According to Accenture’s 2022 Global Consumer Payments report, next-generation payments, including crypto, are growing at a rapid rate. The growth is credited to changes in consumer behavior and advances in technology and regulation. The report also notes the entry of innovative new players into the payments space. The survey took into account 16000 people across 13 countries.

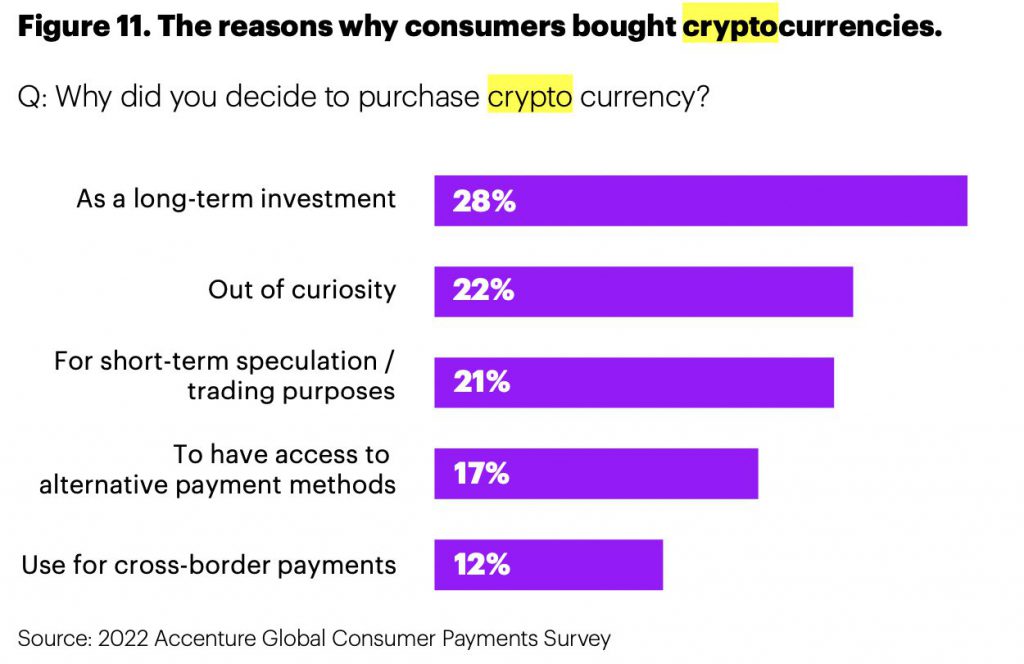

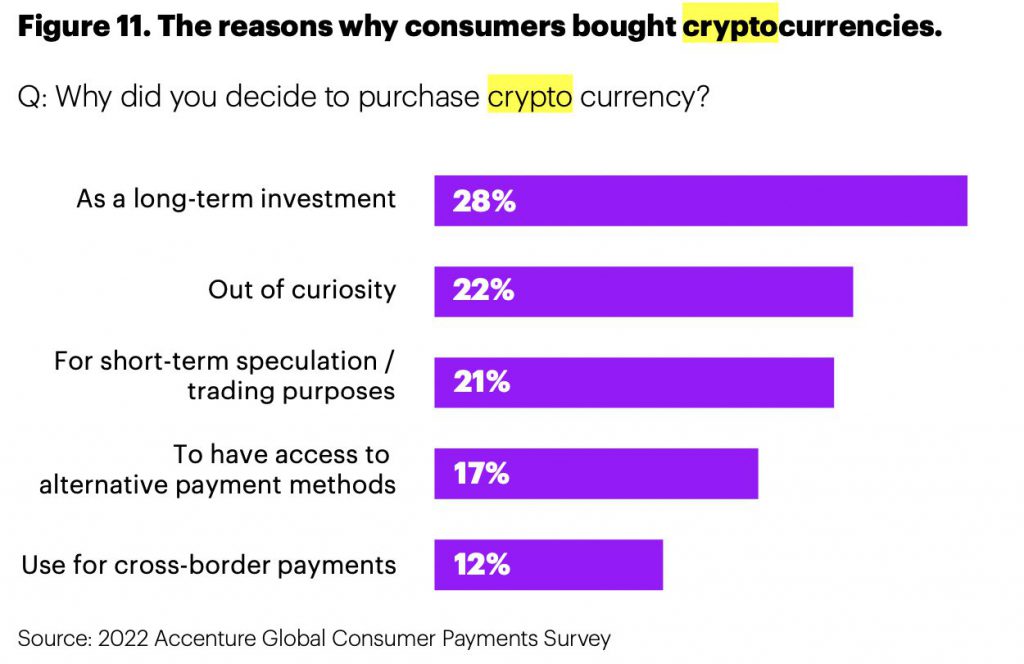

According to Accenture, one in five people claims to own crypto. While many purchased crypto as a long-term investment, several are curious and bought into the speculation. 28% of respondents bought cryptocurrencies as a long-term investment. 22% purchased the emerging asset out of curiosity, while 21% got into it for short-term speculation or trading purposes. As per the report, 17% use cryptocurrencies to access alternate payment mechanisms. Meanwhile, 12% claim to use cryptocurrencies for cross-border payments.

Furthermore, the report noted central bank digital currencies (CBDCs) as an alternative payment option. However, “large-scale deployment is years away.”

Next-gen payments, including crypto, to double in the next few years?

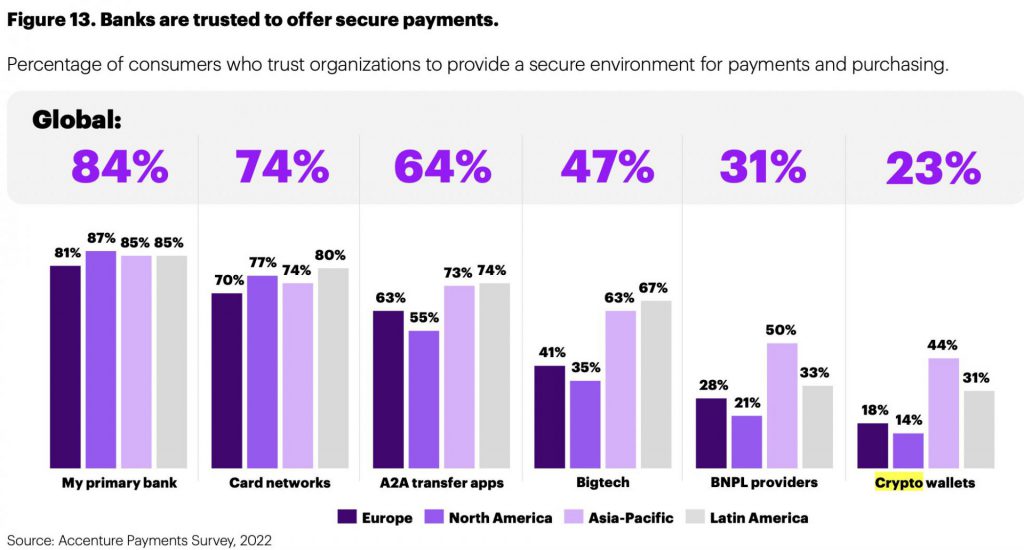

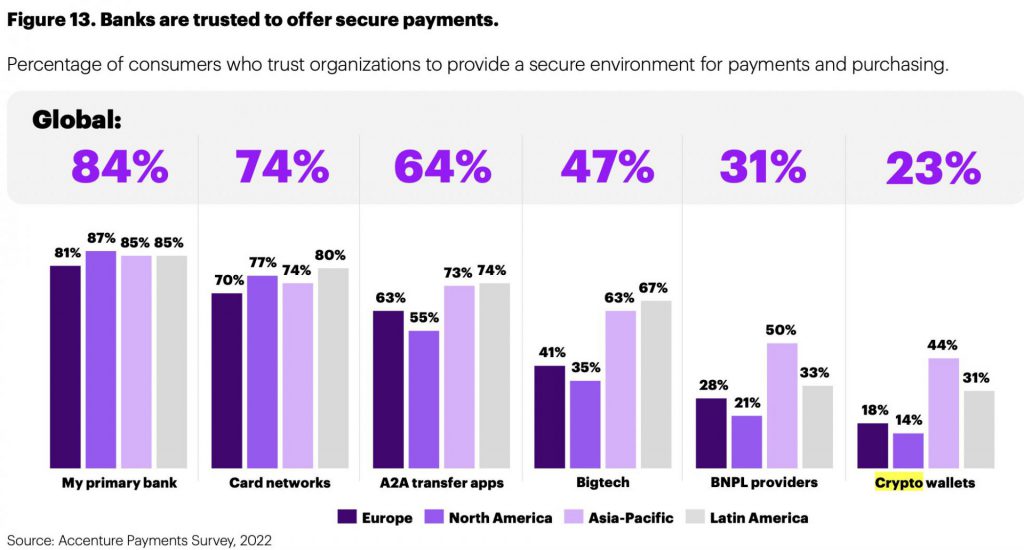

The paper also noted that the recent market volatility may have slowed crypto adoption. Only 23% of respondents believe that crypto wallets offer a secure setting for making payments and purchases. However, respondents from Asia-Pacific are the biggest believers that they can trust organizations to provide a safe environment.

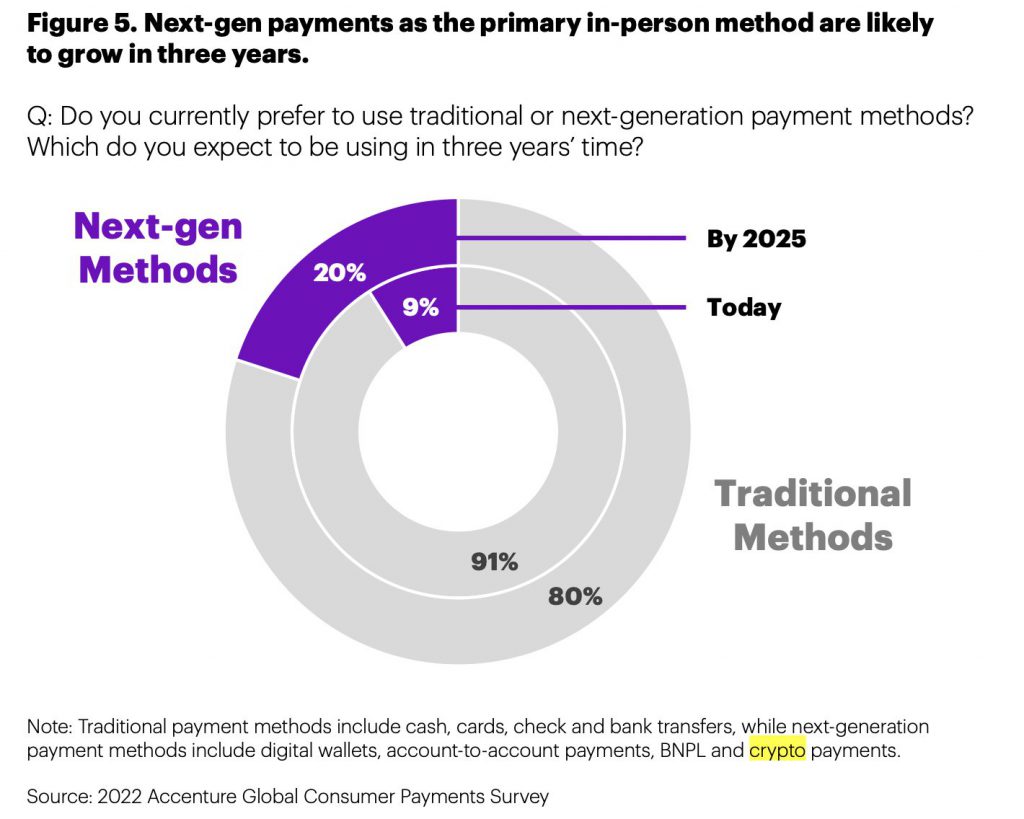

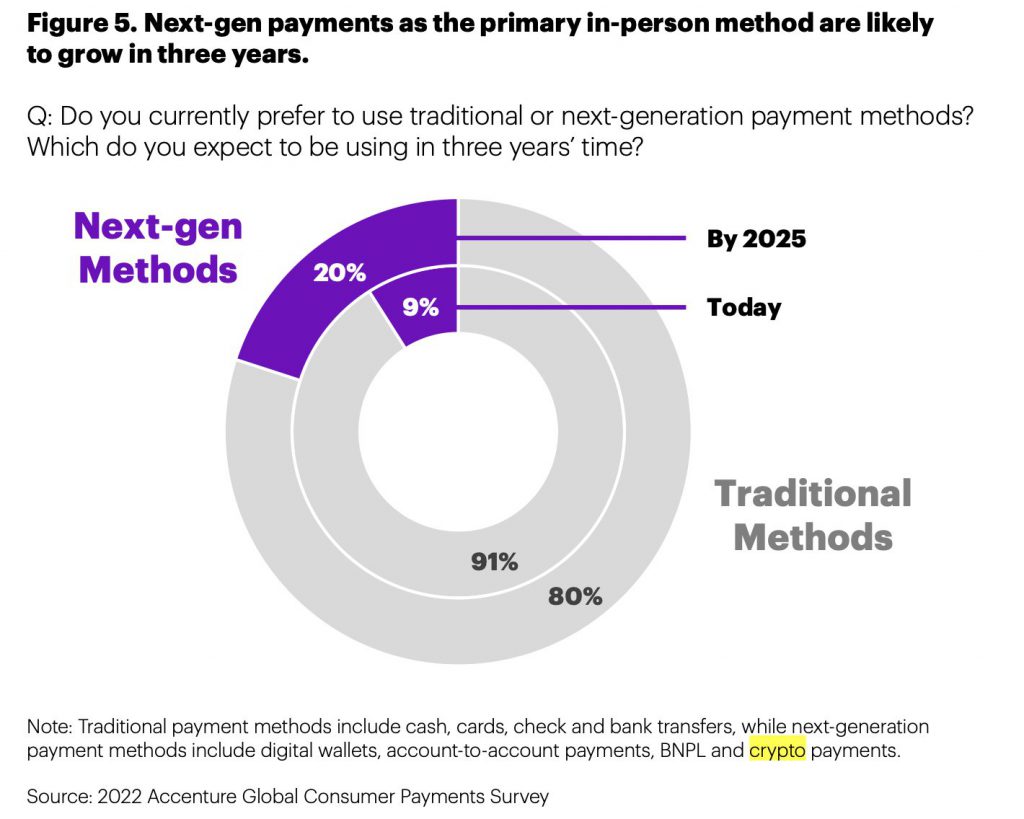

Next-generation payment methods are becoming more popular despite the current market behavior. This covered digital wallets, crypto, biometrically verified payments, and metaverse payments in addition to cash, cards, checks, and online shopping. Metaverse payments will be especially significant when interactions in virtual reality grow more widespread.

As per the survey, the use of next-generation payment methods is expected to reach 20% by 2025, from today’s 9%.

But for the time being, the study’s findings show that 58% of customers are still unwilling to conduct business in the metaverse because they have little faith in the current payment providers. This does not imply that customers lack curiosity.