2022 did not go as planned. The crypto industry recorded a major decline which caused an immense commotion in the market. This fall was further instigated by Sam Bankman-Friend’s FTX. Not only did the defeat of the exchange trigger correction, but it also compelled the community to lose trust in centralized exchanges.

In order to instill trust in the community and highlight transparency, Proof-of-Reserves [PoR] was set up. Exchanges across the crypto industry were urged to kickstart the PoR process.

What is Proof-of-Reserves?

Employing the technique of Merkle trees, PoR is quite popular among exchanges. It is a vetting technique that makes sure that crypto on exchanges has some real backing. A PoR audit ensures that custodians are holding all of the money belonging to their clients.

To attain transparency between the general public and investors, custodial firms in cryptocurrencies utilize PoR audits. To rule out the potential of reserve data being forged, these audits are carried out by neutral third parties.

Since account balances of all these custodial firms will be made visible, it is almost impossible for them to mishandle it. In addition to this, exchanges would refrain from investing their money in other methods or companies.

How does PoR work?

During a PoR verification, the auditor employs cryptography to confirm the inclusion of each account’s balance. As mentioned earlier, the Merkle Tree technique plays an important role. Large volumes of data for facilitating easier processing. As a result, a Merkle root identifies and tallies the balances of all the accounts.

The balances would be verified on public blockchains. The assets are held by digital signatures that are set by exchanges. Details pertaining to the balance and assets on public blockchains are validated. These figures should be in balance to uphold consistency.

Additionally, systems will be put in place so that clients could verify the validity of the assets they own. Any possible data changes will impact the Merkle root, which might indicate asset manipulation.

Who is doing it?

This technique garnered quite some attention from all across the industry. An array of networks decided to implement the same. Binance jumped onto it quickly and rolled out a PoR system for its BTC holdings. CZ even went on to urge his counterparts to set up the same.

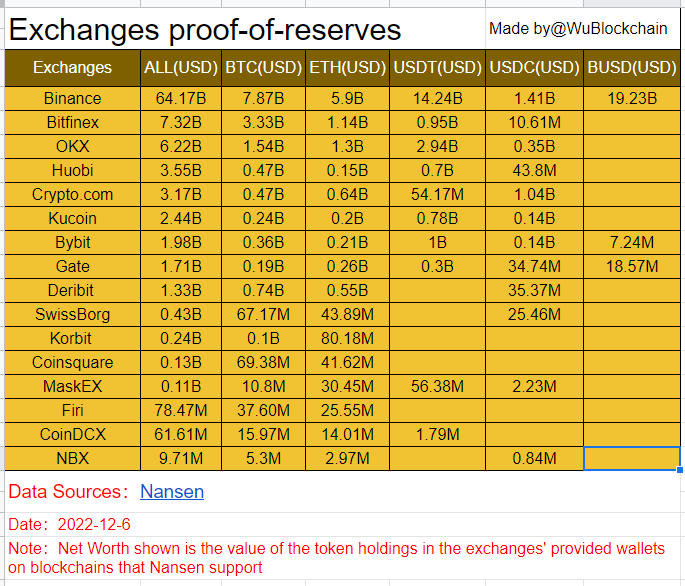

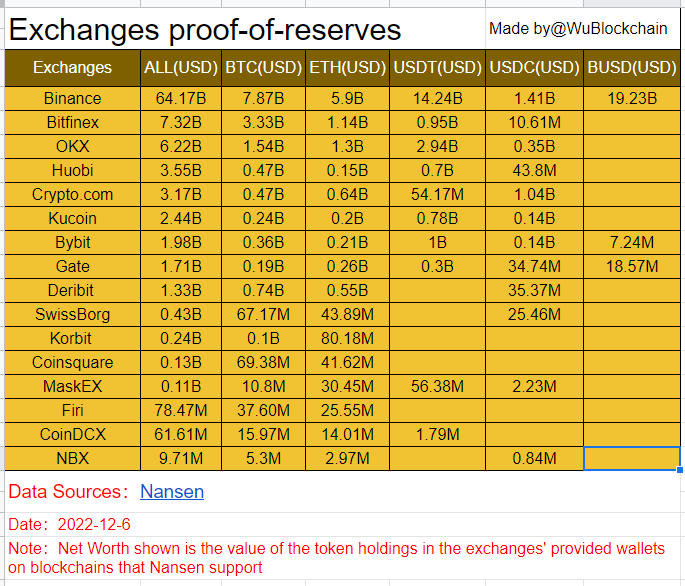

A recent list highlighted how a plethora of exchanges had joined the PoR bandwagon. Several platforms announced the cold wallet address of their reserves. This included Binance, Bitfinex, OKX, and others. MEXC and Bitget were yet to reveal their PoR assets.

As per recent data curated by prominent Chinese journalist Colin Wu, Binance entailed a whopping $64.17 billion worth of assets on its platform. This included $7.87 billion in BTC, $5.9 billion in ETH, $14.24 billion in USDT along with $19.23 billion in BUSD.

Bitfinex stood below Binance. However, the disparity between the platforms’ reserves was quite high. Bitfinex’s total reserve was at $7.32 billion which was quite dainty compared to Binance.

OKX, Huobi as well as Crypto.com were also entailing significant reserves. With all of these prominent exchanges being more transparent, the community garnered some respite.

Limitations of PoR

While this would certainly bring about more confidence in the crypto ecosystem, PoR comes with its own set of shortcomings.

For instance, consumers transfer their assets in and out, which would bring about alterations in the crypto exchange’s balance. The problem with PoR is that it only checks the accuracy of reserve balances during the designated audit window. Therefore, this can be problematic since any faults might not come to light until it’s too late. A custodian would be able to take advantage of the situation to distort the truth.

Stolen funds and loss of keys can further highlight discrepancies in the verification process. Sadly, the Proof of Reserves procedure cannot reveal whether an exchange has borrowed money to pass an audit.

Lastly, there is a chance that the auditor and the auditee could work together. While both parties need to uphold transparency, outside interests could influence them.

KuCoin, for example, has hired Mazars, an international auditing and accounting firm to carry out PoR. Furthermore, this firm previously monitored former President Donald Trump’s accounts. While some were ecstatic, a few others were voicing fear over this news.

Has PoR brought respite to the community?

With PoR getting into the limelight just yet, the industry is yet to witness its true utility. Since it upholds transparency and keeps crypto exchanges in check, this could be a step towards gaining the community’s trust.

If the foreseen shortcomings of the process garner attention, PoR would help restore confidence in the market.