It has been one of the biggest debates in the cryptocurrency industry, but this year brought the discourse a new perspective. With the downfall of FTX, and exchanges being questioned now more than ever, we take a fresh look at centralized vs. decentralized wallets for the coming year.

The past year has been a tremendously difficult one for investors. Yet, the discussions around the best place to store your digital assets remains a vital decision for market participants. Moreover, could the year’s events have swung the pendulum toward greater DeFi efforts?

Centralized Wallets

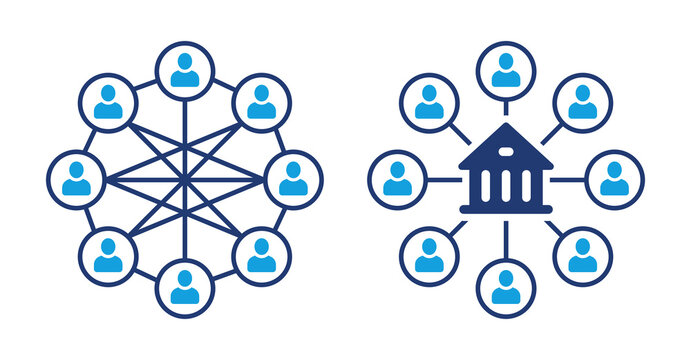

In the world of cryptocurrency, how one stores their digital assets is among the initial and most important decisions. There are two options for consumers, one option being centralized wallets and exchanges.

A centralized wallet is most often an exchange or trading platform that essentially functions similarly to traditional brokerages within the stock exchange. These platforms are third-party entities that maintain full control of that platform, and those investments housed within it.

There are various pros and cons to utilizing a centralized wallet. For most consumers, they sacrifice control for the ease and accessibility they provide. Where these platforms are user-friendly, they also often withhold access to private keys, leaving users at risk for errors not of their own doing.

There is no shortage of well-known crypto exchange platforms. Names like Binance and Coinbase are two of the largest, with the former being the largest by trading volume in the world. Conversely, a name like FTX was one of the most prominent centralized exchanges. Ultimately filling for bankruptcy last month following reports of the misuse of customer funds.

Their fate, and the presence of platforms like Binance, perfectly encapsulate the potential upsides and downsides of centralized wallets. They also influence how we perceive the question of which storage type is best for our digital asset and overall user experience.

Decentralized Wallets

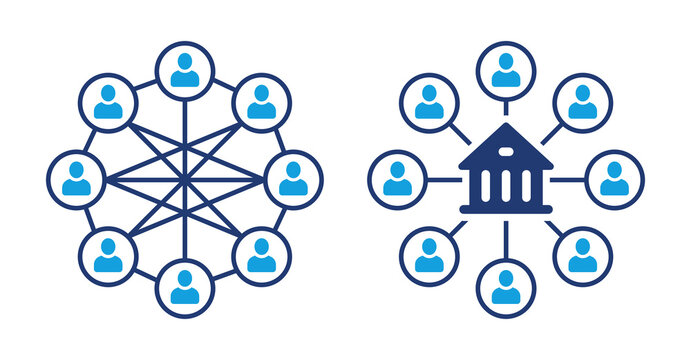

On the other side of the aisle are decentralized wallets. Contrastingly, decentralized wallets keep in the spirit of the DeFi ideologies that birthed blockchains and their subsequent cryptocurrencies in the first place. There is no central authority or entity that you must rely on, allowing the investor to utilize the tremendous blockchain technology developments to keep their own digital assets safe.

These kinds of self-custodial measures are the best option for ensuring that you have access to all facets of your assets. Users who opt for decentralized wallets maintain the most data and security available to them. Conversely, this exceeds what you would find in a centralized exchange.

The option for self-custody does lessen the ease and accessibility of the experience. Moreover, because of the newness of a lot of decentralized exchanges, there is limited functionality and a much smaller market share.

Examples of some of the best decentralized wallets include Coinbase Wallet, ZenGo, and MetaMask, a platform that recently partnered with PayPal. The benefit of self-custody remains that these platforms do not have the level of control that you maintain over your own assets. Additionally, they allow peer-to-peer transactions to be executed without the necessity of a bank or institution.

A Fresh (and Tragic) Perspective

Although the centralized vs. decentralized debate has existed since the beginning, this year took it to a new level. The collapse of FTX has given investors a tangible image of the risk of centralized cryptocurrency. In the wake of its devastation, the exchanges left are now embracing transparency efforts in ways they never have, attempting to quell some of those concerns with proof-of-reserve audits.

Alternatively, the great concern over the regulation, or lack thereof, in the market remains. Platforms like Binance, and Coinbase operate outside of the reach of regulation in government protection. Whether or not these changes occur in the coming year remains to be seen, and they will undoubtedly impact how we view this discourse at this time next year.

Still, the reality of FTX, and the horrid fate of so many investors, proves too big a detriment to not factor it into this discussion. Therefore, the fresh perspective should be to remain vigilant and embrace due diligence.

For users who feel comfortable with the PoR audits done by exchanges, and desire the accessibility of centralized finance, they will maintain a comfort. However, those who remain fearful of the regulation of a centralized platform will likely find peace of mind in the control and authority that DeFi grants investors.