They say crypto takes people on a roller coaster ride. Well, metaphorically, that statement HODLs cent percent true. Ups and downs are a part and parcel of the ride, but of late, the riders of the coaster have only been witnessing the down crash.

2022 began on a bearish note, and since then, the market has noted a handful of bloodbaths. Things, however, looked far worse on Thursday, for question marks were raised about the sustainability of the whole ecosystem, thanks to the LUNA-UST saga.

In its journey of once being a part of the top-10 to standing far behind in the queue at 187, LUNA lost more than 99% of its value. The crash of this one alt was more than enough to intensify the state of bearishness in the broader market.

At press time, it was noted that Bitcoin and Ethereum had lost 30% each of their respective values over the past week alone. Most other alts followed suit. As a result, the cumulative crypto global market cap stood at a malnourished $1.2 billion. at press time.

Worst affected casualties

Time and again, the state of the market has altered people’s emotional, psychological and financial fate. Rags to riches stories are commonly narrated during uptrend phases, while riches to rags stories become the talk of the down during downtrend phases.

Owing to the great grand crash of 2022, crypto billionaires have lost major chunks of their capital, at least on paper.

Consider this – Brian Armstrong, the founder of Coinbase, had a personal fortune of $13.7 billion as recently as November. The number shrunk to around $8 billion by the end of March. However, per the Bloomberg Billionaires Index, it’s just worth $2.2 billion now.

Coinbase’s co-founder Fred Ehrsam’s worth too tumbled down to $1.1 billion, after depreciating by more than 60% this year.

Changpeng Zhao, the CEO of Binance, debuted on the Bloomberg wealth index in January with a net worth of $96 billion. By yesterday, nonetheless, that number had melted down to $11.6 billion.

Then, of course, there’s Michael Novogratz—a hardcore LUNAtic. On 6 April, at the Miami Bitcoin conference, the Galaxy Digital exec stated, “I’m probably the only guy in the world that’s got both a Bitcoin tattoo and a Luna tattoo.”

He had tweeted about the same earlier in January this year. Novogratz’s fortunes have plummeted from $8.5 billion in early November to $2.5 billion on Wednesday.

Crypto exchanges feel the pinch too

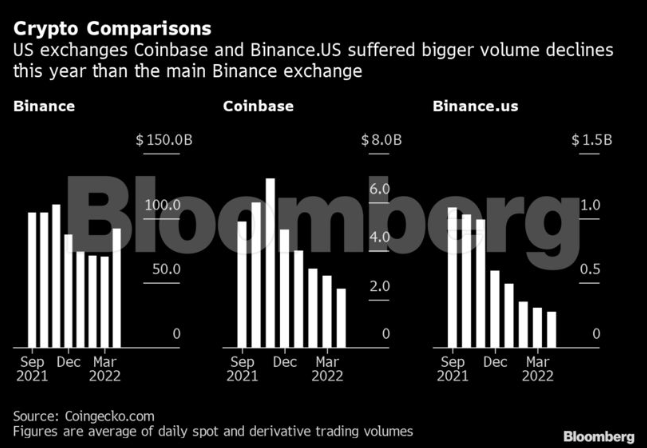

Per Bloomberg, crypto exchanges in the US seem to be suffering more of a downturn than their global counterparts. Trading volumes at Coinbase have steadily fallen since the beginning of the year, while more internationally focused Binance saw an uptick in volume last month. Binance’s US-focused business, on the other hand, experienced an even steeper decline than that of Coinbase’s.