The Bank of International Settlements [BIS] recently submitted a report to finance ministers of the world’s 20 largest economies [G20]. The Bank pointed out the structural flaws present within the crypto ecosystem and went on to highlight why the digital asset class should not be used as money.

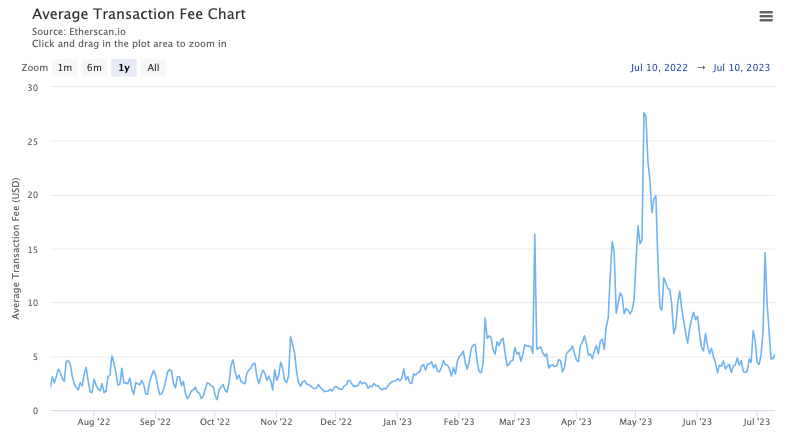

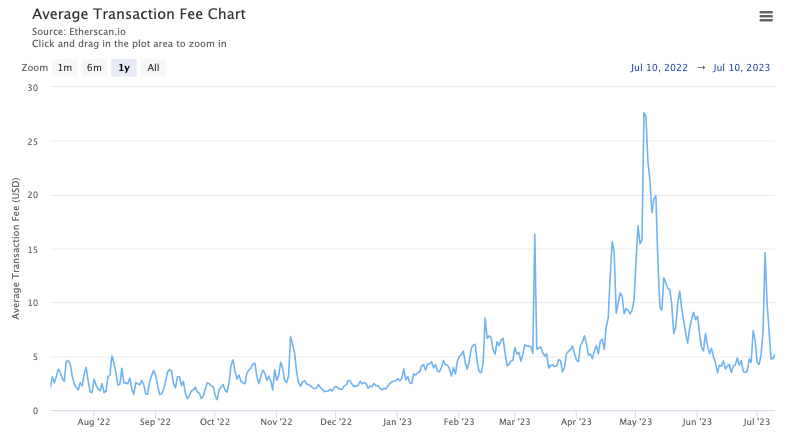

Specifically, the BIS report focused on three key takeaways. First, it characterized the “congestion, and high fees” within the crypto ecosystem. According to the BIS, this leads to “fragmentation.” Usually, the fees paid by users for a transaction depend on the demand by other co-users and traffic on the blockchain at a particular time. Therefore, the fees kept fluctuating.

Also Read: Bitcoin’s 2023 Correlation with Cardano, Shiba Inu, XRP Dips

Other Crypto, DeFi Flaws

Secondly, the BIS pointed out that despite “an original ethos of decentralization” crypto and DeFi present various risks. This is because they “feature substantial de-facto centralization.” Giving an example, the bank’s report pointed out,

“A prime example concerns stablecoins, which piggyback on the credibility of the central bank’s unit of account and may pose risks to monetary sovereignty.”

Third, the bank went on to assert that DeFi inherently “amplifies” known risks. It pointed out that this sub-sector within the crypto economy mostly “replicates” the services offered by the traditional finance system. According to the BIS, DeFi does not essentially finance activity in the real economy. The growth is driven by the “speculative influx” of new users, the report alleged. This poses substantial risks to investors, the BIS contended.

Despite remaining skeptical about crypto and its stability, efficiency, accountability, and integrity, the report did acknowledge some elements of “genuine innovation.” Functionalities like programmability, composability, and tokenization were lauded. Thus, rather than technological limitations, the BIS was concerned about structural flaws resulting from

the underlying “economics of incentives.” As a result, the bank noted that crypto is not quite suitable as a monetary tool. Its report concluded by asserting,

“Crypto has so far failed to harness innovation to the benefit of society. Crypto’s inherent structural flaws make it unsuitable to play a constructive role in the monetary system.”

Also Read: 93% of Banks Working on CBDCs: India, EU, UK, Intently Exploring