The crypto market has been consolidating for more than a fortnight now. Bitcoin has been rangebound between $26k-$27.5k. Likewise, most other large and mid-cap assets have also been consolidating. However, there are several on-chain signs pointing toward recovery at this stage.

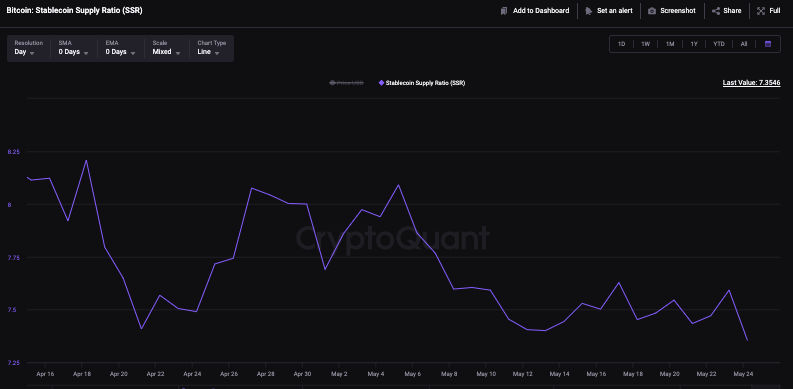

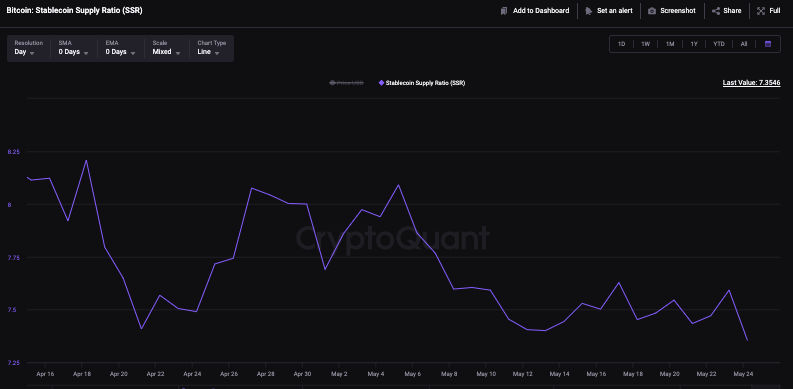

The Stablecoin Supply Ratio [SSR], for instance, has been dropping over the past few days. In the first week of the month, it created a local peak at 8.09. Now, however, it is down to 7.35. Lower values usually indicate a comparatively high stablecoin supply.

Historically SSR bottoms have led to some form of strong recovery if not a complete trend reversal. Thus, it can be contended that the current downtrend is pointing toward the textbook theory of buy pressure gaining steam and hints towards a possible leg up for Bitcoin.

In fact, several companies like Blockchain.com have been bearing the fruit of stablecoin adoption. At the Qatar Economic Forum, the company’s Co-Founder and CEO Peter Smith revealed today that its growth in economies like Nigeria, Ghana, and Colombia is “predominantly driven by stablecoin usage.”

Investors typically amass stablecoins and keep them as dry powder. Then, whenever they feel the time is right to enter the market, they divert them towards assets like Bitcoin and help initiate a recovery. In fact, as pointed out in a recent article, Africa is one of the fastest-growing crypto markets. So, the rise in the use of stablecoins here is indirectly a boon for the macro crypto landscape.

Also Read: Here’s How Africans Use Bitcoin Without Internet Access

The strongest survive

Despite being in the midst of the aftermath of crypto winter, significant strides are being made on a daily basis in the space. Companies are tying up with each other to cater to consumers from different geographical locations. Parallelly, product offerings are also being diversified. In fact, consumers too continue to amass crypto assets in the current conditions.

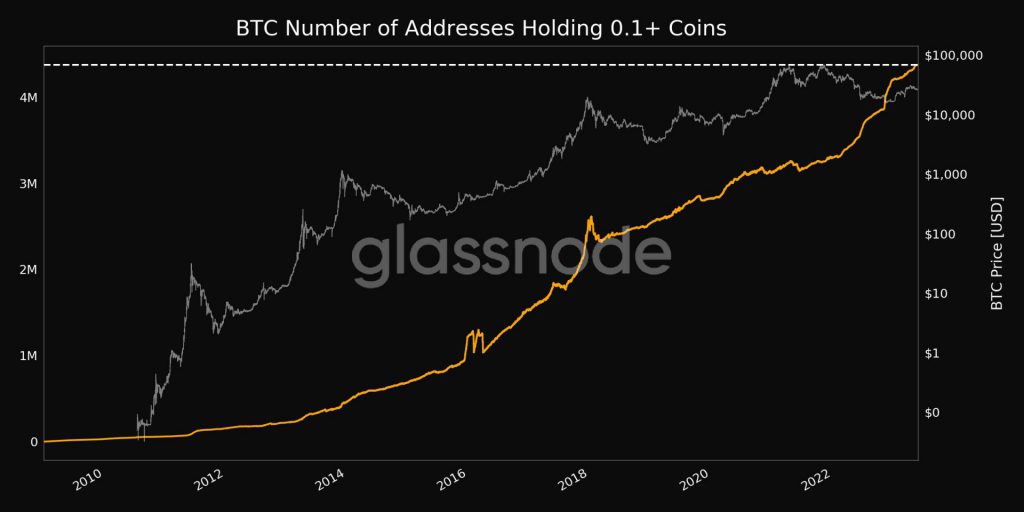

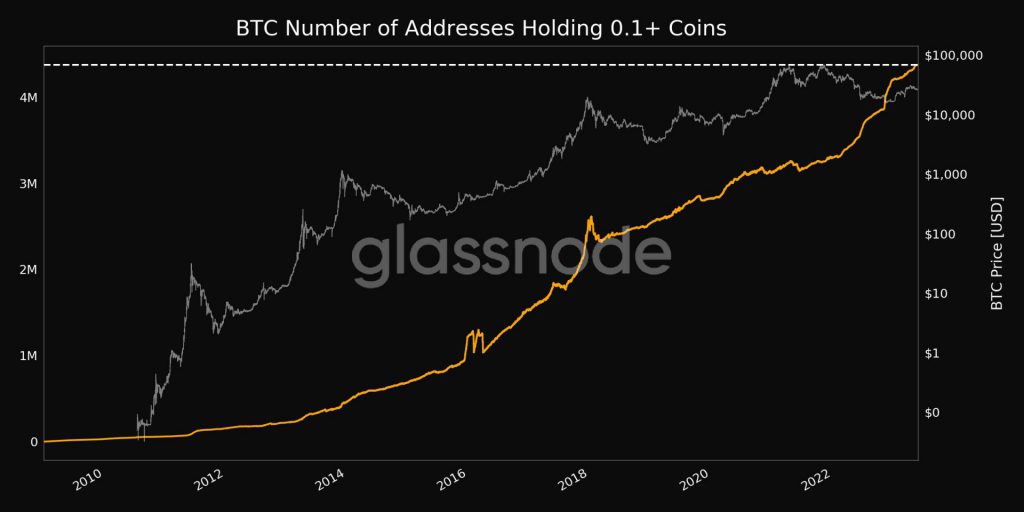

For instance, the number of addresses holding 0.1+ coins just reached an all-time high of 4,374,601, supporting the narrative. Rolling the ball further, Smith said during his interview today,

“I think the crypto market is going to be much bigger in the future than it is today.”

Smith went on to label the companies that survived winter to be “the absolute strongest.” Specifically, he said,

“It’s really healthy to have these cleansing periods throughout the market… If you look at the most valuable companies in crypto a year and a half ago, there are only four of us left. Only the absolute strongest survive.”

Regulations

Regulations go hand-in-hand with growth and adoption. Several nations have made progress on this front of late. Parallelly, international agencies have also been working on the same.

Several from the industry like Brad Garlinghouse feel that bodies like the SEC are “playing offense” and “attacking” all players. In effect, they feel that enforcement actions are “not healthy.” That being said, executives have duly acknowledged the need for regulations and feel that regulatory frameworks have to “start with clear protections for consumers.” Commenting on the most unlikely scenario on the regulatory front at the Qatar Economic Forum, Smith said,

“It’s probably unlikely that they create the United Nations for crypto regulatory.”

"It's probably unlikely that they create the United Nations for crypto regulatory," @blockchain's @OneMorePeter #QatarEconomicForum #منتدى_قطر_الاقتصادي @jennzaba pic.twitter.com/YysnqJSD25

— Bloomberg Live (@BloombergLive) May 25, 2023

Also Read: Ripple CEO: SEC’s Enforcement Actions Are ‘Not Healthy’