the exchanges.

Bitcoin drops but Altcoins lead correction charge

Bitcoin registered a decline close to 6% at one time, as weekly losses reached over 10%. Its trading volumes did not establish any decline, indicating that selling pressure was momentarily high.

Amidst the top-five coins, Binance Coin was severely affected with a drop of 8% over the past day. Its valuation plunged under $550 support, and it registered a low of $510. Selling volumes for BNB was the highest since the 2nd week of September, which is a strong bearish sign.

Interestingly meme tokens such as Shiba Inu and Dogecoin did not crash as much as expected. SHIBA consolidated near the $0.00004500 range at press time, with Dogecoin testing its October support of $0.22.

However, Algorand and Mana token managed to remain uncorrelated from the bearish pressure. At press time, ALGO was up by 15% over the past day, with MANA token recording a 13$ hike. At press time, the SAND token was the top performer with a whopping 32% rise in the charts.

Is the worst over or ahead?

Willy Woo, Bitcoin commentator, and analyst remained on the optimistic side of the market as he suggested the current market to be a buying opportunity. The corrections made technical sense. For tokens such as Ethereum, it has been on a rise since September.

A continuation of bullish trends requires a sell-off period to remain healthy and avoid overheating. Yet, the bearish pressure could lead to further decline if immediate recoveries are invalidated. Earlier, Bitcoin was expected to reach $62,500 immediately, however, the current trend remains unpredictable for the time being.