CryptoCompare has released its latest report on the evaluation of crypto exchanges. The Exchange Benchmark was created by CryptoCompare in 2019 as a tool to offer transparency to the digital asset exchange market. It establishes a risk-assessment methodology and delivers openness and responsibility to a complicated and continuously changing market.

According to the report, exchanges with the lowest risk include Coinbase, Gemini, Bitstamp, and Binance, all having AA ratings.

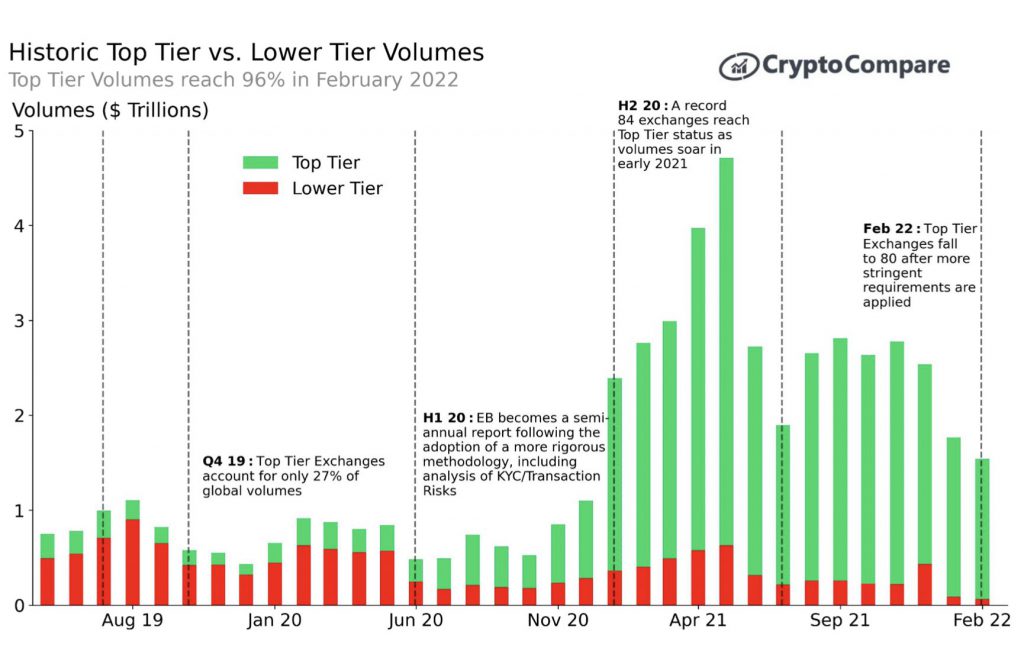

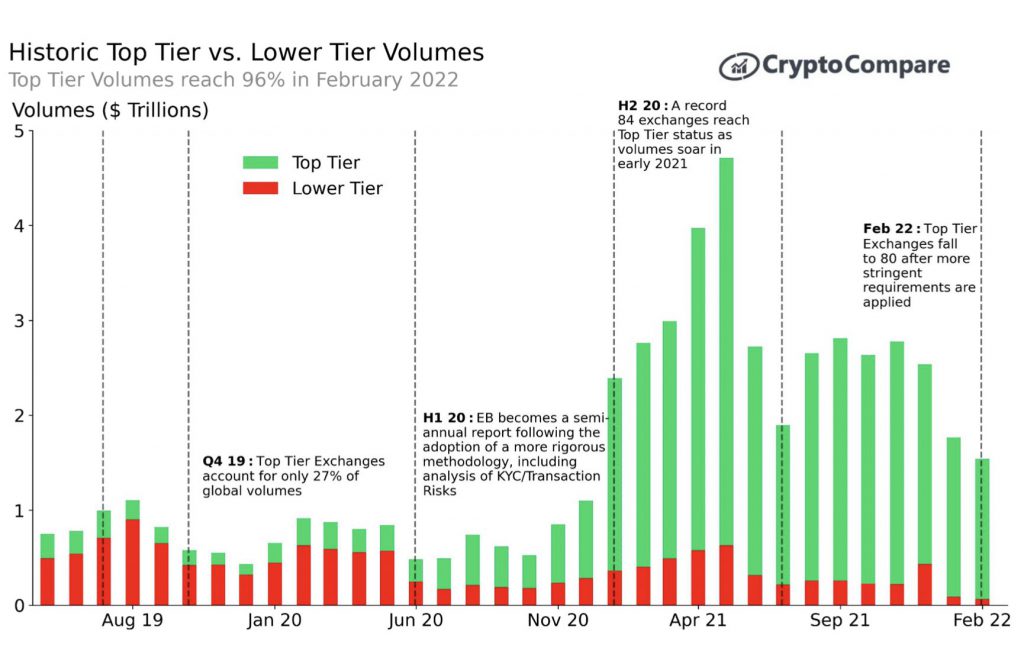

Since August 2021, top-tier exchanges have increased their volume market share, going from 89% in July 2021 (based on August 2021 rankings) to an average of 91% in the six months between September 2021 and February 2022. (Based on the latest March 2022 rankings).

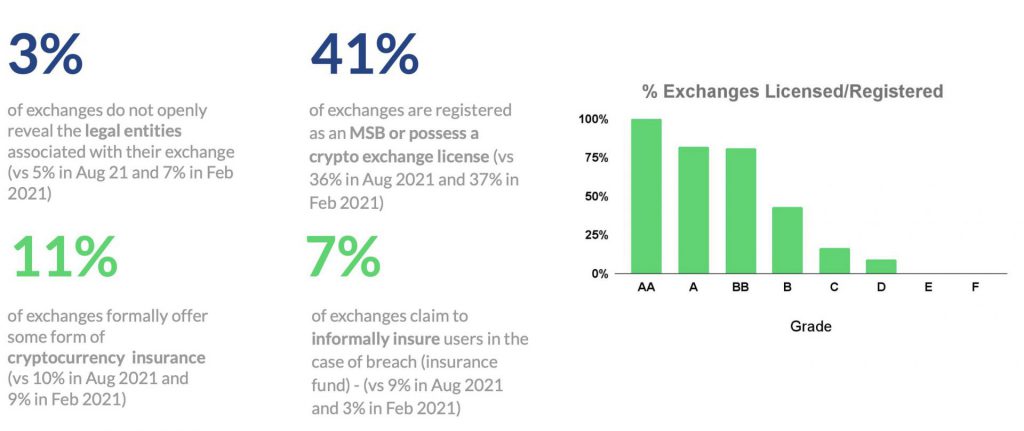

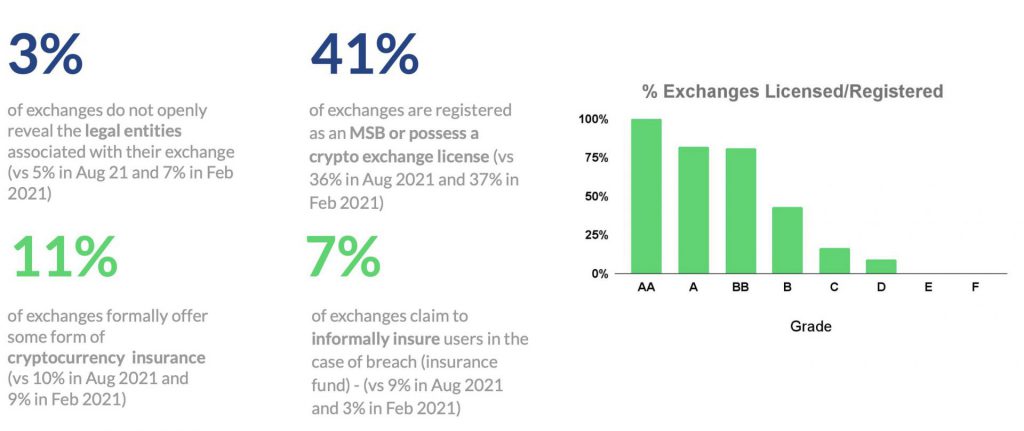

In the most recent Exchange Benchmark, just 78 exchanges met the criteria for Top-Tier classification due to tighter benchmark conditions (vs 87 in August 2021 and 84 in February 2021). In the meantime, 15 exchanges have achieved AA-A classification, up from 9 in August 2021.

Since August 2021, several top-tier exchanges have made major acquisitions. These include competitor purchases, which are causing industry consolidation, as well as umbrella acquisitions, which are allowing exchanges to grow into other areas.

FTX, Binance, Gemini, and Kraken were some of the top exchanges that expanded into other spaces.

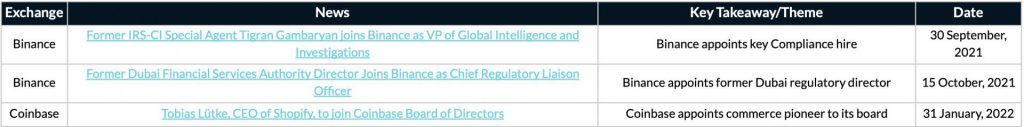

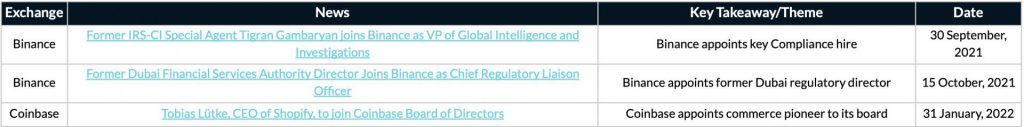

Exchanges have begun to grow their workforce to hire new employees that will have a good impact on their company and the industry as a whole. Adding team members with regulatory experience or advisors whose skills can offer value to the firm are examples of this.

While most crypto exchanges currently operate on a global scale, many have formally expanded their operations into additional territories in the recent six months.

As both retail and professional traders relocate to lower risk exchanges, top-tier crypto exchanges have grown their market share from 89% in 2021 (based on August 2021 rankings) to 96% in February 2022 (based on the most recent February 2022 rankings). Top-tier exchanges account for 88% of digital asset volumes on average over the last six months.

Consolidation of exchanges has significant consequences for the crypto industry’s future. Volumes have begun to concentrate around the top tier exchanges, according to CryptoCompare, and this tendency is expected to continue in the future. As the sector matures, it’s projected that an oligopoly of exchanges will dominate trading volumes as their traction grows and lesser firms fade away.

Digital asset exchanges will also have a significant impact on the future of the crypto sector. Exchanges and their leaders, such as Brian Armstrong of Coinbase and Changpeng Zhao of Binance, are among the most powerful organizations and personalities in the industry.

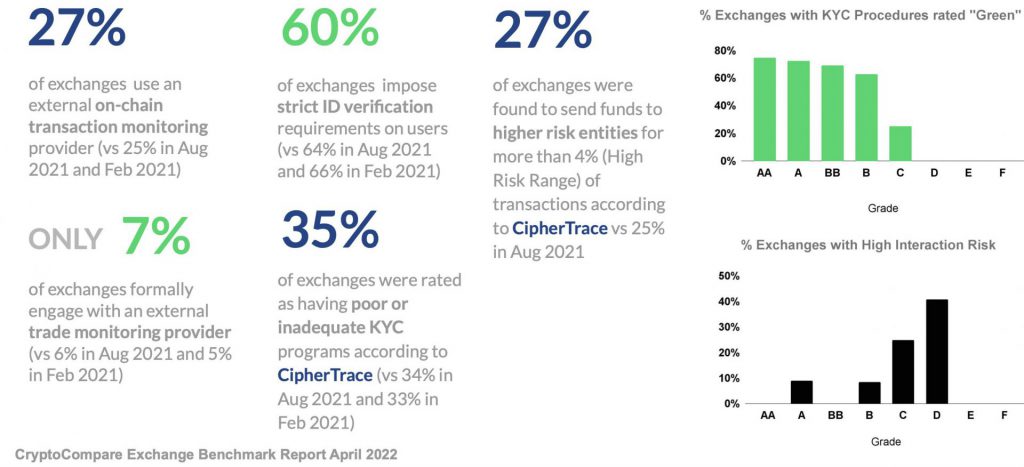

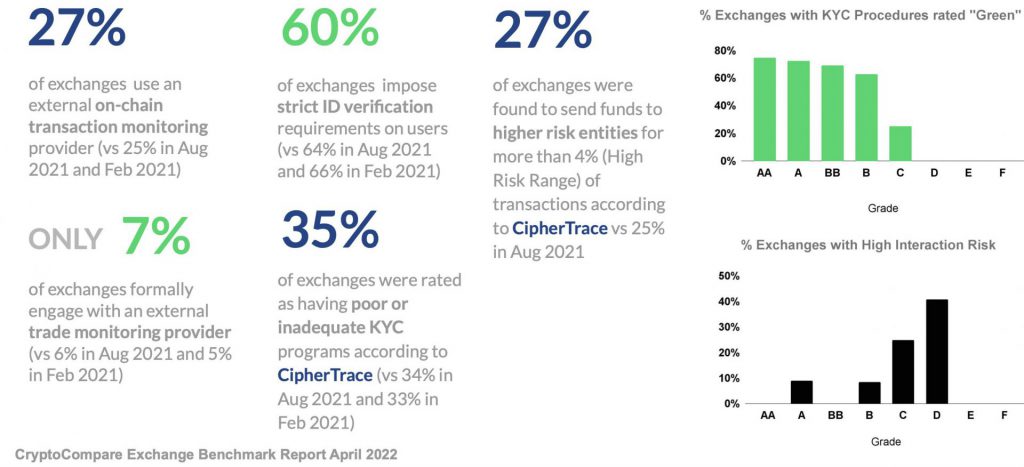

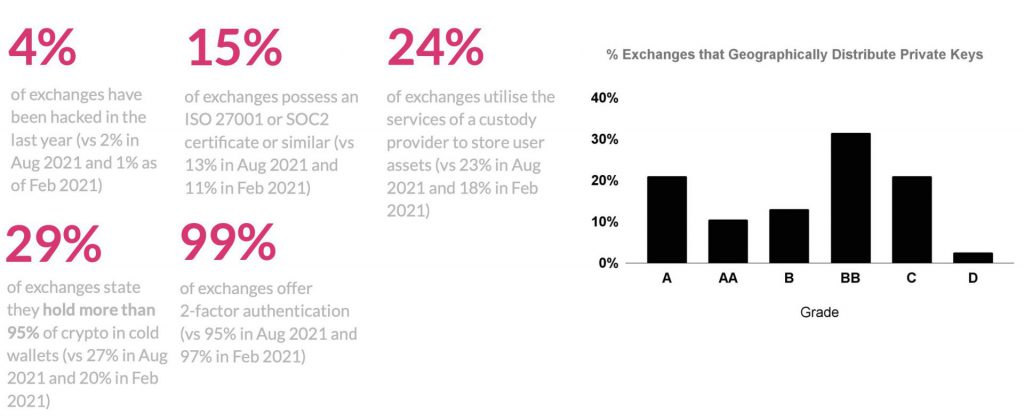

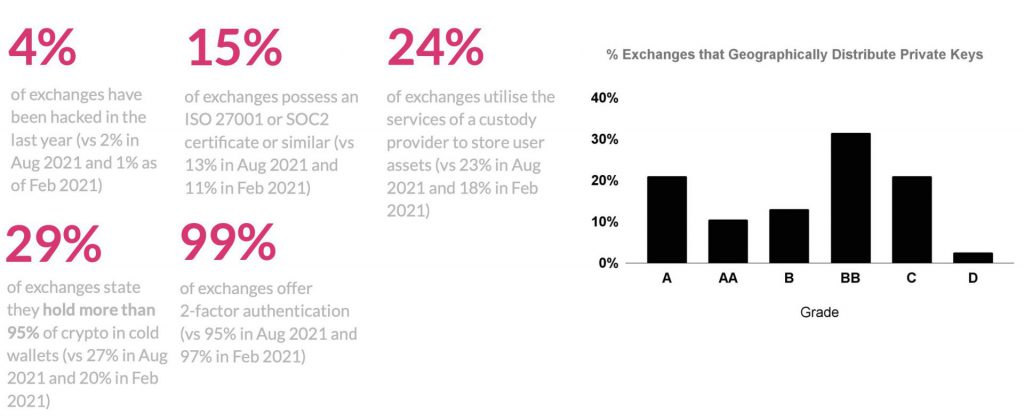

Below are the findings as reported by CryptoCompare:

According to CryptoCompare’s results, Coinbase came out on top of the crypto exchanges list, followed by Gemini, Bitstamp, and Binance. The AA rating was given to all of the aforementioned exchanges. 4 exchanges obtained an AA rating, 11 received an A rating, 27 received a BB rating, and 37 received a B rating out of the 79 Top-Tier exchanges. Lower-Tier exchanges accounted for 80 of the total.