Two of Europe’s leading crypto firms have joined hands to launch the world’s first Solana exchange-traded product (ETP) during a disconcerting period for the smart contract operator.

The alliance, made between CoinShares, Europe’s largest digital asset investment firm by assets, and FTX, a top cryptocurrency trading platform, will see the launch of the world’s first physically-backed Solana ETP. The ETP carries a unique staking mechanism that allows issuers to share staking rewards with investors.

As per the announcement, the ETP will launch with 1 Million SOL in seed capital, amounting to a dollar value of $92 Million based on SOL’s press time level. The statement also revealed that the CoinShares FTX Physical Staked Solana ETP will be listed on Germany’s digital trading bourse, Xetra.

Solana – Bullish long term but weak short-term?

The decision to launch a Solana ETP comes in a wildly contrasting period for the world’s seventh-largest cryptocurrency. The altcoin has risen by 23% since 13 March, making good use of a bullish period for alts. Furthermore, a listing on the Winklevoss-run Gemini earlier on in the month is expected to generate long-term wealth.

Commenting on the new partnership, Sam Bankman-Fried, FTX CEO, said “The goal of FTX Access is to bring institutional-grade services and products to market in a cost-effective manner. We only want to launch products that are genuinely innovative and add value to our clients”

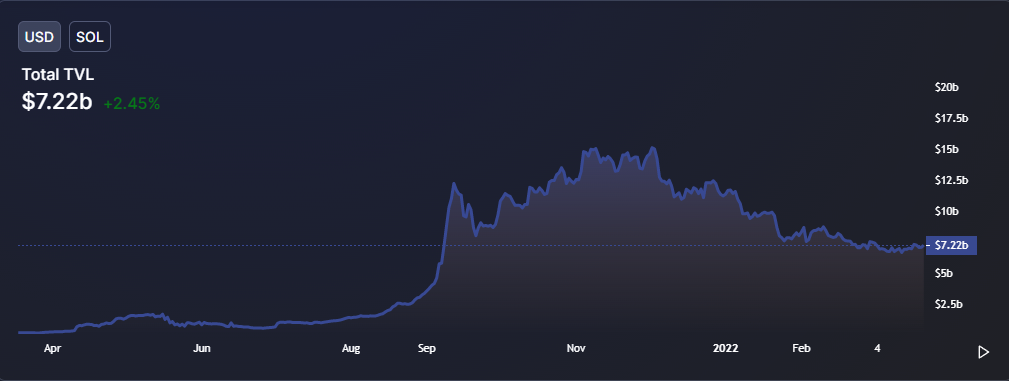

While the news certainly expands Solana’s long-term prospects, the partnership does turn a blind eye towards the project’s near-term uncertainties. Solana’s Total Value Locked (TVL) has declined consistently throughout December 2021, slipping from an ATH of $15 Billion during the winter to a 6-month low of $6 Billion on 14 March. Its price has traded below $100 for over three weeks despite the recent price increase.